R&F buys up to four years of breathing room as creditors give go-ahead for developer to group 10 offshore bonds into three amortised notes

- Guangzhou R&F will regroup 10 offshore bonds with US$4.94 billion in combined principal amount due between now and 2024 into notes due in 2025, 2027 and 2028

- The coupon rates of the existing bonds, ranging between 5.75 per cent and 12.375 per cent, will be fixed at 6.5 per cent for the new notes

A Chinese property developer has received a go-ahead from its offshore bond holders to regroup all of its outstanding debt, in a restructuring that gives it three to four years of breathing room as it struggles to raise cash.

The new bonds are scheduled to be listed on the Singapore stock exchange on July 15, according to R&F.

“The [payment] extension for the bonds, with no haircuts in the face value and a slight coupon reduction is acceptable as the extension would allow [investors] to avoid a lengthy debt restructuring, and [still] be able to receive coupons in the meantime,” said Lucror Analytics’ credit analyst Leonard Law. “The holistic restructure could be a possible approach for struggling developers that have yet to default.”

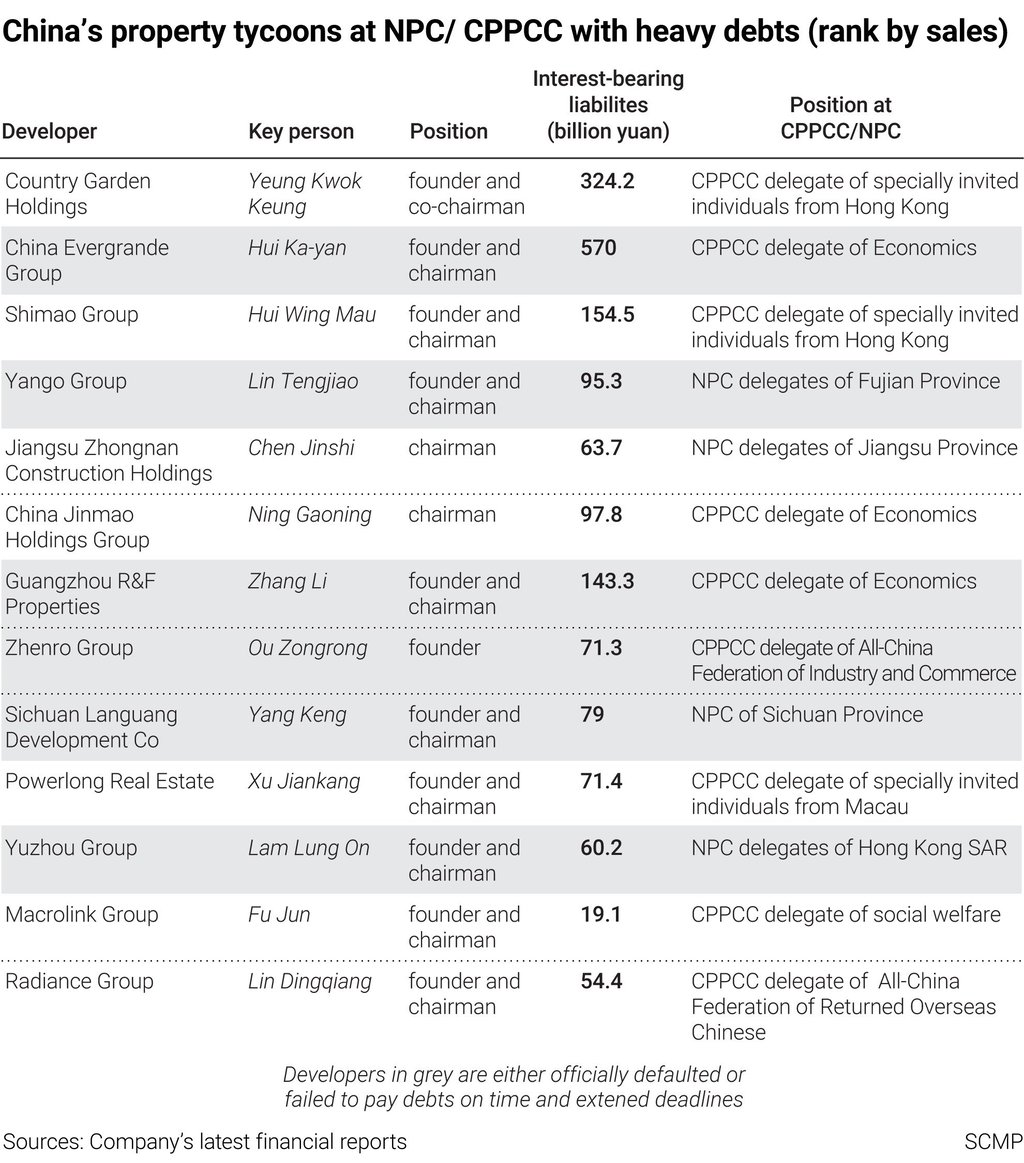

The workout, advised by solicitation agents including JPMorgan Securities (Asia Pacific), is good news for China’s beleaguered developers as they struggle to raise cash to repay US$84 billion of debt due this year alone. A third of these developers – such as China Evergrande Group, with the dubious honour as the world’s most indebted developer – may be “acutely strained” in the worst-case scenario, said S&P Global Ratings.