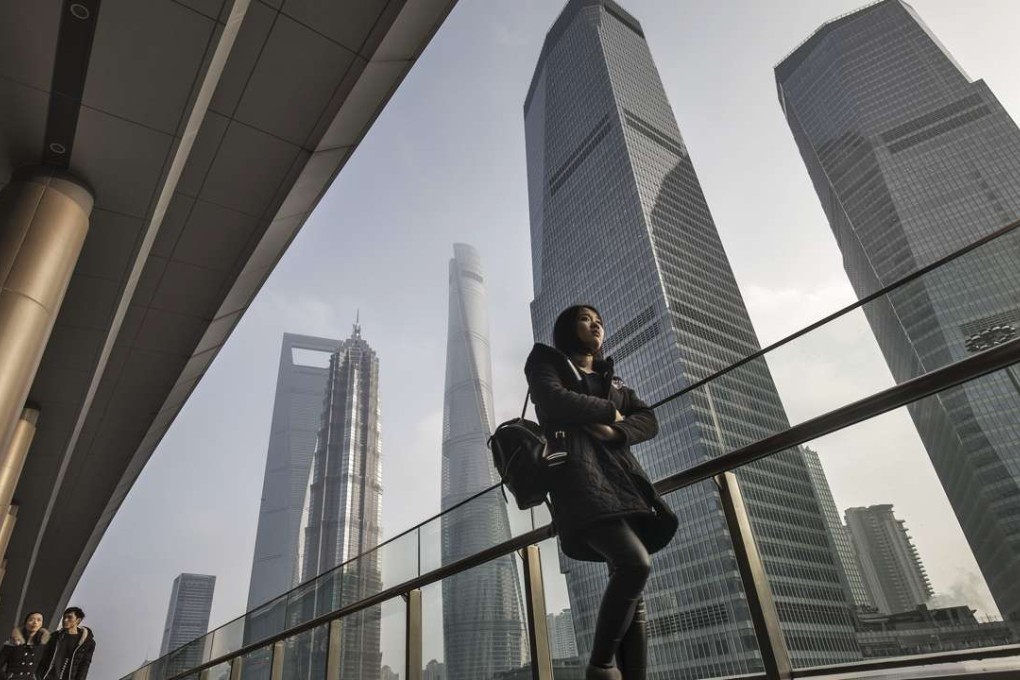

Massive China deals lift Asian venture capital fintech funding to record US$5.4b in 2016

China is home to six of the world's 22 venture capital-backed financial technology ‘unicorns’ -- start-ups valued from US$1 billion

Mega deals in China drove the total amount of funding raised by venture capital-backed financial technology start-ups in Asia to a record US$5.4 billion across 165 transactions last year.

That was up from US$4.8 billion across 162 transactions in the region in 2015, and nearly on par with the US$5.5 billion taken last year by United States venture capital-backed fintech start-ups across 422 deals, according to data from venture capital research firm CBInsights.

It said Asia accounted for about 20 per cent of such deals worldwide and 43 per cent of global funding last year.

“Major investments made by China’s established companies tipped the fintech balance in Asia last year,” Jon Allaway, the senior managing director for Asia-Pacific financial services at consultancy Accenture, told the South China Morning Post over the weekend.

Chinese online shopping giant JD.com signed up new investors led by Sequoia Capital China, China Harvest Investments and China Taiping Insurance to raise US$1 billion in funding for subsidiary JD Finance in January last year. This fundraising valued JD Finance at US$7.1 billion.