Jake's View | Move on 'foreign investors' tax breaks is shutting a Hong Kong loophole

Beijing's move to end tax breaks involving 'foreign-controlled' enterprises is sealing up narrowing a huge loophole that passes through Hong Kong

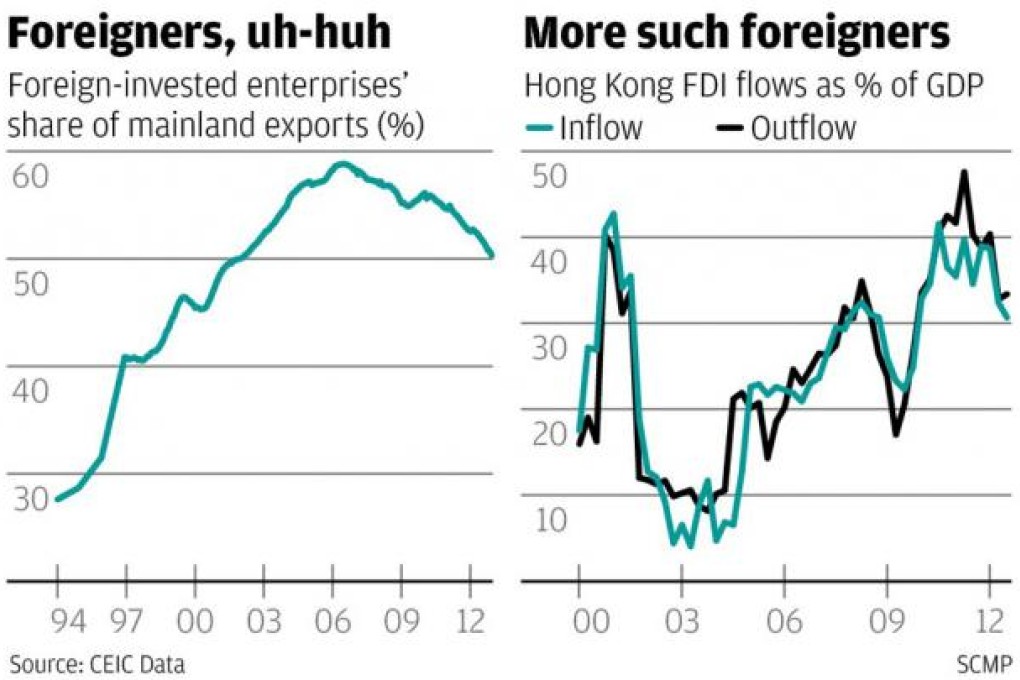

Let's start by putting this hit-the-foreigners element of Beijing's latest tax initiative into perspective. The first chart shows you the share of foreign-invested enterprises in the mainland's exports. From less than 30 per cent 20 years ago it rose to almost 60 per cent in 2006 and has now declined again to about 50 per cent.

This, however, is still a very high figure. Try to imagine that half of Japan's industrial export base was foreign-controlled. It wouldn't be Japan. Has China sold out its birthright?

And now the real story: turn to the second chart of Hong Kong's foreign direct investment (FDI) inflows and outflows. I admit that it's a bit of a jumble with two lines tracing up and down over each other but this is just the point.

Most economies are by a wide margin either net recipients or net donors of foreign investment but it's hard to tell which way things go in our case. For every dollar we take in we seem to send a dollar out again and, on the face of it, this seems pointless. Why don't we just use our own money for our own investment? Surely this would be both cheaper and more trouble-free.

Notice also the scale of these FDI flows. Over the past three years they have each averaged about HK$700 billion a year, or more than 35 per cent of gross domestic product.