Topic

News about the global financial industry with a focus on developments in Hong Kong and China.

Rebound of Hang Seng Index may have confounded the doom mongers, but Hong Kong also needs to attract liquidity and reclaim a top position for IPOs.

Hong Kong Monetary Authority hopes proposed term ‘licensed digital bank’ will inspire confidence in those that use such facilities when online fraud is on the rise.

Attracting listings to the bourse from Southeast Asia, the Middle East and other regions, and introducing trading when typhoon signal No 8 is in force are at the top of his list.

As Beijing restructures the economy, the importance of having accurate and precise information from across the country is critical.

- New life insurance sales in the first three months rose to HK$65.3 billion from HK$47 billion a year earlier

- Sales of policies to mainland visitors amounted to HK$15.6 billion in the three months to March, compared with HK$9.61 billion a year earlier

Convertible bond issues are seen growing in popularity across the Asia Pacific region as companies seek to lower their interest costs at a time when the primary equity market is sluggish.

China State Construction Engineering Corporation, a key exponent of Beijing’s Belt and Road Initiative, is cited for water pollution and non-compliance with labour laws.

The legendary investor has changed his view on China stocks as he believes the country’s recent property support measures will restore confidence. A recent trip to the south of the country also helped change his mind.

The issuance diversifies the authority’s funding sources in the capital market with the most competitive financing costs, chairman says.

Online sales of insurance policies have grown swiftly since the introduction of digital insurers five years ago, but Hong Kong still lags behind overseas markets, according to the head of the city’s first online insurer.

HSBC sees opportunities to lend against wealthy clients’ private assets, as it leverages its balance sheet strength to finance this fast-growing market.

Logan Group is entering a crucial stage in its offshore restructuring, with just three months to pay or refinance a loan or risk losing control of a key luxury home project in Hong Kong, The Corniche.

Some NFT firms and platforms do not have the right controls to counter money laundering, terrorist financing and sanctions evasion, according to the department’s assessment.

China-listed firms paid cash dividends totalling 2.2 trillion yuan (US$300 billion) for 2023 despite a fall in combined profit, official data shows. Fund managers are not convinced broader governance improvements are afoot.

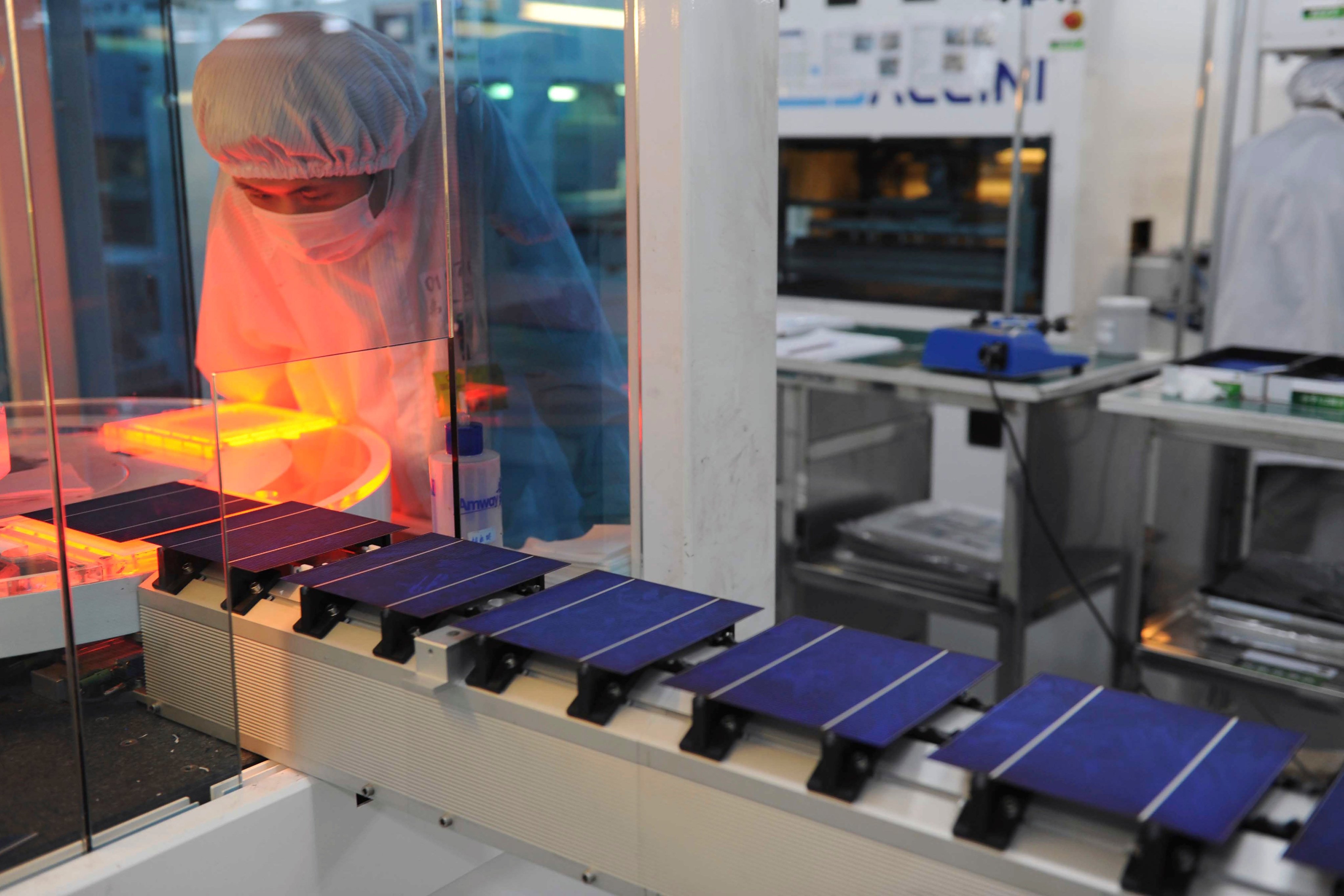

Apart from domestic semiconductor manufacturers, the third phase of China’s ‘Big Fund’ is expected to support chip equipment and material suppliers, analysts said.

China Merchants Port Group joins at least four other large corporations that have scrapped plans to hire or ended contracts with the auditing firm in the last month, after whistle-blowers in April alleged PwC ‘turned a blind eye’ to misconduct by China Evergrande.

The Singaporean lender’s digital banking capability will increase substantially and lead to greater use of AI and machine learning in its products and services, CEO Helen Wong says.

The owner of Britain’s struggling Royal Mail said on Wednesday it had accepted a takeover proposal from Czech billionaire Daniel Kretinsky worth US$4.6 billion

BlackRock’s iShares Bitcoin Trust has attracted the greatest inflow, totalling US$16.5 billion, since nine spot bitcoin exchange-traded funds went live in the United States in January.

Lenovo’s convertible bond sale follows similar offerings by e-commerce giants Alibaba and JD.com as issuers seek to lower funding costs in a high rate environment by capitalising on a red-hot stock market.

Hong Kong investors’ concentration in real estate and local stocks ‘has not worked out well’ in the past few years, digital wealth adviser Endowus says.

Amid high compliance costs, the SFC’s notice that crypto exchanges should not serve mainland investors is prompting some firms to leave the city.

China aims to establish a national standard for corporate sustainability disclosure by 2030 as part of efforts to improve economic sustainability, tackle climate change and catch up with its global peers when it comes to environmental, social and governance reporting.

Latest Cross-Border Yuan Insight report suggests that Beijing’s efforts to challenge US dollar hegemony still face considerable hurdles, from exchange-rate fluctuations to impediments in cross-border capital flows.

Communications Authority says it has approved an application by TVB to allot 8.7 million new shares to GF Global Capital.

Investors are growing increasingly positive on China’s long-term growth prospects but are ‘underinvested’ in the world’s second-largest economy, HKEX CEO Bonnie Chan says.

Carl Tannenbaum comments on interest rate cuts and outlines concerns in the face of geopolitical tensions and global supply-chain upheavals.

The company, one of China’s largest private-sector conglomerates, aims to cut its debts by 10 billion yuan (US$1.38 billion) annually in the next two to three years.

The Middle East and Indonesia are the next targets for Hong Kong to attract family offices, but more needs to be done to bolster the city’s status as a global family office hub, according to an InvestHK executive.

‘Think of it as a Chinese version of the Marshall Plan in the green economy era,’ but beware of backlash, says a member of the central bank’s Monetary Policy Committee.

Hotels in mainland China will need to raise their performance and returns to succeed as real estate investment trusts, according to JLL. A 4 per cent annual return will be favoured by regulators and investors.

During a meeting of China’s Politburo, plans are reviewed for ensuring accountability and propriety among officials carrying out the country’s campaign against financial risk.

The third phase of the China Integrated Circuit Industry Investment Fund has 19 equity investors, led by the Ministry of Finance and the country’s major state-owned banks.

Generative AI is adding uncertainty to an already uncertain world, but Hong Kong can cope with the challenges by leveraging its hub status and acting as a gateway to China, according to HSBC’s Peter Wong.

.JPG?itok=SSmqFLVw&v=1714463271)