As China’s working population falls, factories turn to machines to pick up the slack

- China’s factories are turning to automation to upgrade production lines, and at the same time prepare for fewer, higher-skilled workers

- Chinese manufacturing companies like Midea have already embraced automation to sharply reduce the number of humans needed

This is the 12th in a series of stories about China’s once-a-decade census, which was conducted in 2020. The world’s most populous nation released its national demographic data in May and the figures will have far-reaching social policy and economic implications.

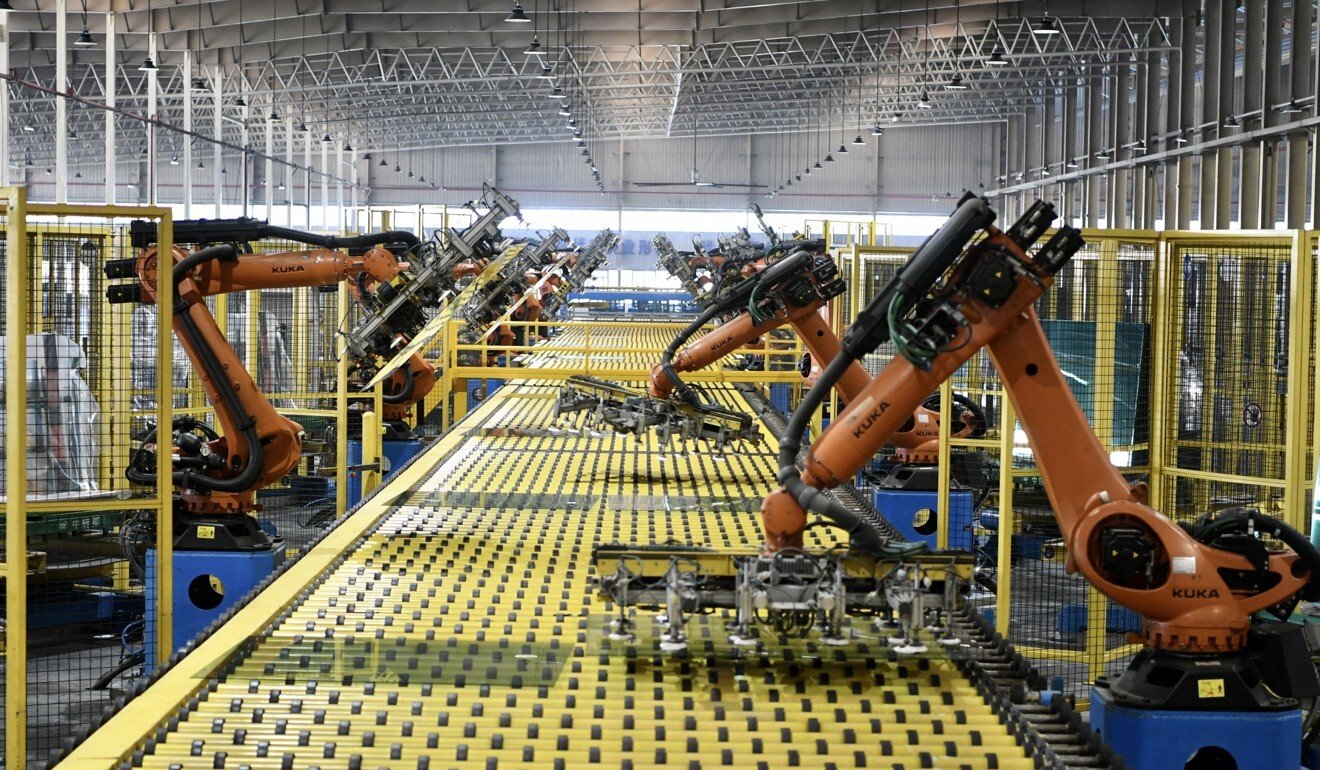

Orange robot arms weld and assemble with extreme precision. Digital cameras, powered by the latest computer vision technology, monitor parts as they move through the assembly line. Autonomous robots transport materials in, and finished products out, of the building silently and without human supervision.

Human beings have been physically removed from this assembly line, replaced by robots and digital-savvy technicians and engineers operating at a distance, who can monitor events in real-time via a digital panel accessible from anywhere in the factory via a portable device.

This is what a modern microwave-making factory run by Midea, one of the world’s largest home appliance makers, looks like in the southern city of Foshan, China, today.

What used to require 16 people now only needs four, said Xu Nian’en, a director at this Midea plant. The company has, over the last six years, invested 4 billion yuan (US$622 million) to transform itself, raising efficiency by 62 per cent and reducing its workforce by 50,000.

The challenge is an acute one for China as it continues to move up the value chain from what was once considered the world’s factory floor and has become more pressing as it confronts an impending demographic crunch that will change the country’s workplace for generations.

How China aims to dominate the world of robotics

China’s working-age population, people between the ages of 15 to 59, accounted for 63.35 per cent of the entire population last year, a decline of 6.79 percentage points from a decade ago, the census data showed.

Moreover in 2020, the figure was only three-quarters of the total in 2011 and will fall to just above half by 2050, according to Lu Jiehua, a professor of population studies at Peking University.

The census data does however, show progress in higher education with the number of people gaining a college education jumping from 8.93 per cent in 2010 to 15.5 per cent in 2020, putting the country ahead of many developing nations.

And this is the promise of artificial intelligence (AI) and technology – that many of the dirty, repetitive manual jobs of yesteryear will be replaced by more highly-skilled jobs in future.

The change is already being felt as factories find it harder to find younger workers willing to toil away on production lines.

“Nowadays, the generation in their 20s prefer service jobs, like live-streaming or sitting in offices,” said Yuan Jing, a deputy general manager of a medium-sized smart classroom equipment manufacturer based in Hebei province.

Thousands of factories across the country are already hard at work replacing manual labour with automation, robotisation and digitalisation.

Yuan’s company is doubling down on new technology at a new plant under construction, investing about 60 million yuan (US$9.4 million) on automation that will reduce the number of line workers needed for some processes by about half.

Midea plans to replace an additional 30 per cent of its front-line workers over the next three years with the help of digitalisation and automation, said Midea’s Zhou.

Over the past decade, China has gradually been transforming itself from a low-cost and low-skill labour country that churns out everything from cheap plastic toys to new iPhones, into a hub for smart manufacturing for more value-added products.

“In some senses, [the demographic changes] are not news,” said Xi Ning, chair professor of robotics and automation at the Hong Kong University (HKU). “The government actually anticipated this many years ago.”

Factories in China are now applying AI to crunch vast amounts of data and automate many processes, while the government included a policy to regulate and make data available to boost the industrial internet in its 14th five-year plan.

China unveils plan to become a manufacturing superpower by 2025

Financial support for robotics manufacturers and automation businesses comes from various levels of government in the form of subsidies, low-interest-rate loans, tax relief, or land rental incentives.

For the robotics industry, China’s government offers lavish subsidies that account for roughly 20 per cent of its net profit, according to Sinolink Securities, a financial services firm.

In March, Midea became China’s second company after Haier to have two facilities named as “lighthouse factories” by the World Economic Forum (WEF), an international honour recognising “the world’s most advanced factories” which are judged to be “leading the way in the adoption of Fourth Industrial Revolution technologies”.

This year’s list also included factories around the world at companies such as HP, Johnson & Johnson, Siemens and Proctor & Gamble.

“The process of digitalisation means altering a country’s core competitiveness at a fundamental level,” said Zhu Min, former deputy managing director of the International Monetary Fund and the head of Tsinghua University’s National Institute of Financial Research, in a speech last month.

“The labour cost for a Midea air-conditioner today is only about 10 yuan (US$1.60) – this was inconceivable in the past.”

And unlike other countries with legacy systems that need to be overcome for the industry to upgrade, the whole industrialisation process in China happened in the past 30 years, meaning manufacturers can effectively start from “a blank slate”, said HKU’s Xi Ning.

Xu Shaoyuan, a research fellow at the Development Research Center of the State Council, said that the decline and ageing of the working-age population were unlikely to have a significant impact on the country’s industries, as technological progress might be faster in replacing manpower than the demographic changes.

“With improvements in physical health, many people are still willing and able to work even after reaching the retirement age of 60. And with the advancement of technology, the physical requirements for workers are, in general, declining,” Xu said.

Meanwhile, while labour costs have been rising steadily over the last decade in China, many factories have moved from more expensive coastal areas to relatively impoverished and cheaper areas in the west of the country.

The national annual average wage of employees in urban private companies in China nearly tripled to 57,727 yuan (US$9,000) in 2020 from 20,759 yuan in 2010, according to the National Bureau of Statistics.

For the manufacturing sector, the average annual wage of employees of enterprises was 74,641 yuan in 2020, while in 2017 that figure was 58,049 yuan.

However, China’s robotic workforce still pales in comparison to its human workers, with 187 robots per 10,000 employees currently.

In comparison, Singapore has the highest density of robots, with 918 robots per 10,000 employees, followed closely by South Korea with 868 robots, according to January data from the International Federation of Robotics.

02:20

Intelligent sorting systems help China's JD.com cope with demand during Covid-19 pandemic

And while the demographic crunch may be met with a smaller, more skilled workforce in China in future, it could be a negative for those workers who are unwilling or unable to adapt fast enough to more advanced workplace technologies.

China and the world will also have to embrace an upgrade in education and jobs. As traditional blue-collar jobs become obsolete, many of these factory workers will have to upskill or change their profession.

“Many workers will not be doing mechanical work on production lines, they will need to be able to handle data analysis and other more valuable things,” said Midea’s Zhou. “Our existing employees must transform, otherwise they could be phased out.”