Topic

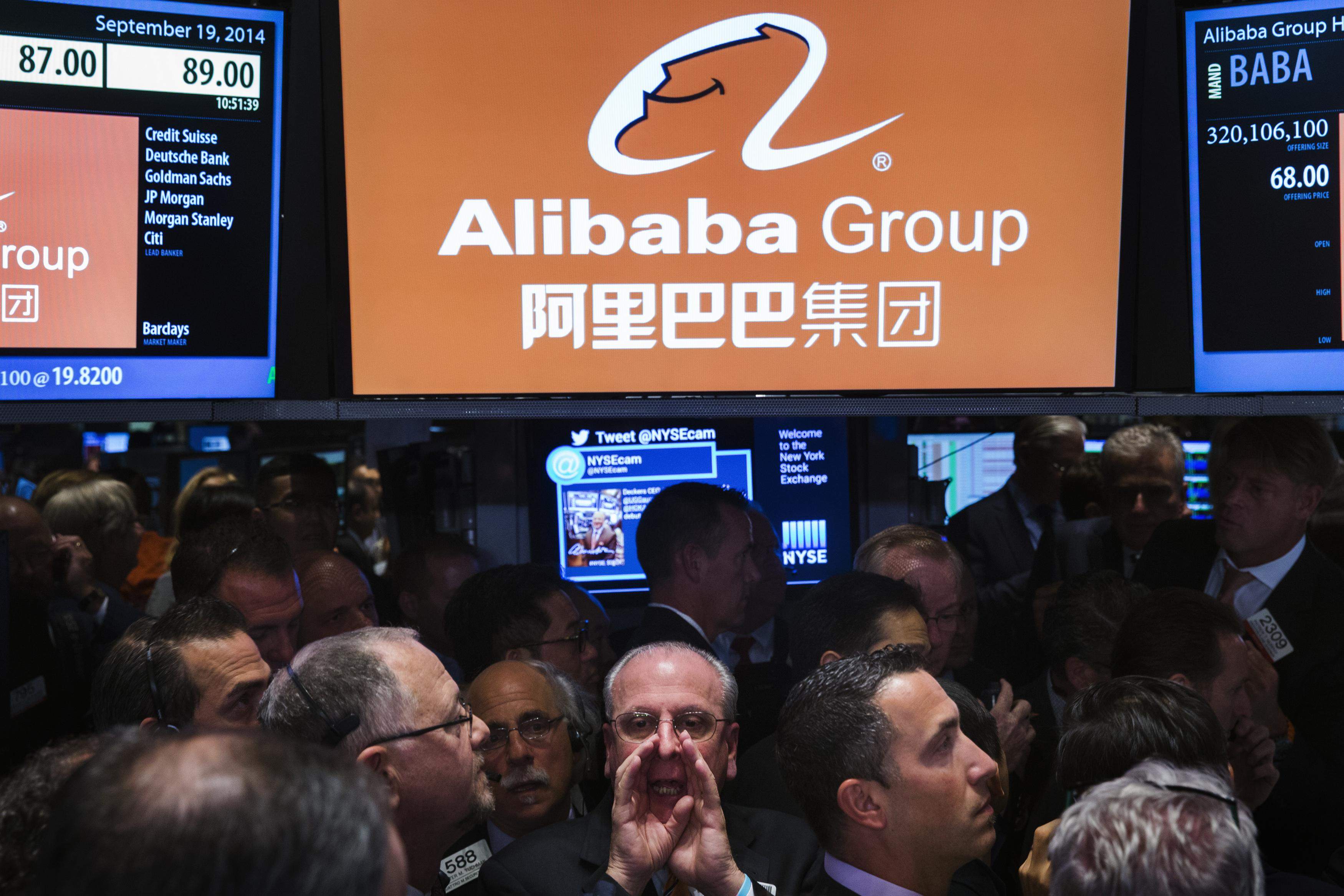

Alibaba is China's largest e-commerce company, with holdings in a wide portfolio of businesses from logistics, cloud services and finance to media. The company provides business-to-business, business-to-consumer and other services through platforms including Alibaba.com, Tmall, and Taobao. Alibaba is the owner of the South China Morning Post. It was co-founded by Jack Ma, who retired as chairman in 2019 but is still a major shareholder.

De facto central bank aims for first-mover advantage through blockchain technology, providing welcome lift to Hong Kong’s image as global financial centre

With the crackdown on fintech firms over, the sector must look forward and realise its full potential in driving China’s recovery.

Trades in local dollar or yuan in city stock market will offer greater choice to those investors seeking to diversify not only in shares but also currencies.

Wang Xiangwei, the Post’s former editor-in-chief, reflects on his career as a journalist, reporting on China, the need for a hiatus, and why he wants to return to Hong Kong.

Primary listing in Hong Kong by tech giant will allow ordinary people to share in success of such companies and help drive nation’s development.

- The price of AI services in China plummeted in May after ByteDance kicked off a price war by pricing access to its LLMs at 99.8 per cent below GPT-4

- Industry insiders fear the harm could be fatal for many start-ups, but app developers are enjoying cheaper access to the tech powering their services

The budget shopping platform’s new ‘automated price-tracking system’ will enable merchants to swiftly adjust the cost of goods online during the 618 shopping festival.

The transaction followed the disposal of Alibaba’s shares in Bilibili and Xpeng in March.

The executive reshuffle at Taobao and Tmall Group shows how Alibaba is adhering to calls made by company co-founder Jack Ma to ‘give more power’ to young people.

Zhejiang Jingzhunxue, whose CEO is an Alibaba alumnus, received 200 million yuan from the e-commerce giant to develop an interactive AI education tool.

Lenovo’s convertible bond sale follows similar offerings by e-commerce giants Alibaba and JD.com as issuers seek to lower funding costs in a high rate environment by capitalising on a red-hot stock market.

Police say fake customer services staff frauds an ‘increasing trend’, with HK$4.16 million the biggest single loss logged.

Richard Liu lashes out at employees as the Chinese e-commerce giant tries to run a tighter ship amid rising competition and a weak economy.

Shares of the parent of Temu and Pinduoduo are being held back by geopolitical risks and fierce competition in China’s e-commerce sector.

The departure of AI experts from these Big Tech firms reflects increased investor interest in start-ups that could become the next OpenAI.

Meituan, Tencent, NetEase and PDD Holdings are potential candidates to sell convertibles, according to UOB Kay Hian analyst Julia Pan.

The English footballer will be featured in AliExpress commercials during the European Football Championship, which kicks off in mid-June.

Alibaba has emerged as a major backer of Moonshot AI, one of China’s hottest artificial intelligence start-ups, holding a 36 per cent stake in the firm.

Nvidia’s H20 chip is being sold in some cases at more than a 10 per cent discount in China, compared to Huawei’s Ascend 910B, sources said.

The Chinese tech giant is selling up to US$5 billion worth of convertible bonds, while company leaders set e-commerce and cloud computing as its core businesses in a move ‘towards strategic clarity’.

Alibaba and others have released encouraging early sales data from China’s biggest shopping season after Singles’ Day, an indicator of consumer sentiment in the world’s second-largest economy.

Along with Meta, OpenAI and Samsung, the companies committed to publishing safety frameworks for measuring risks.

Mainland ride-hailing giant Didi Chuxing has offered driving services in Hong Kong since 2018 alongside Uber and Amap entered market in March.

Moonshot AI is in talks with investors for additional funding that will boost its valuation by US$500 million over its previous round in February.

Alibaba Cloud has slashed the fees for using its generative artificial intelligence models by up to 97 per cent, a week after ByteDance launched a rival service that costs less than most competitors.

Alibaba’s Taobao and Tmall Group is working with ByteDance’s Douyin to attract users from the short video app, as the e-commerce giant boosts spending on the annual midyear shopping festival.

Mainland online retailers JD.com and Alibaba’s Tmall on Monday started offering deeper discounts on iPhone 15 models.

The mainland’s e-commerce sector achieved a 12 per cent overall growth in the March quarter, according to data from JPMorgan.

Saudi Arabia’s Public Investment Fund and Michael Burry’s Scion Asset Management increased their holdings of Chinese large caps, while Singapore’s Temasek reduced its stock holdings.

ByteDance’s aggressive pricing for its Doubao large language model family shows the increased opportunity in mainland China, where more firms are scrambling to adopt GenAI tools.

Alibaba Group Holding’s primary dual listing in Hong Kong could open the doors for China’s 210 million investors to buy a stake in the US$400 billion behemoth.

Strong financial results by the two companies are the touchstones of the earnings growth that global investors are looking for, as they debate whether China’s post-pandemic recovery was a flash in the pan.

Confidence among Chinese consumers was showing ‘early signs of growth’, according to Alibaba chairman Joe Tsai, as the e-commerce giant expects business to be back on the growth path this year.

Alibaba net income rose 10 per cent to US$11 billion in the 2023 financial year, the first annual results since co-founder Joe Tsai took over as chairman.

The Tokyo-based company earned a better-than-expected net income in the March quarter, helped by investment gains.