Topic

- The stress tests have become an annual report card for America’s banking system since being implemented after the Great Recession and 2008 financial crisis

- The tests show the US banking industry would be able to survive a severe global recession, property crisis and a high unemployment rate

HSBC poached 42 bankers and misused SVB’s confidential, proprietary and trade secret information following the takeover in late March, complaint says.

Banks including Citizens Financial Group, PNC Financial Services Group and JPMorgan Chase & Co are among roughly half a dozen bidders vying to buy First Republic Bank, according to sources familiar with the matter.

The bank is exploring options as the news overshadowed its market-beating first-quarter profit and sent shares down 21 per cent.

Readers discuss the loophole that fuelled SVB’s collapse, the ‘mountain’ of MTR fares, and platform gaps at train stations.

Readers discuss the need for stronger policy on antimicrobial resistance, and how Hong Kong should respond to the banking crisis.

Turmoil in Western financial markets has spurred a flight to safety among global investors, hurting the region’s start-ups – even if most Asian lenders are unlikely to fall to a Silicon Valley Bank-style collapse.

HSBC paid £1 for a £1.4 billion business when it acquired the UK unit of Silicon Valley Bank earlier this month, CEO Noel Quinn says. It has since lured billions of deposits from global tech start-ups.

Lu Lei, deputy head of China’s foreign exchange regulator, says authorities must become more vigilant of risks in the financial sector following the sudden collapse of Silicon Valley Bank.

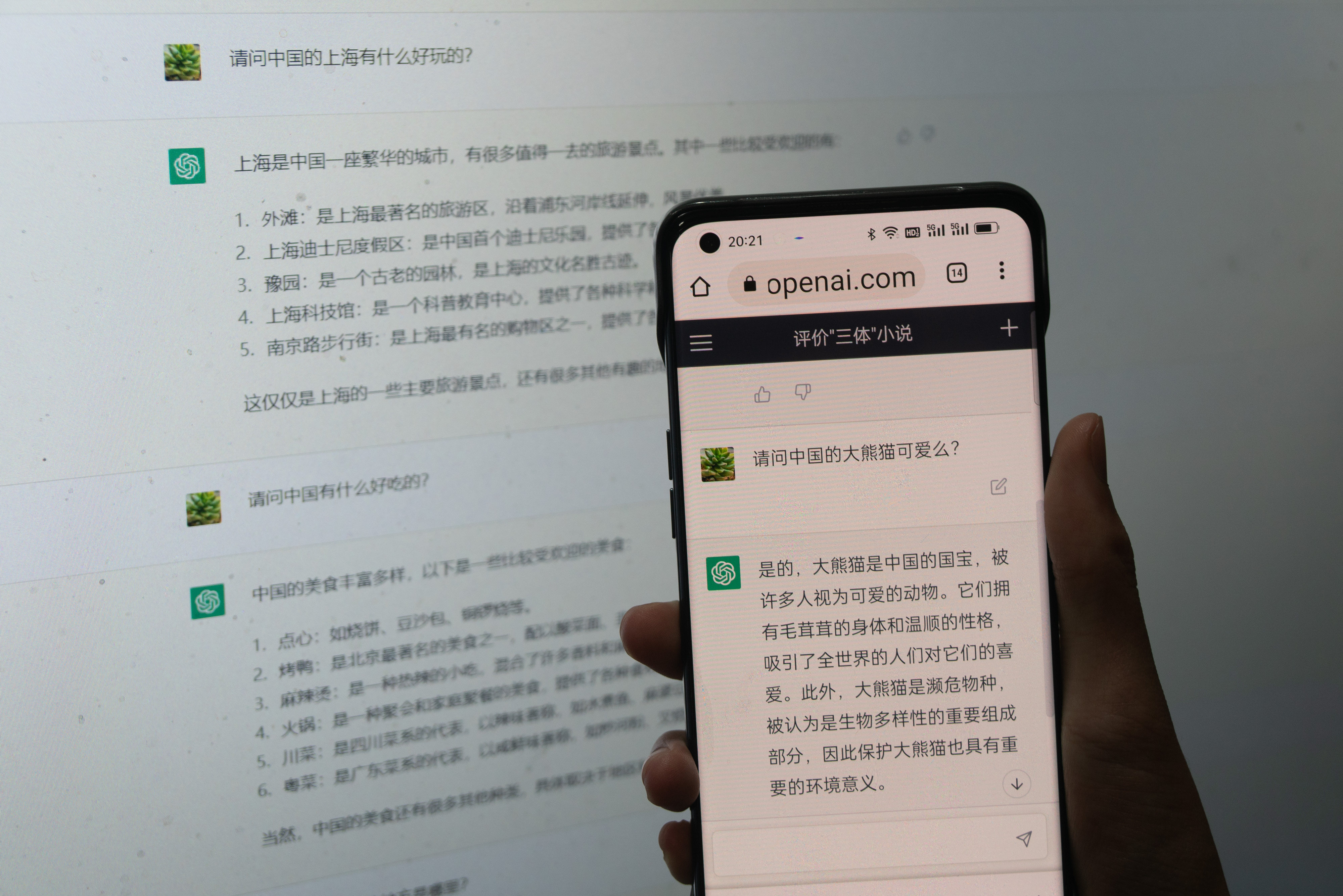

Readers discuss how to fully realise the potential of ChatGPT, happier times in US-China relations, and short sellers’ role in capital markets.

China’s new leadership team is racing to defuse financial risks, including at top banks and state-owned industrial giants, against a backdrop of slowing economic growth and an overseas banking crisis.

Readers discuss concerns over social media platforms other than TikTok, and the significance of China’s financial regulatory overhaul.

Investment guru Mark Mobius, who earlier had expressed concerns about China’s capital controls, said that while he continues to be bullish on the country, it would be far more attractive to foreign investors if it eases up on investment flows.

The Swiss government was forced to intervene to save the troubled bank amid a crisis of investor confidence, Finance Minister Karin Keller-Sutter said.