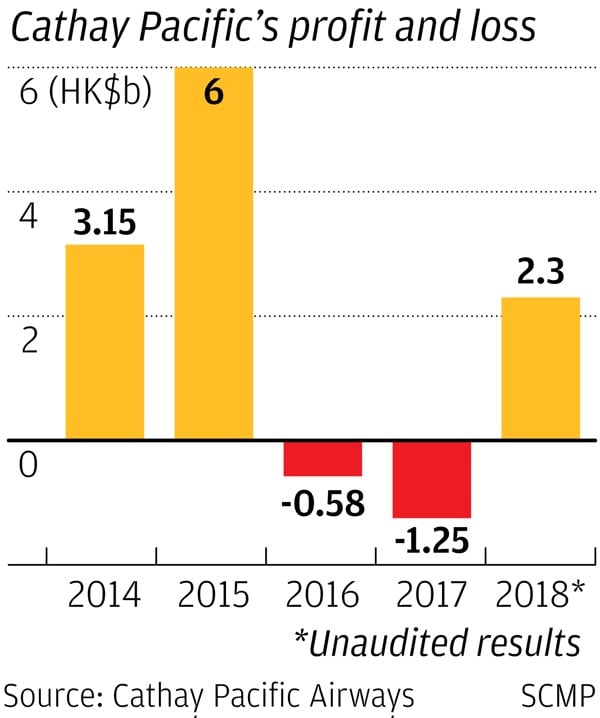

Cathay Pacific announces HK$2.3 billion net profit for 2018 – a huge turnaround from previous year

- Airline suffered first back-to-back loss in its history in 2017

- Company is due to reveal full set of 2018 results in March

Embattled Cathay Pacific Airways said on Wednesday it expects to announce a net profit of HK$2.3 billion (US$295 million) for 2018 – a huge turnaround from its HK$1.25 billion loss the previous year.

“The transformation programme has had a positive impact,” Cathay said in a statement to the Hong Kong stock exchange.

It was only the second time Cathay had made an unscheduled profit performance announcement since it became a publicly traded company in 1986.

The other time was in July 2008 when the airline warned soaring fuel prices meant it could not accurately judge its financial results.

Hong Kong listed companies are required to alert or warn shareholders of any significant changes in profits or losses prior to scheduled announcements.

The unaudited results were better than analysts had expected, with a consensus of 15 having estimated HK$1.1 billion.

“The worst is behind Cathay,” said Paul Yong, a Singapore-based equity analyst of DBS Bank. “This is also why the stock rose so much today.”

The carrier’s share price jumped by 90 cents – or 7.44 per cent – to HK$13 on Wednesday, an eight-month high.

Yong said the turnaround was mainly driven by lower fuel prices, Cathay’s biggest cost.

He expected jet fuel prices to stay low – about US$65 per barrel – and said airlines would benefit from a rise in earnings of more than 5 per cent for every US$1 decline per barrel.

Andrew Lee, equity analyst of Jefferies Hong Kong who forecast a profit of HK$702 million last year, said the 2018 profit was “a good, positive surprise”.

Lee estimated the passenger yields in 2018 would jump 6.8 per cent year on year with the second half outperforming the first.

He added the air cargo yield grew 8.4 per cent last year, but the business would come under more pressure as the global trading environment deteriorates in the face of an uncertain future surrounding the ever growing US-China trade war.

It remained unclear whether the airline has set aside money for potential regulatory fines.

“At least the passengers keep coming regardless of the data breach. No matter what the bad things about Cathay are about, people are willing to travel,” said transport expert Geoffrey Cheng.

The company will reveal its full set of 2018 results on March 13.

The detailed results will shed more light on whether the company’s core airline business is able to record its first profit in three years after contributing HK$7.6 billion in losses over that period, dragging down the group’s wider performance.

Additional reporting by Danny Lee