Advertisement

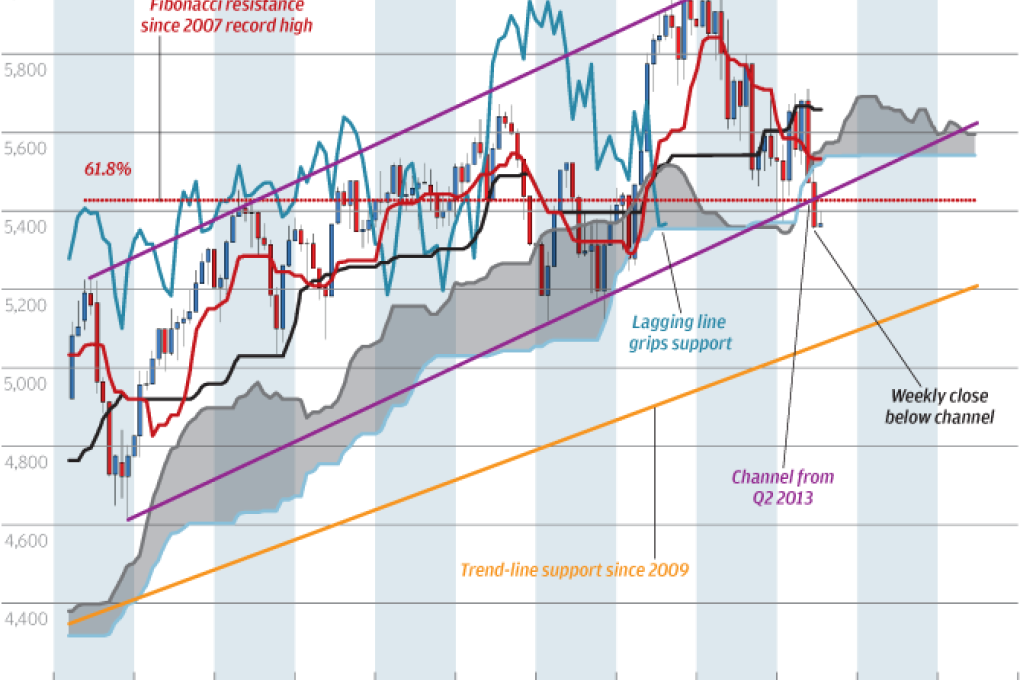

Chart Book | Chart of the day: More bears in the outback

We warned about Australia's All Ordinaries Index several weeks ago, and it appears bearish forces have shifted up a gear. Not that momentum has become any stronger since June, nor that it is oversold, but what focused this technical analyst's mind was last week's close below 5,400 points, below the Fibonacci 61 per cent retracement resistance from the 2007 record high and under the channel from 2013.

Reading Time:1 minute

Why you can trust SCMP

Advertisement

Advertisement