Advertisement

Advertisement

TOPIC

/ company

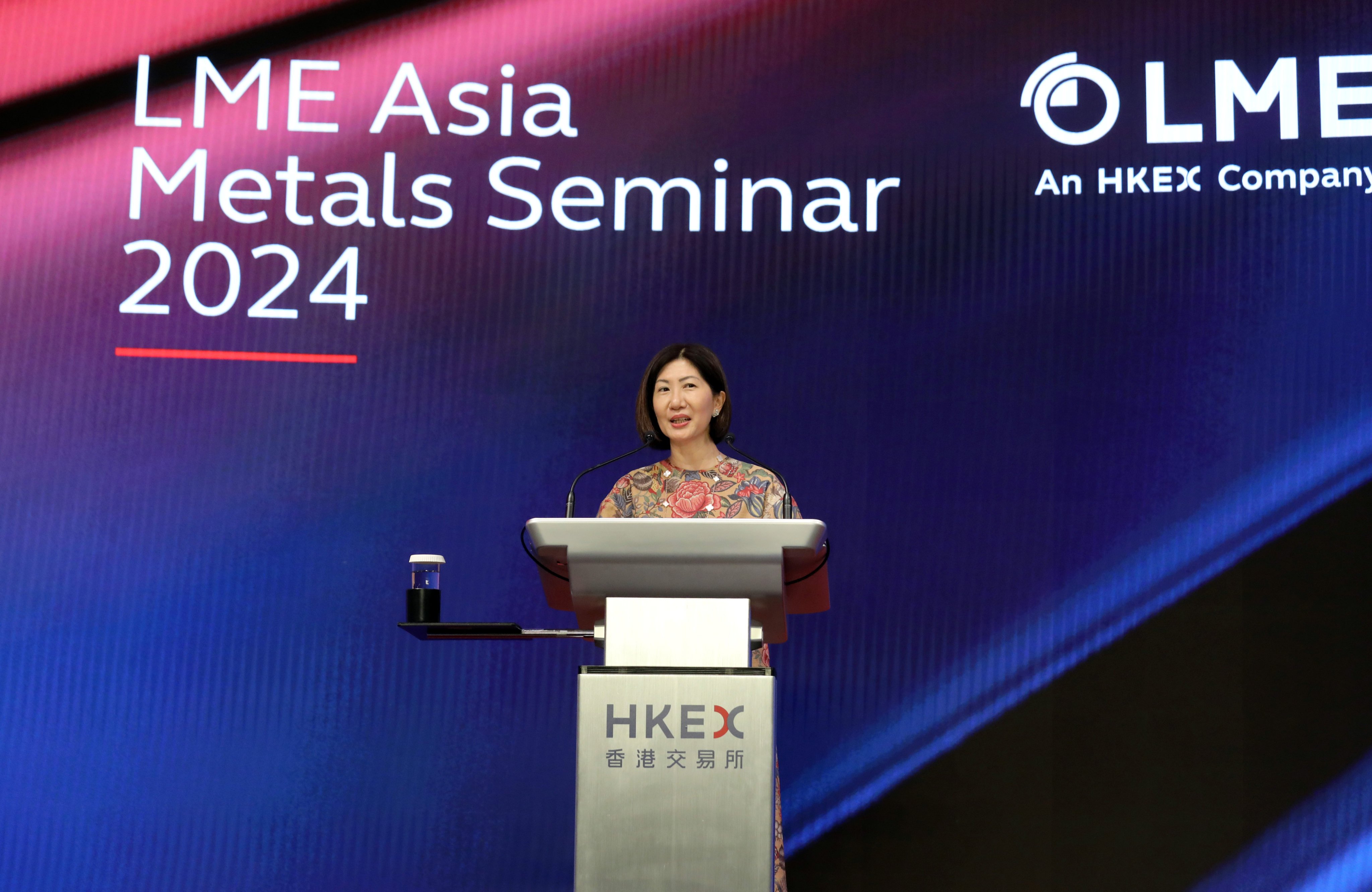

London Metal Exchange

London Metal Exchange

Set up in 1877 to provide a venue for trade conducted among metal merchants in London, the LME was sold in 2012 to the operator of the Hong Kong stock exchange. In 2013, it was a defendant in lawsuits accusing Goldman Sachs, JP Morgan and Glencore-Xstrata of rigging the aluminium market.

Chairman / President

John Williamson

CEO / Managing Director

Matthew Chamberlain

CFO / Finance Director

Tabitha Silverwood

Industry

Financial Services

Website

lme.com

Headquarters address

10 Finsbury Square, London EC2A 1AJ, United Kingdom

Year founded

1877

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement