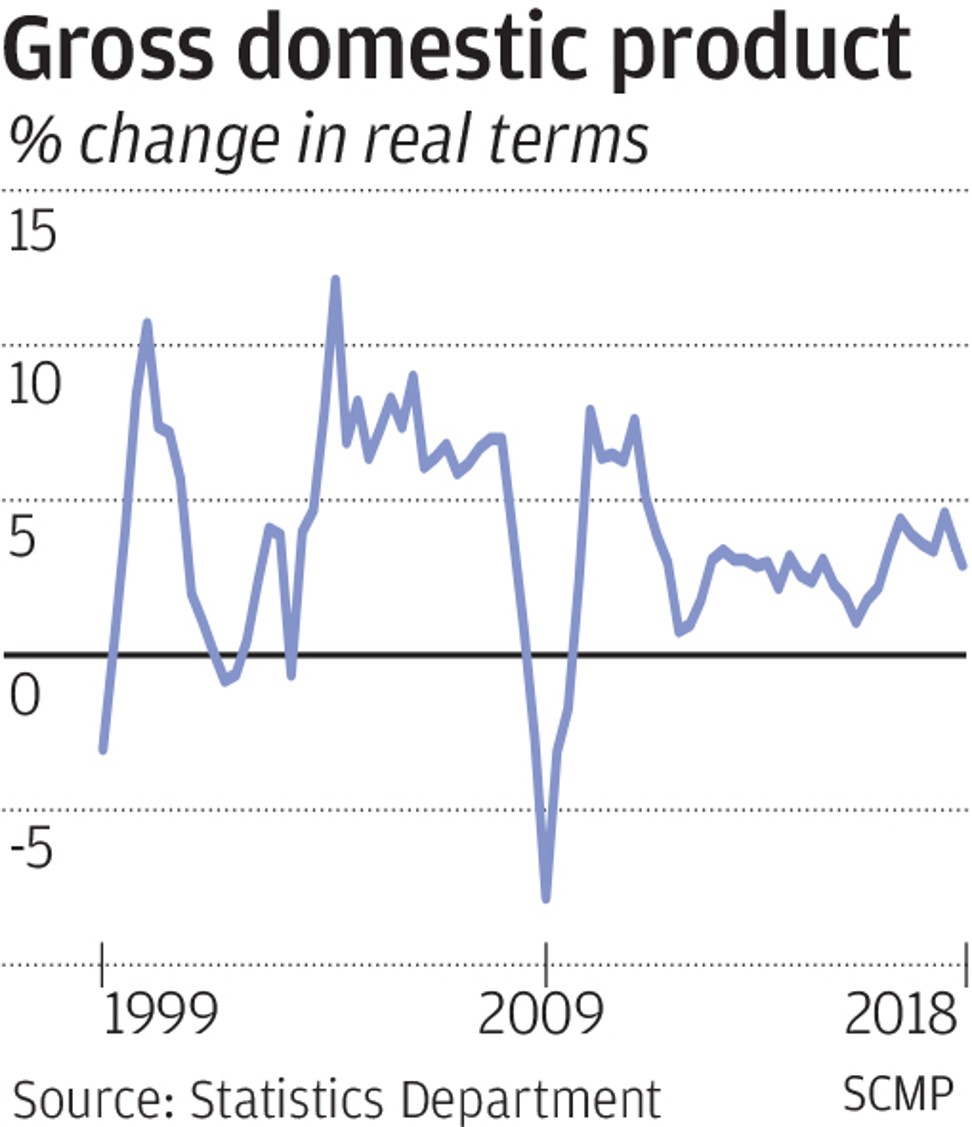

Trade war starts to bite as Hong Kong economy slows in third quarter with GDP at lower than expected 2.9 per cent

- Government warns of ‘increasing downside risks’ and the city might feel repercussions of an extended US-China trade war

Hong Kong’s booming economy is running out of steam, having grown at a slower than expected 2.9 per cent in the third quarter this year under the weight of weakened property and stock markets.

It was the slowest quarterly growth in two years.

Gross domestic product slowed from a 3.5 per cent rise in the second quarter and a 4.6 per cent jump in the first quarter.

Some economists had estimated third quarter growth at 3.3 per cent and forecast it would further slow to below 3 per cent in the final quarter of this year.

The government estimated full-year growth at 3.2 per cent, which was still within its earlier projection of 3 to 4 per cent for 2018.

Hong Kong GDP records 3.5 per cent growth for second quarter

The city, which has long served as a middleman for the East and West in trade and services, faces rising headwinds from global trade turmoil as the US-China trade war escalated in September.

“The impacts on Hong Kong’s external trade have begun to surface, and are likely to become more apparent in the near term,” government economist Andrew Au Sik-hung said of the trade war.

Hong Kong, which has nearly half of its exports to the United States from China exposed to punitive tariffs, is trapped in the middle of the trade war.

The September levies on Chinese goods will jump to 25 per cent on January 1, 2019.

Au said Hong Kong faced further threats from looming interest rate rises in the United States, which had seen three increases so far this year, as Hong Kong homeowners heavily relied on mortgages.

According to the residential property index compiled by global real estate management and investment firm JLL, Hong Kong home price growth slowed to 0.3 per cent in the third quarter, after rising 4 per cent in the second quarter and 4.4 per cent in the first quarter.

Iris Pang, ING Wholesale Banking economist for Greater China, said third-quarter GDP was far worse than her forecast of 3.3 per cent growth and she downgraded her estimate for the forth quarter to 2.2 per cent growth from 2.8 per cent. She also cut her full-year forecast to 3.3 per cent growth from 3.6 per cent. Last year GDP jumped 3.8 per cent.

“The economic recovery since late 2016 has been too short,” she said. “Next year’s outlook is worrying.”

‘Prepare for the worst’ from US-China trade war, commerce minister warns

Pang anticipated a big chunk of trade activities would “disappear” after the new tariffs took effect on January 1, which would hurt the logistics and export financing sectors in a chain reaction.

She said consumer spending next year would take a beating as many families had parked their investments in residential property, which meant they had little to spare for shopping.

Alongside poorer stock and property markets, she saw few positive signs on the horizon.

The benchmark Hang Seng Index lost 2.65 per cent between July and September.

Pang urged the government to step up construction of public housing to offset the negative impact of the trade war.