In Malaysia, a snag in US search for alternative to Chinese rare earths

- As the trade war threatens to put Chinese rare earth minerals out of America’s grasp, Washington turns to alternative supplies to fill the gap

- Few Malaysians are willing to tolerate the environmental damage that would entail

“Lynas cannot come and dictate how the rule of law is applied … They cannot ask for exemptions as if it’s their right,” she told Malaysian media in December.

Her ministry has stood firm on policies aimed at protecting the environment, amid a push to meet renewable energy goals and slash the import and use of plastics.

I’d side with rich China over fickle US: Mahathir

The move against Lynas presents the company with a hurdle in the race to fill what it describes as a “critical supply chain gap” for Western manufacturers, which rely on rare earths to produce a range of hi-tech products from smartphones to military weapons.

The firm recently announced a joint venture with Texas-based Blue Line Mining to set up a plant in the United States that will be the only large-scale facility for rare earth production outside China, which produces about 90 per cent of global supply.

“Rare earth separation capacity has been absent from the United States for several years,” Lynas said in a recent statement. It added the deal with Blue Line would ensure American companies had continued access to rare earths through a US-based source.

Lynas’ Malaysian business said the agreement would have no effect on its local operations.

“Rare earths are an important strategic resource, and are also non-renewable,” Xi said.

“We must strengthen technological innovation … step up environmental protection, and achieve sustainable development,” he said.

Although the US has previously threatened to slap tariffs on Chinese rare earth imports, it has yet to do so.

“The prognosis for an amicable outcome to the US-China trade talks is looking bleak, and the world should be prepared for a protracted trade war between the two superpowers. For rare earths, Lynas will be seen as a saviour to the US although it will not be able to fully meet its demand,” he said.

The search for alternative supplies as well as substitutes for the metals would continue, Yeah added.

What leverage does China’s rare earths dominance hold in trade war?

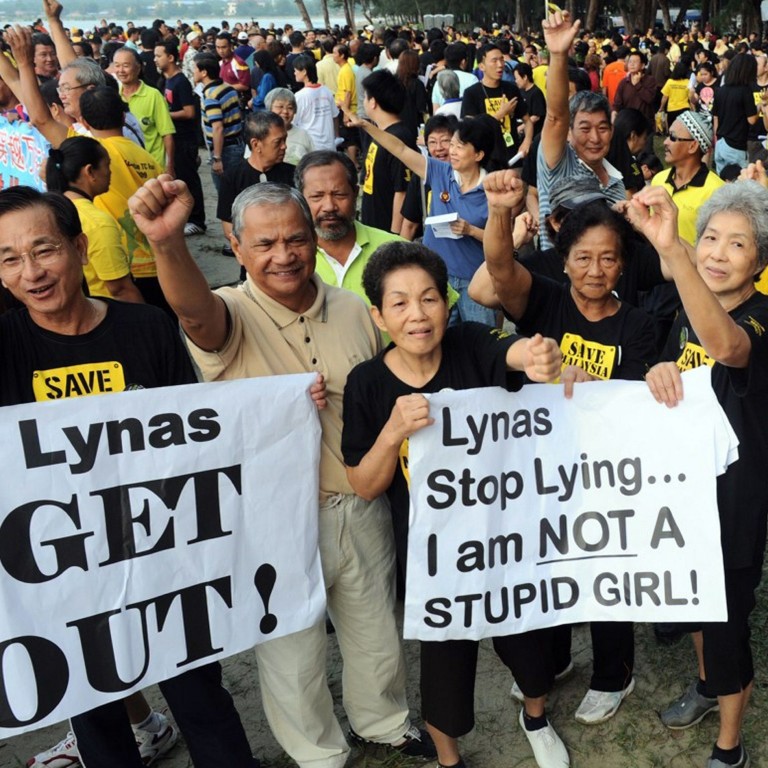

The Lynas Advanced Materials Plant in Kuantan continues to be a sticking point for locals and activists, who have protested against the potential health and environmental repercussions of the plant. Their primary concerns centre on proper waste management and disposal.

“The previous administration turned a deaf ear but now we have data that shows the environmental fallout – the groundwater is contaminated,” she said.

Last year a review committee set up by the government to look into Lynas discovered a high amount of nickel and chromium in groundwater samples. Although Lynas denied the contamination was due to its operations, Fuziah has maintained it only occurred after the company began work.

“The current government is more progressive in terms of environmental policies,” said Fuziah, who was made a deputy minister last year.

Environmental activist turned MP Wong Tack echoed Fuziah’s view.

“Health and environment concerns come first. Lynas has shown in the past that it’s good at twisting the narrative,” he said. “In September their licence expires unless they live up to the agreement to remove waste. I have had enough. Malaysian laws are very clear.”

The lawmaker in 2011 founded the Save Malaysia Stop Lynas movement, which organised protests against plans for the plant.

His ascension to elected office has not caused him to turn away from his anti-Lynas activism. In March he accused the Australian High Commissioner to Malaysia of “coloniser behaviour” after the diplomat said Kuala Lumpur was close to renewing Lynas’ licence.

Australia has refused to accept waste from the firm into its territory, with Western Australian mines minister Bill Johnston telling The Australian newspaper that the best place for contaminated material was “where it comes from, which in this case would be in the mine void. But we are not going to take mine waste back from overseas”.

Japan just found enough rare minerals for 780 years of local demand

Australian conglomerate Wesfarmers recently attempted a US$1.1 billion takeover bid for the company as its shares hover at an 18-month low and creditors anxiously eye the miner’s finances.

“This memorandum of understanding signed with Blue Line is just a public relations stunt. Their goal is to tell the government of Malaysia that its demand isn’t reasonable, and to raise the [share] price,” Tan said.

His take on the situation is a popular one in Malaysia. MP Fuziah said Lynas had been keeping silent on its waste generation issues while “continuing with its public relations exercises”, and the mining company has to be held accountable.

She said: “Come September, if the issue of waste management remains unresolved, Lynas’ operating licence must not be renewed, period.” ■