Topic

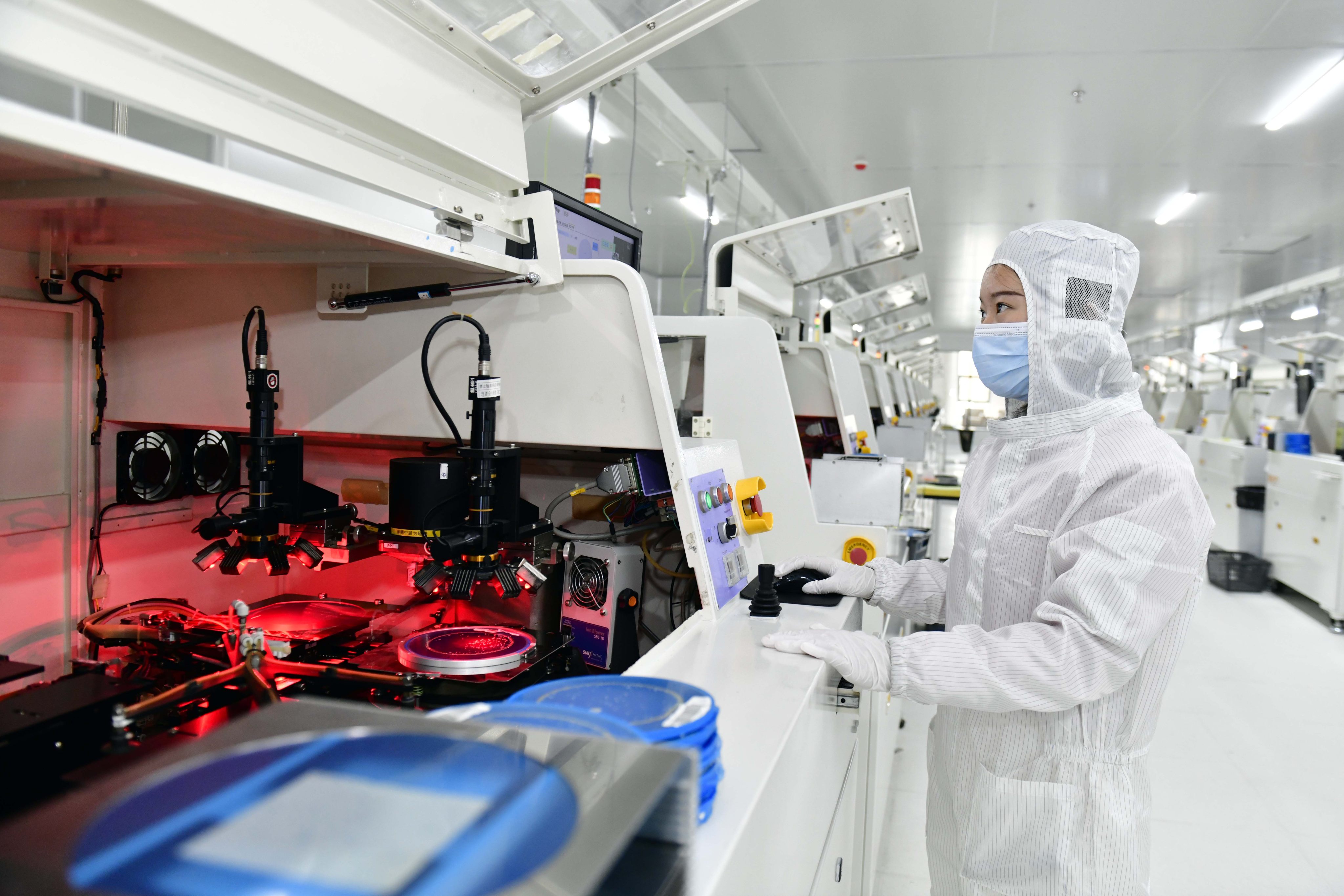

- The People’s Bank of China will reactivate two tools to stimulate lending for tech development and equipment upgrades, both major economic priorities

- Central bank will refinance US$69 billion for commercial banks that provide loans to qualifying enterprises, spurring credit and boosting activity

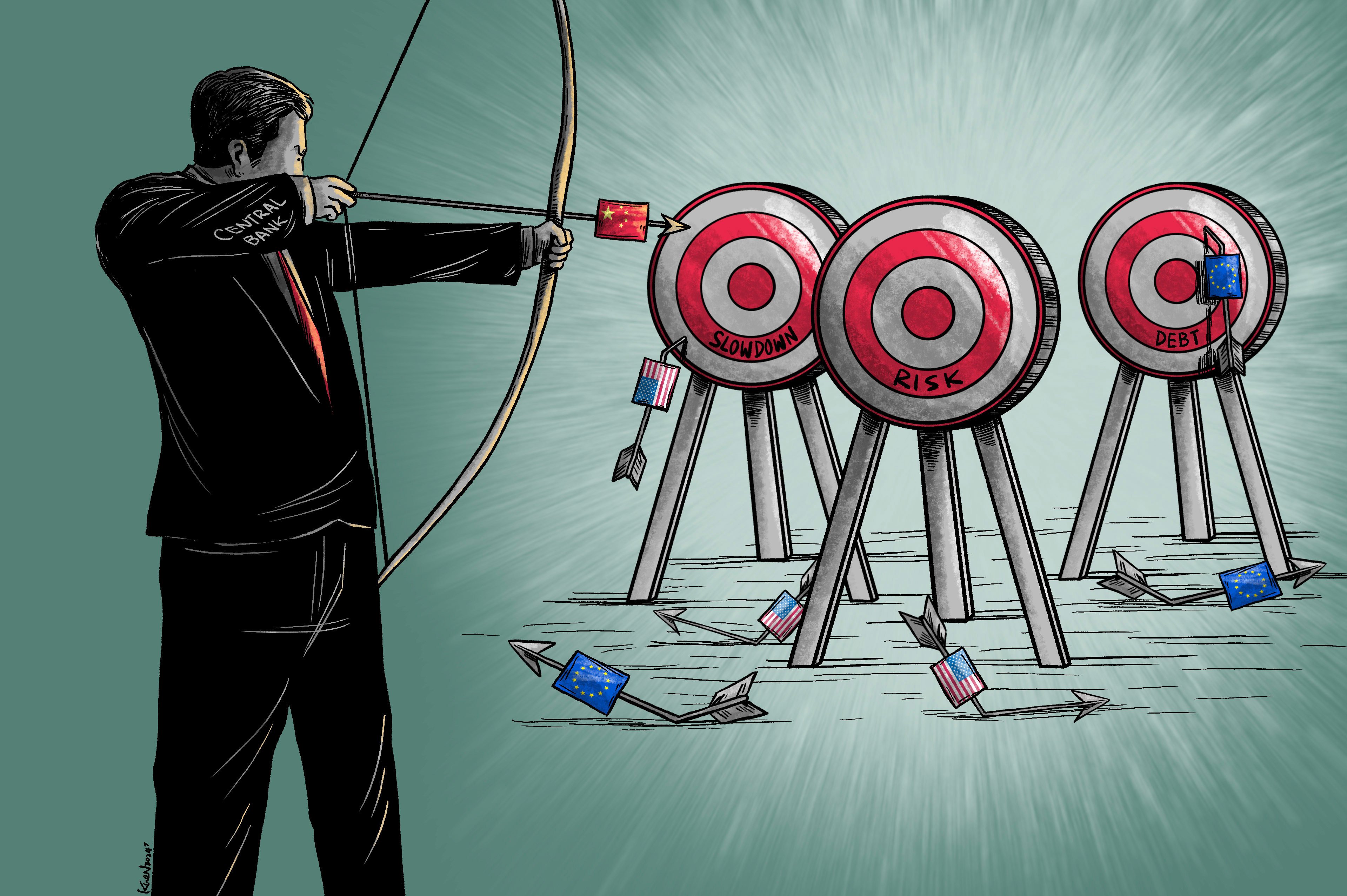

In an uncertain monetary environment where the US Federal Reserve has yet to announce interest rate cuts, China’s central bank is seeing potential moves to increase activity constrained by pressures on the yuan.

The move will make loans more costly for consumers and businesses, but banks will be able to earn more money from lending.

After changes to its leadership and structure, and with draft laws altering its scope, China’s central bank looks to be taking on a different role from years past – one which seems notably distinct from Western norms.

A Chinese economic adviser has said the central government should take advantage of its relatively low debt ratios and use its resources to spur consumption and guide effective investment – two things sorely needed as the country attempts to return to steady growth patterns.

In a recent research report, China International Capital Corporation determined a direct fiscal stimulus is the best course of action for economic growth this year, after several rounds of credit support to businesses have not had the desired effect.

Analysts and traders are divided over whether the Fed will cut rates in March, or whether a move later in the year would make more sense.

The Fed will lower rates starting in March for a total of four times this year and inflation will hit the US central bank’s 2 per cent target, according to Joshua Schiffrin, Goldman’s global head of trading strategy.

Gold headed for its first annual gain in three years as investors doubled down on bets that the Federal Reserve will start to unwind its restrictive monetary policy stance in 2024.

High borrowing costs aren’t going away anytime soon as many countries face the challenge of reining in runaway inflation, according to central bankers attending a conference organised by BIS and the Hong Kong Monetary Authority.