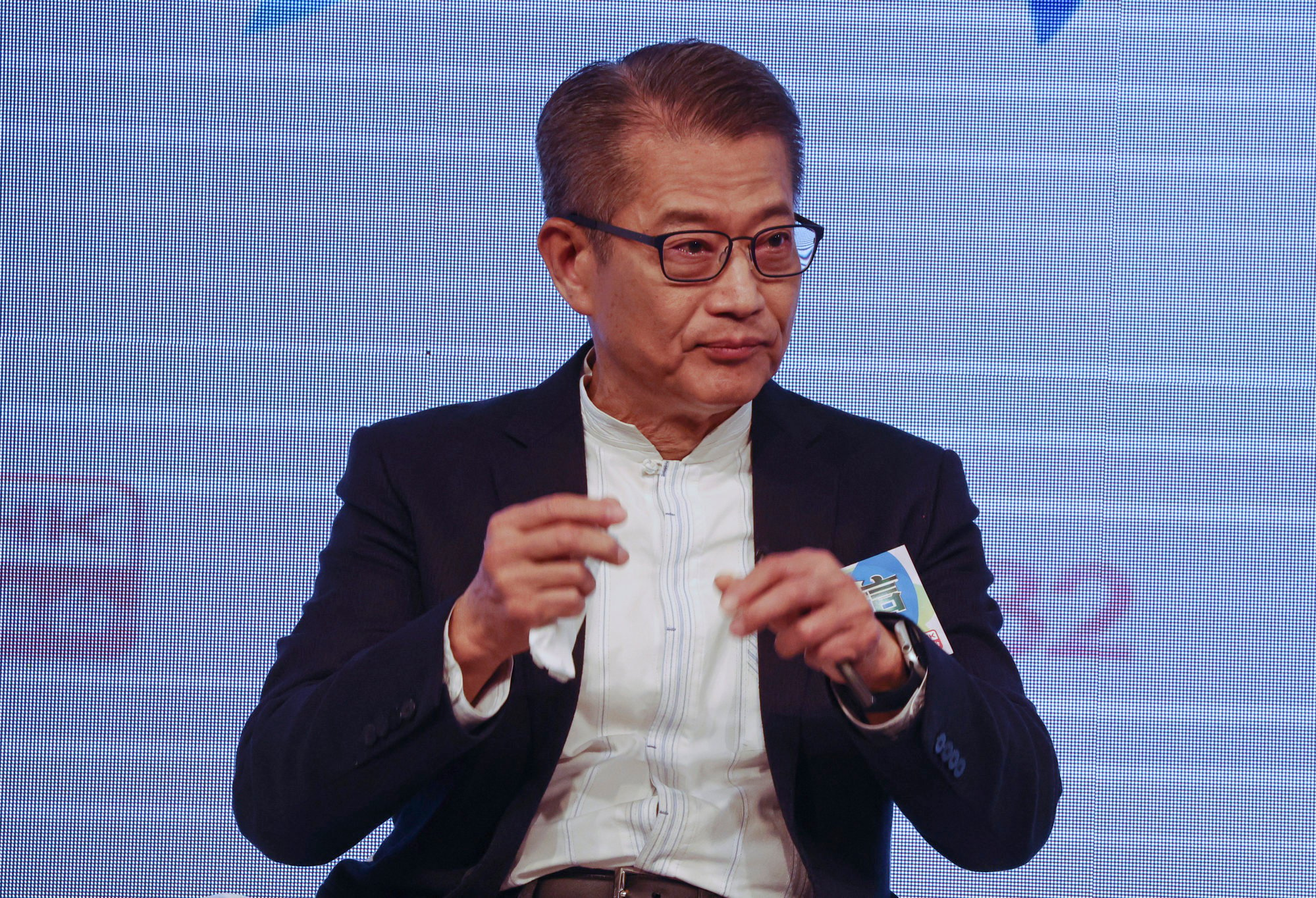

Hong Kong’s finance chief floats tax break for middle-class families with foreign domestic helpers

- Government would also have to decide whether concession would apply to families who employ local domestic workers, Paul Chan says

- While administration does not intend to drastically roll back relief measures, some adjustments needed given deficit, he warns ahead of next month’s budget address

Hong Kong’s finance chief has vowed to consider a tax break for middle-class families who hire foreign domestic workers to help them cope with the pressures of a post-pandemic economy.

Chan also made it clear the double stamp duty that non-residents must pay on home purchases would remain unchanged but the government had decided against introducing a tax on vacant flats.

“The government needs to increase income and cut expenditure in the face of a high deficit and soaring expenses aggravated by the ageing population,” he said. “We need to study in detail which tax items should be rolled out to increase our revenue.

“In this regard, the whole society will have to bear this responsibility together.”

The government last November downgraded its full-year economic forecast for 2022-23 from between 0.5 per cent growth and 0.5 per cent contraction, to a 3.2 per cent drop, after gross domestic product (GDP) fell for three straight quarters, prolonging the city’s recession.

The finance minister recently projected a budget deficit exceeding HK$100 billion (US$12.77 billion) for the current financial year, almost twice his estimate in February last year. The government’s financial reserves could also fall to about HK$800 billion, equivalent to 11 months of government spending.

Hong Kong’s economy could face ‘difficulties’ but recovery on horizon: Paul Chan

Given the momentum of recovery remained weak in the aftermath of the Covid-19 pandemic, the government would adopt a “middle-of-the-road” fiscal policy, balancing expenditure and revenue while adjusting certain relief measures to ease the financial burden on the public, Chan said.

“Over the past few years, we’ve rolled out massive countercyclical fiscal measures to ease the economic downturn, causing a soaring deficit. Therefore, we will have to make some adjustments to our fiscal policy,” he said.

“But we know that the public is still under a lot of financial pressure with limited recovery momentum. We will have appropriate measures to ease the pressure on the public and won’t roll back all the relief measures in one go.”

Chan also promised to consider a tax allowance for families who hired foreign domestic helpers.

“We’ve heard similar calls to have a tax allowance for hiring of foreign domestic helpers,” he said. “Actually, this has been listed as our area of study.”

But Chan said officials would need to decide whether the tax break should also be given to families who hired local domestic helpers, as well as look at how much extra administrative work the policy would create overall.

Consumption vouchers again for Hong Kong? Won’t work, say experts

By the end of April last year, Hong Kong had about 332,000 foreign domestic helpers, most of them from the Philippines or Indonesia.

Foreign domestic helpers account for one-tenth of the city’s workers and 5 per cent of Hong Kong’s population of 7.48 million. They are present in 15 per cent of all local households.

Chan also said the administration was still undecided over whether to continue its consumption voucher scheme, under which the government dished out HK$102.4 billion in the past two years to stimulate the economy. Residents received HK$5,000 in 2021 and HK$10,000 last year to spend at local businesses using online payment platforms.

“There are divergent opinions in society about the e-voucher scheme with supporting and opposing views. Both sides have strong reasoning,” he said.

“So far we haven’t reached a conclusion on this. We need to be prudent about our public finances … When the economy is not good, we need to keep a close eye on our purse and to live within our means.”

Some audience members also called on the government to increase support for the elderly, including subsidies to cover operations done at private facilities. While promising to consider expanding medical subsidies, Chan warned spending on healthcare had soared due to the Covid-19 pandemic, with expenditure for the current financial year shooting up to about HK$150 billion.

Gary Ng Cheuk-yan, a senior economist with Natixis Corporate and Investment Bank, said the government should roll out another round of the consumption voucher scheme, and this time offer HK$7,000 per person to ease pressures on the public. He added subsidies for electricity and public transport should also be continued to help those in need.

“The public is still facing tremendous fiscal pressure due to the sluggish economy, including coping with a spike in interest rates for making mortgage payments,” he said.

Hong Kong helpers stressed about money, don’t sleep enough amid pandemic

“Providing a digital voucher worth HK$7,000 to each person won’t create a long-term burden on the government as this is just a one-off measure which can help people from all walks of life.”

Ng also argued that it would be better and less complicated for the government to raise the deductions in salaries tax instead of providing a tax break for families hiring a foreign domestic helper.

“It will be much easier to simply raise the salaries tax deductions which can benefit all and save all the administration fees. A tax break for families who hire domestic helpers will require administrative staff to check the employment document which will be very complex,” he said.

Betty Yung Ma Shan-yee, chairwoman of the Hong Kong Employers of Overseas Domestic Helpers Association, said her group hoped Chan would implement the tax break for families hiring foreign domestic helpers, as such families had to spend more than HK$7,000 a month, including on meals and transport for the workers.

“This is a benevolent policy which will help not only the middle class, but also many [low-income] families who really need a domestic helper to look after their elderly parents. The tax break can ease their burden and also encourages families to have children,” she said.