Chinese chip maker SMIC’s sales fall for third straight quarter despite boost from Huawei’s 5G smartphone revival

- SMIC reported a 15 per cent fall in revenue in the September quarter to US$1.62 billion, missing analysts’ projection of US$1.64 billion

- Net income dropped 80 per cent to US$94 million, compared with estimates for US$178.1 million

SMIC is one of the highest-profile companies at the heart of Beijing’s ambitions to build a world-class tech sector less reliant on American innovations.

Huawei itself shows signs of resuming the growth that Washington’s sanctions derailed.

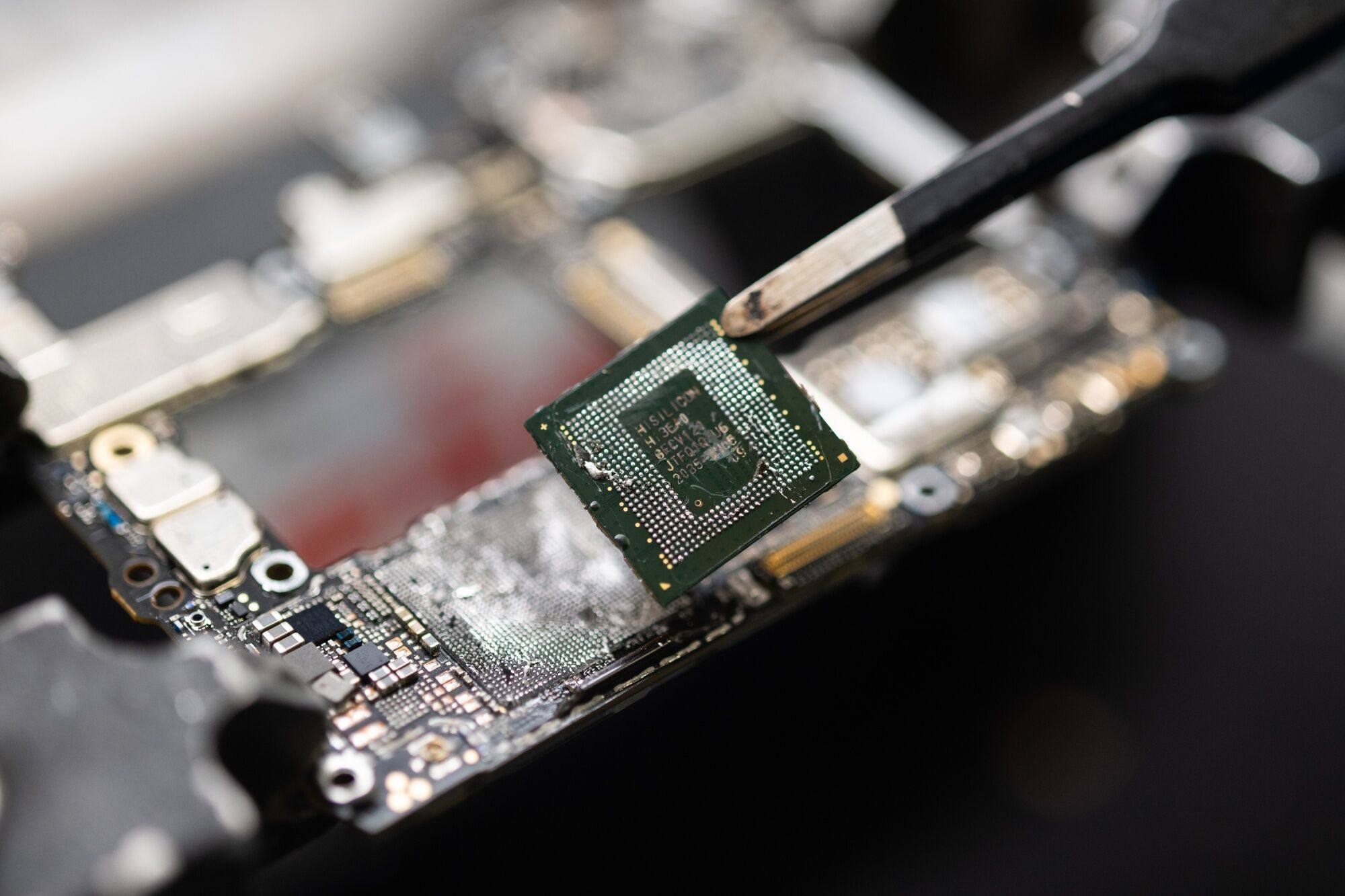

Tech war takes a new turn as Huawei pushes 5G smartphones with mystery chip

SMIC’s executives are expected to take questions about Huawei and its longer-term chip plans on Friday morning.

“Robust demand for Huawei devices, from servers to handsets, underscores local support for domestically produced chips, potentially sustaining the company’s capacity utilization beyond expectations,” Bloomberg Intelligence Analyst Charles Shum wrote in a note ahead of the results release.

Despite the boost from Huawei, SMIC continues to grapple with uncertainty in China’s smartphone market, the world’s largest.

SMIC, Huawei chip advances will continue despite US sanctions, says TSMC veteran

Smartphone shipments in the country fell 5 per cent in the third quarter and none of the top five players sold more handsets than a year ago, according to research firm Canalys.

Longer-term, it remains to be seen whether Beijing’s overt support for the country’s chip-related firms will pop up SMIC’s bottom line.

“China’s drive toward semiconductor self-sufficiency appears to buffer SMIC against anticipated third-quarter headwinds in sales and profit margins, despite broader market challenges from stagnant smartphone and consumer-electronics recoveries,” Shum of Bloomberg Intelligence wrote in a note ahead of the chip maker’s results release.