Hong Kong couple and son among six arrested for laundering HK$2.5 billion, officers probe links to other transactions involving different family and even more cash

- Customs arrests the group on suspicion of running money-laundering operation through 59 bank accounts

- Officers looking at possible connection to another criminal case involving HK$3 billion of laundered cash

Hong Kong customs has arrested six people including a couple and their son on suspicion of laundering about HK$2.5 billion (US$322 million) through 59 bank accounts over two years, as officers investigate possible links to an even bigger criminal case involving another family.

In the latest arrests revealed on Thursday, a 23-year-old man and his parents, aged 48 and 50, were held along with the mother’s 36-year-old male friend, who officers suspect are the core members of a money-laundering syndicate.

Also arrested were two men – a garage worker, 23, and a chef, 25 – thought to be the holders of 13 bank accounts used to collect and launder HK$550 million in 2019 and 2020.

Hong Kong crime family arrested in HK$3 billion money-laundering investigation

In September, officers picked up five members of another family accused of laundering more than HK$3 billion, alongside the owner of a money exchange company which had previously employed the woman, 48, arrested in the latest case.

Officers from the Customs and Excise Department’s syndicate crimes investigation bureau are looking at whether the two cases are connected and if the same ringleader is behind both families.

Law enforcers are also trying to track down two directors of another money exchange company in relation to the new arrests. The woman detained this month was in charge of that company and the 36-year-old man was her colleague before it closed for business last year.

Acting on intelligence, Hong Kong customs began investigating the syndicate in mid-2020, but the couple and their son were not initially under investigation.

The family was only identified in connection with the alleged money-laundering activities after customs officers arrested the three men in a series of raids in Tai Po last Thursday.

It is understood the woman was at the home of the 36-year-old suspect during one of those raids, but she was not arrested at the time and officers took her personal details before letting her go.

“While carrying out analysis and further investigation, we believe the woman and her husband and son were behind the three men. The family also involved a lot of suspicious financial transactions. Officers immediately took action and arrested them on the next day [last Friday],” a law enforcement source said.

Superintendent Grace Tang Wai-ngan, of customs’ syndicate crimes investigation bureau, said the couple’s son was responsible for recruiting people to help process the suspicious transactions, and he had also opened 12 bank accounts for handling HK$200 million in 2018 and 2019.

Tang said 22 bank accounts belonging to that suspect’s parents were also used to handle HK$1.2 billion in suspicious transactions, adding she believed the mother played a key role in the syndicate because her accounts dealt with about 45 per cent of the HK$2.5 billion involved in the case.

According to officials, the woman was paid HK$20,000 a month while working at the money exchange company in Sheung Wan and her husband, 50, was employed at a restaurant on a monthly salary of HK$30,000, while their son earned HK$15,000 a month in the catering industry. They are all now unemployed.

“The family had a total monthly income of HK$65,000, but around HK$1.4 billion had been funnelled through their 34 bank accounts in about 1,400 transactions in 2018 and 2019,” said Senior Superintendent Mark Woo Wai-kwan, who heads customs’ syndicate crimes investigation bureau.

“The amount of the money dealt by the family is not commensurate with their family’s income and profiles.”

The 36-year-old man was accused of using his 12 bank accounts to launder HK$600 million in 2019 and 2020.

Woo said preliminary investigation revealed the group had laundered HK$2.5 billion through 59 bank accounts between January 2018 and February 2020.

“Over 2,600 suspicious financial transactions were involved. The biggest single transaction was more than HK$22 million,” he said.

More than half of the transactions involved dozens of shell companies with no record of running businesses in the city. Registered directors of the shell companies included residents of mainland China.

The cash from the rest of the transactions came from other individuals and unknown sources.

“It’s a typical money-laundering tactic used to conceal the origins and the flow of the dirty money,” Woo said.

After a months-long probe, dozens of customs officers swooped to arrest the six suspects in a series of raids in Yuen Long and Tai Po on Thursday and Friday last week.

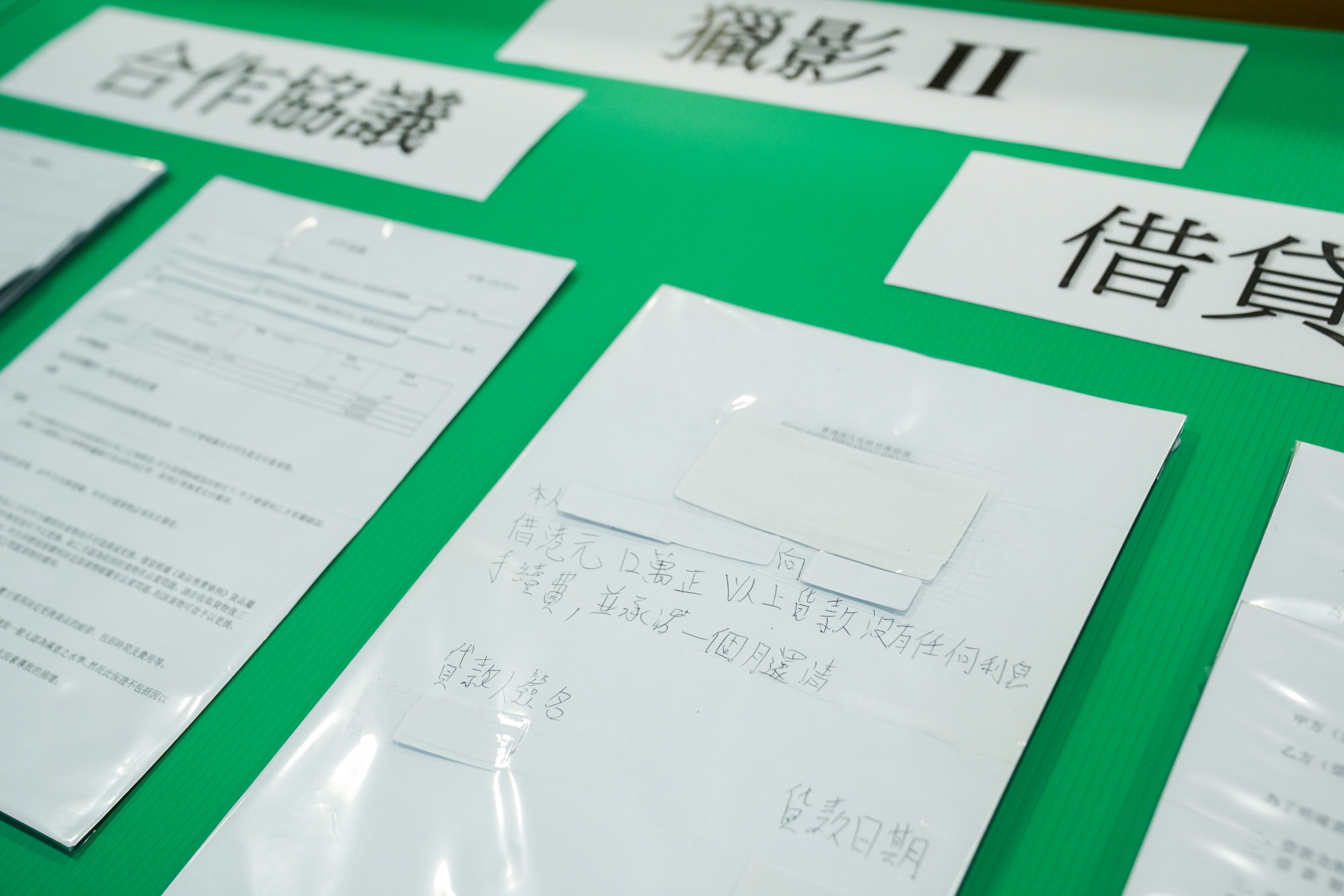

Mobile phones and documents including bank statements were seized, but neither cash nor assets linked to the funds were confiscated or frozen in this case. It is understood the core members left hundreds of dollars in each of their accounts.

The source said the suspects might have used other bank accounts to hide their money or for deploying other tactics to conceal their assets.

All of the suspects have been released on bail pending further investigation. Customs officers are investigating the origins of the money and the types of illegal businesses behind the funds.

Woo also warned of online employment traps in which jobseekers were offered high pay, but had to hand over control of their bank accounts to hold money from unknown sources.

Regardless of whether monetary reward was involved, those offering up their personal bank accounts to deal with money from unknown sources might risk committing money-laundering crimes, he said.

In Hong Kong, money laundering carries a maximum penalty of 14 years in jail and a HK$5 million fine.

Police in January arrested seven current and former Hong Kong bankers in a crackdown on an international money-laundering syndicate alleged to have handled HK$6.3 billion in criminal proceeds over four years – the city’s biggest such case in nearly a decade.

According to the force, the syndicate sent 16 people – a mix of Belgians and mainlanders – to the city to open business accounts to be used for money laundering.

The city’s largest ever money-laundering case – involving HK$13.1 billion – came to light with the 2012 arrest of a 22-year-old mainland man.

He laundered the money through his bank accounts between August 2009 and April 2010, making 4,800 deposits over an eight-month period. In January 2013, he was sentenced to 10½ years in jail.