UK supports the ‘Belt and Road Initiative’ behind the scenes

Among the more visible areas of involvement is finance, with British banks quick to join China’s global trade initiative

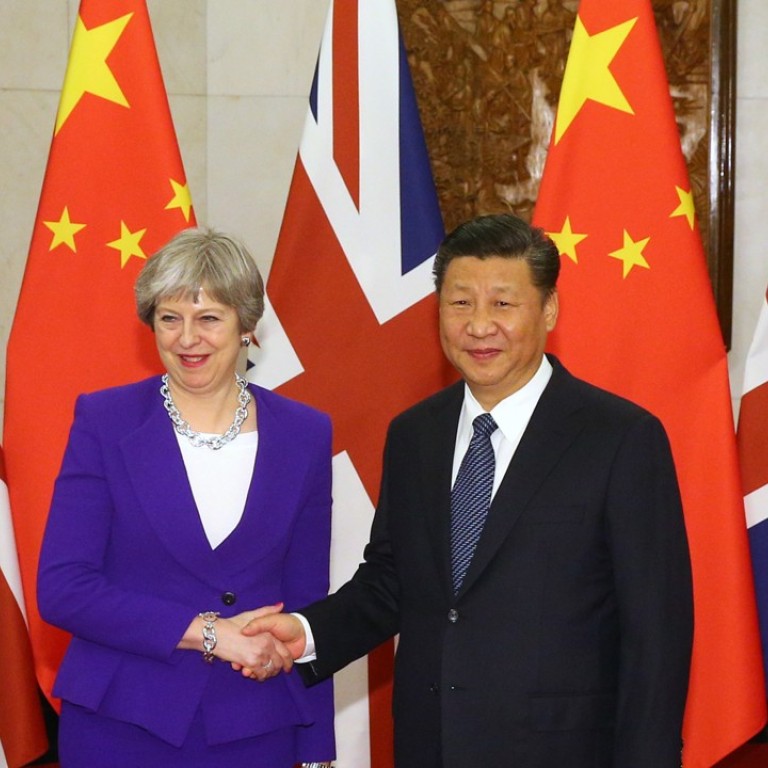

British Prime Minister Theresa May was careful to ensure that there was no official backing for China’s “Belt and Road Initiative” when she led a major trade delegation to Beijing in January.

But there is indirect support as Britain searches for strategic partners in a post-Brexit era. “For the UK, the recognition of its new status – clearly out of the European Union and most likely a hard Brexit scenario – has pushed May towards an intermediary role,” Natixis said in a report summarising May’s visit with about 50 ministers and business leaders.

The UK will become the first large advanced economy to support the initiative, if not directly. London is also identified as a key participant for financing. British and Chinese banks are invited to collaborate in financing the initiative, and the UK government has agreed to contribute to a new Asian Infrastructure Investment Bank (AIIB) fund for the same purpose.

“The UK government has been trying to switch towards a more bilateral relationship with China and two major issues stand out this time.

“First, the UK will become the first large advanced economy to support the initiative, if not directly. London is also identified as a key participant for financing. British and Chinese banks are invited to collaborate in financing the initiative, and the UK government has agreed to contribute to a new Asian Infrastructure Investment Bank (AIIB) fund for the same purpose.

“Second, Theresa May has clearly pushed for London to connect to China’s capital market. The most imminent action will be a London-Shanghai Stock Connect. A bond connect is also mentioned but is clearly less immediate,” said Nataxis.

The visit ended with delegates finalising deals worth about £9 billion (HK$92.34 billion) in areas such as finance, innovation, agriculture and technology, according to China’s Ministry of Commerce.

Among the more visible areas of involvement is finance, with British banks quick to join China’s global trade initiative, led by Standard Chartered.

“Our job is to try and pull the different pieces together, because there will be some local financing required,” he said.

The bank has won 20 related financing deals over the past four years – including a US$515 million project financing for a power plant in Zambia, a US$200 million loan for a Bangladesh electricity plant, and a US$42 million export credit facility for a gas terminal in Sri Lanka.

A memorandum of understanding was also signed with the China Development Bank to grant loan credit of 10 billion yuan (HK$11.46 billion) to help finance such projects.

Ben Hung, Standard Chartered’s head of Greater China North Asia, and group head of retail banking, reiterated the bank’s commitment at its results announcement in February. He said it was involved in more than 50 deals related to Beijing’s plans to grow global trade.

“In reality, a lot of these projects tend to start with some form of bidding. You have to do escrow accounts and FX services before you get into project financing,” he said. “But it doesn’t matter at what stage these projects are – our footprint is ‘so belt and road’.”

Natixis outlined a number of outcomes from talks regarding the trade initiative after the UK delegation’s visit to Beijing.

The outcomes included a detailed discussion about potential aspects of cooperation in the “Belt and Road Initiative”, an agreement to implement the Belt and Road Financing Guiding Principle and promote cooperation on investment and financing under the Initiative, and an announcement by British Standard Chartered of further financing commitment to the Initiative.

A further outcome is both sides agreeing to deepen Belt and Road project identification, research and capacity building. In addition, the UK Export Finance (UKEF) is to support up to £25 billion of new business for projects along the path.

A proposal was put forward for a bilateral UK-China investment fund with an initial round of US$1 billion to invest in the UK, China and the third markets to support the Initiative.

China Development Bank and the UK will discuss the possibility of establishing investment funds for better cooperation between Chinese and British companies.

Fox said that the UK’s strong reputation in services, consumer goods, and advanced manufacturing makes it perfectly suited to meet the needs of China’s dynamic economy, as well as playing a part in China’s global trade initiative.

Fox said the potential for UK companies was particularly relevant to “sustainable infrastructure, financial and legal services, innovation and technology, and public health”.

“If well implemented, the ‘Belt and Road Initiative’ could help support development and global economic growth across Asia and beyond,” he says.

“We are preparing for a new chapter, post-Brexit, in our golden era of bilateral relations,” Fox said, pointing out the attractiveness of the UK as a place to do business, and its “personal ties” with China.

Jim O’Neill, chairman of British think tank Chatham House, said last week that Belt and Road was “possibly the most important thing for the future of world trade”.