China’s bitcoin miners, wary of tighter government scrutiny, make plans to move overseas

Unlike coal or copper – mining in the digital bitcoin world is open to anyone with an internet connection and the suitable hardware

A nondescript office on the outskirts of Beijing, strewn with screwdrivers and partially assembled computer circuit boards, seems an unlikely candidate for a company at the forefront of what proponents say is nothing less than the upending the established global financial order – and what JPMorgan chief executive Jamie Dimon has branded a scam.

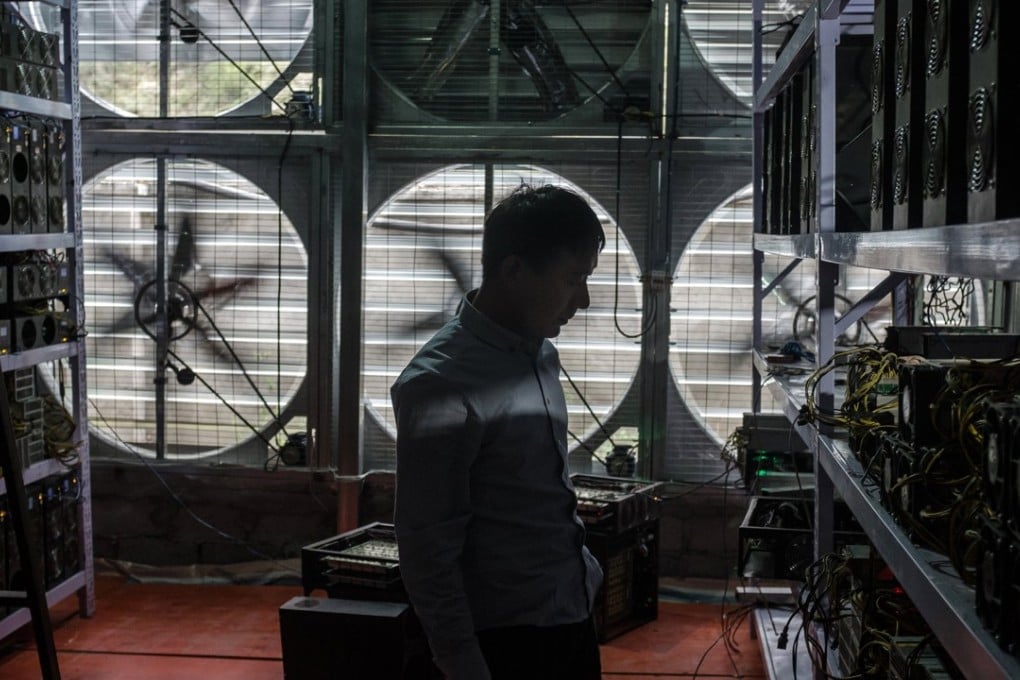

Rows of computer cards and the rhythmic whirring of fans needed to stop them from overheating offer a glimpse into the billion-dollar hi-tech “mining” business behind bitcoin, the world’s most popular cryptocurrency now trading at the equivalent of four ounces of gold.

However, the jury is still out on the broader future of cryptocurrencies, with critics like Dimon on the one side versus ardent supporters like Chinese bitcoin miner Akria Cui on the other.

During the time the cryptocurrency rocketed from just US$10 in 2012 to more than US$7,800 on Friday, China has emerged as the undisputed leader in bitcoin mining, something that was originally conceived as a game among cryptography enthusiasts. China is home to four of the five largest bitcoin mining operations, controlling roughly 70 per cent of the computational power, according to research by the Centre for Alternative Finance at the University of Cambridge.