Accountant KPMG calls for tax breaks for companies setting up headquarters in Hong Kong

KPMG also calls for allowances to allow mothers to continue working amid declining workforce

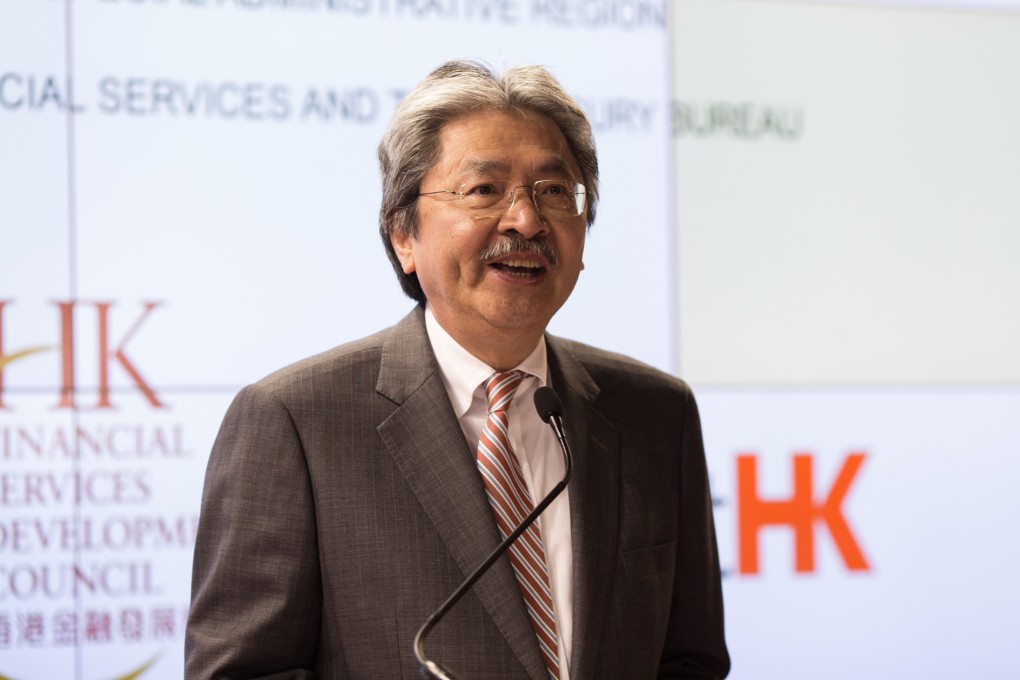

Financial Secretary John Tsang Chun-wah was urged on Monday to boost Hong Kong's competitiveness in his forthcoming budget by offering tax incentives to corporations which set up headquarters in the city, and to create allowances to encourage mothers to remain in the workforce or rejoin it.

Accounting firm KPMG polled nearly 400 business executives recently on their expectations for the February 25 budget. It found that more than 40 per cent of respondents thought that the government's priority should be the city's competitiveness, followed by livelihood and housing issues.

More than half of the respondents said the government should focus on stimulating economic growth to increase tax revenues in a bid to overcome a possible structural deficit. Government fiscal advisers warned last year that the city could face a deficit of HK$1.54 trillion by 2041.

To boost competitiveness, KMPG said profits tax should be reduced to 14.5 per cent for companies setting up headquarters in Hong Kong. The current rate is 16.5 per cent.

The firm is also predicting that the government will record a budget surplus of HK$65.5 billion for the current fiscal year, which ends on March 31. This is significantly higher than the administration's initial estimate of HK$9.1 billion, though KPMG said it was too early to say how last year's Occupy protests would affect government revenue.

However, the projected budget surplus will drop to HK$38.5 billion after HK$27 billion is allocated to a new housing reserve fund, which will be used to help meet the government's goal of building 290,000 public flats in the next decade.