Here’s the inside story of how Xiaomi’s plan to list in Shanghai fell apart

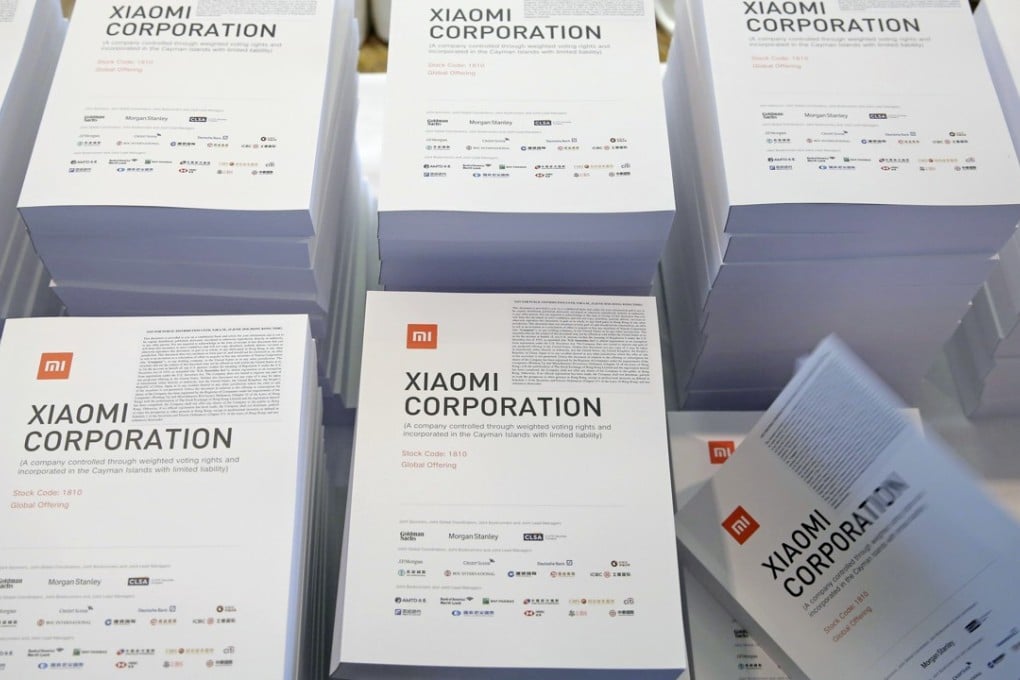

The collapse of Xiaomi Corp.’s plan to sell stock in mainland China is an example of Beijing’s ambition getting ahead of its reality.

Intransigent regulators, lack of clarity from the central government and a company sticking by its own deadline combined to scuttle the first attempt to sell Chinese depositary receipts, according to people familiar with what happened. That forced Xiaomi to nearly halve what it would raise and has thrown into doubt what was expected to be a conga line of other Chinese tech giants joining exchanges in Shanghai and Shenzhen.

Xiaomi had planned to raise about $10 billion selling stock in Shanghai and Hong Kong, but that fell apart when it couldn’t adequately answer 84 questions posted online by Chinese regulators and still meet its target for a Hong Kong listing, the people familiar said, asking not to be identified. Officials at the China Securities Regulatory Commission were concerned Xiaomi was pricing its debut too high and that retail individuals, who are the majority of China’s stock market, might get wiped out if things go south, according to one of the people.

Instead Xiaomi is targeting as much as $6.1 billion from just the former British colony and says it will revisit CDRs later.

“Adding a China CDR into a long-planned Hong Kong offering at short notice was always going to be a tall order,” said Jason Sung, capital markets partner at law firm Herbert Smith Freehills in Hong Kong.