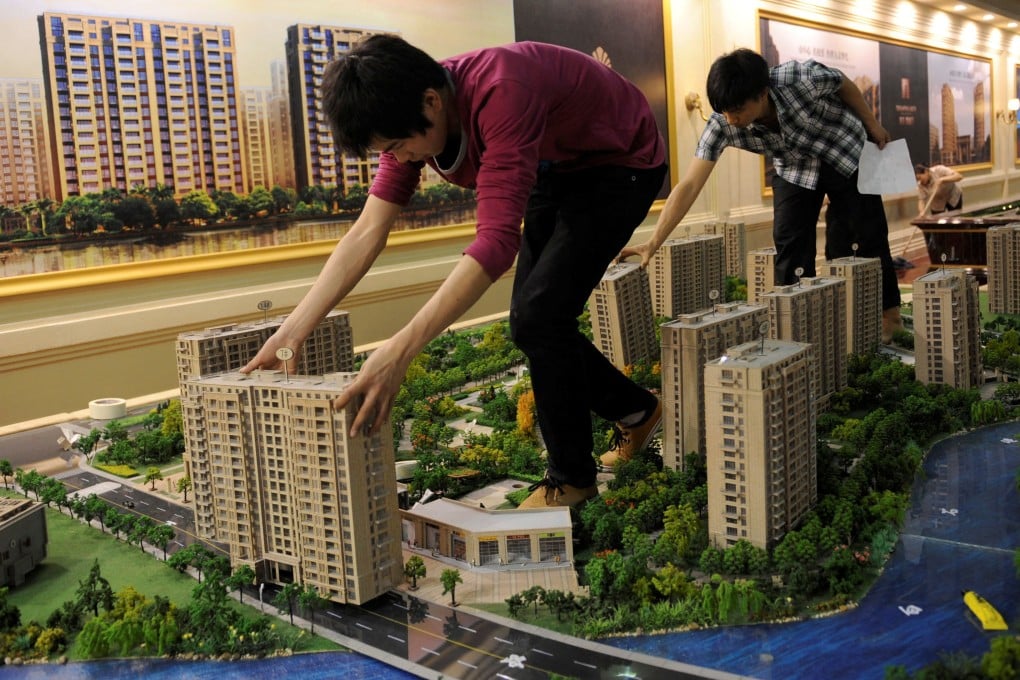

China property: Hangzhou, the headquarters of Alibaba and Geely, mulls buying unsold homes to boost market

- Authorities in Hangzhou, the capital of China’s Zhejiang province, are planning to buy homes and rent them at affordable rates, to reduce inventory and boost sales

- The move will be implemented by the city’s Linan district, which plans to acquire a total of 10,000 square metres, with flat sizes not exceeding 70 square metres

The Housing and Urban-Rural Development Bureau of the technology hub’s Linan district said it would buy housing units and car parking spots. The units will not exceed 70 square metres (753 sq ft) and the price will be based on the prevailing market rate, the bureau said in a notice on Tuesday.

The procurement process will run from May 15 to May 24, and the total floor area to be bought will be capped at 10,000 square metres, the bureau said, adding that the selected developers will not be allowed to sell on the open market.

“This move shows that the ‘national team’ is trying to implement the Politburo meeting’s call to ‘digest existing housing inventory’ and ‘optimise new housing’,” said Yan Yuejin, a director at the Shanghai-based E-house China Research and Development Institute. “The initiative also sheds light on how to absorb the projects that developers have built.”

This approach is different from recent moves to relax restrictions around housing purchases, as it depends on the fiscal capacity of local governments, Yan added.

After the Politburo meeting on April 30, China’s top leaders said they were assessing comprehensive measures to reduce the housing inventory and boost sales.