Hong Kong failing to cash in on ‘silver economy’ with 70 per cent of elderly people feeling let down by choices and services

Consumer watchdog survey shows dishonest practices by telecommunications firms are major bugbear

Seven in 10 older consumers in Hong Kong feel let down by the range of goods and services catered to their age group even though many have cash to spare, and dishonest practices by telecommunications firms are a major bugbear.

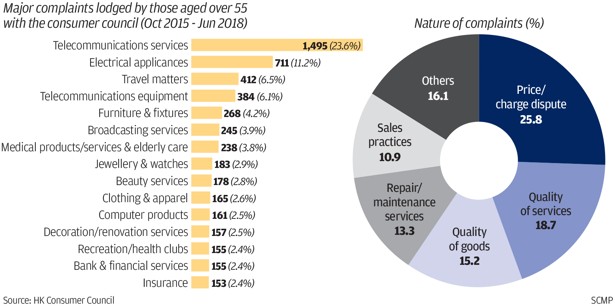

The city’s consumer watchdog said about a quarter of complaints filed by those aged 55 and above between October 2015 and June this year related to unhappiness with the telecoms sector.

Another 11 per cent were to do with buying electrical appliances, while 6.5 per cent concerned travel purchases.

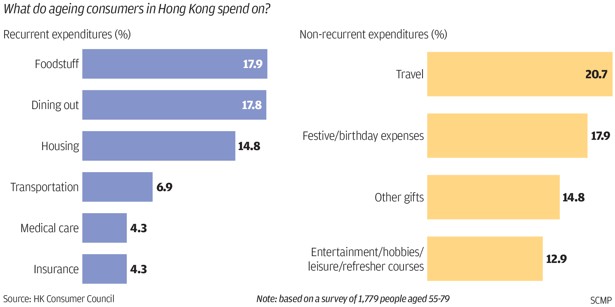

Separately, a survey of 1,779 people aged between 55 and 79 from October to December 2016 found they were also largely dissatisfied with choices offered by the insurance, catering and tourism sectors.

Consumer Council chief executive Gilly Wong Fung-han cited examples of how telecoms staff had made customers pay extra for printed receipts and promoted services not suitable for seniors.

“Is it necessary to sell the most expensive plan with unlimited data to the elderly?” Wong said.

The council did not name any telecom companies in its report.

The council also held two focus group discussions with seniors as part of a two-year study into their consumption behaviour and problems they faced.

During a session last June with 12 elderly people, the group complained about a lack of notification for contract renewals, poor customer service, and hard-to-read leaflets and agreements.

Criminals or victims? Most elderly Hongkongers caught for petty crimes showed signs of dementia

A separate session with 10 people on medical services found they were confused by the city’s elderly health care voucher subsidy scheme, and had come across misleading salespeople selling health products. They also felt there was insufficient information on the availability of nursing home services.

The council’s survey found that ageing consumers with problems – whether physical, emotional or cognitive – were much more likely to experience unfair trade practices, with the likelihood increasing by almost 200 per cent for those with two or more conditions.

But asked if they would seek redress, only about half said yes. If they encountered problems with purchases, the majority said they would turn to their children or grandchildren for help.

Retiree Lee Sai-ying, 85, said she hoped salespeople would be more friendly to seniors.

“I always ask my children to buy electrical appliances with me,” she said. “We are old and people always think we don’t know anything and sometimes discriminate against us.”

Are Hong Kong’s banks doing enough to help their disabled or elderly customers?

Wong suggested the government install safeguards for older consumers, such as in Japan, where they are allowed to cancel contracts for purchases they later realise are excessive. This rule helps seniors living alone, who have been targeted by door-to-door salespeople and sold food products in bulk.

In Australia, there are digital literacy programmes for old people run by volunteers and organised by the government.

Hong Kong is set to see a “silver surge” in the coming decades, with 2.5 million people aged 65 and above by 2043, up from 1.16 million two years ago.

Post-war baby boomers are better educated and will have more personal income from employment, the council said. Its report found survey respondents aged between 55 and 64 had an average monthly income of HK$10,758 (US$1,373) and expenditure of HK$7,381.

So in 10 years, the market would be filled with consumers who had improved retirement protection and consumption power, the council said.

Older residents spent money on food, dining out, travel, festive expenses and even refresher courses, reaffirming their “active” lifestyle.

“Many people have the impression the elderly do not spend much, but in fact, they buy a lot of things, attend a lot of interest classes, and have a variety of expenses,” Wong said.

The watchdog urged the government to encourage the development of innovative products for the elderly, such as apps that alert users about contract expiry dates and old-age-friendly mobile phones.

Businesses should improve their sales practices and customer service, such as by using larger fonts in printing.

HKT and China Mobile – two of the four major telecoms firms in the city – did not respond to requests for comment.