Advertisement

Advertisement

TOPIC

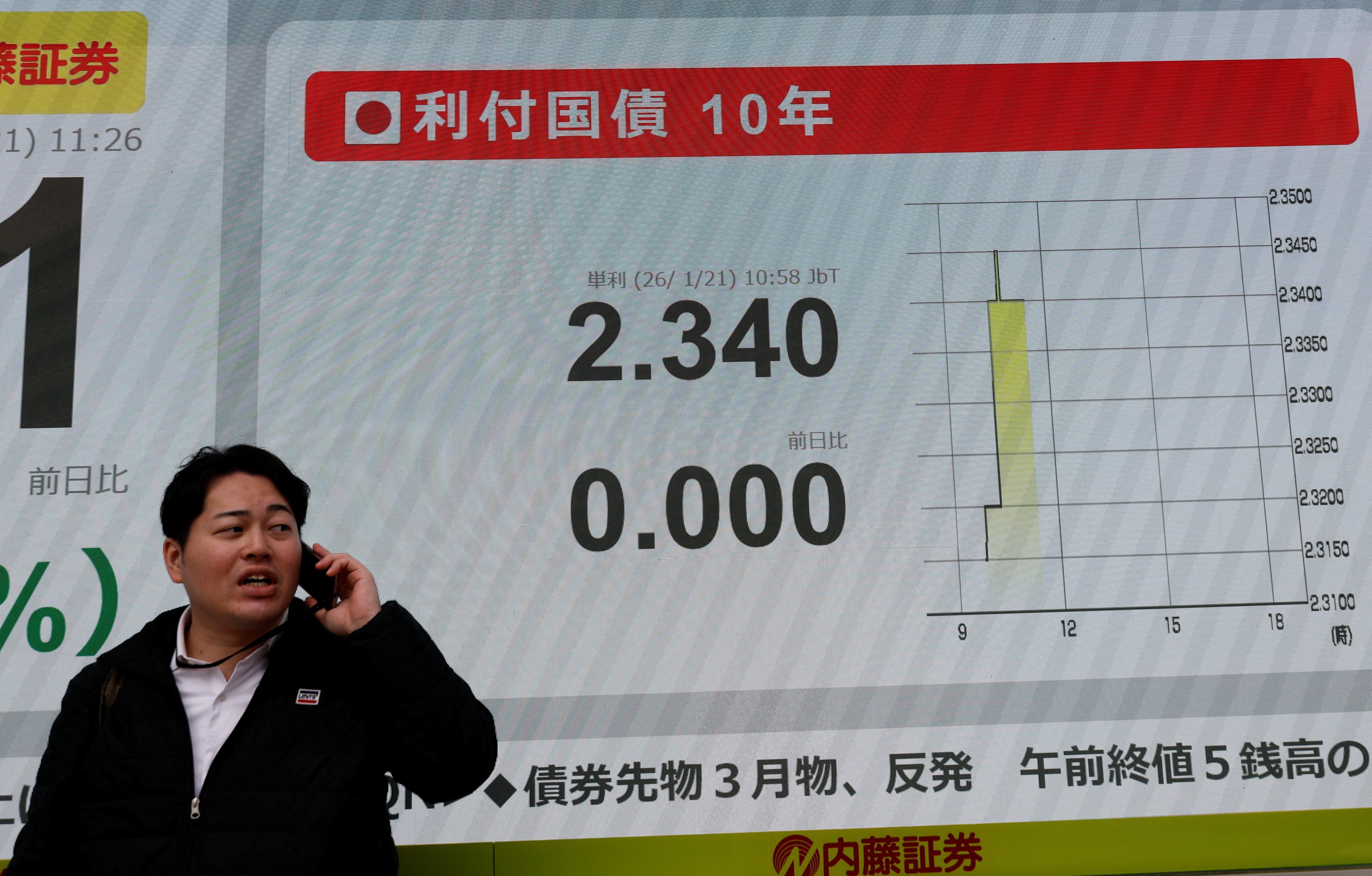

Central banks

Central banks

News about policymaking in the world’s major central banks with a focus on the People’s Bank of China, the Federal Reserve, the European Central Bank, the Bank of England, the Bank of Japan and the Reserve Bank of Australia.

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Help preserve 120 years of quality journalism.

SUPPORT NOWAdvertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement

Advertisement