China’s finance ministry goes back to old playbook with move to spur bond sales

After disagreement with central bank, local governments told to issue new ‘special purpose’ bonds for infrastructure before the end of September

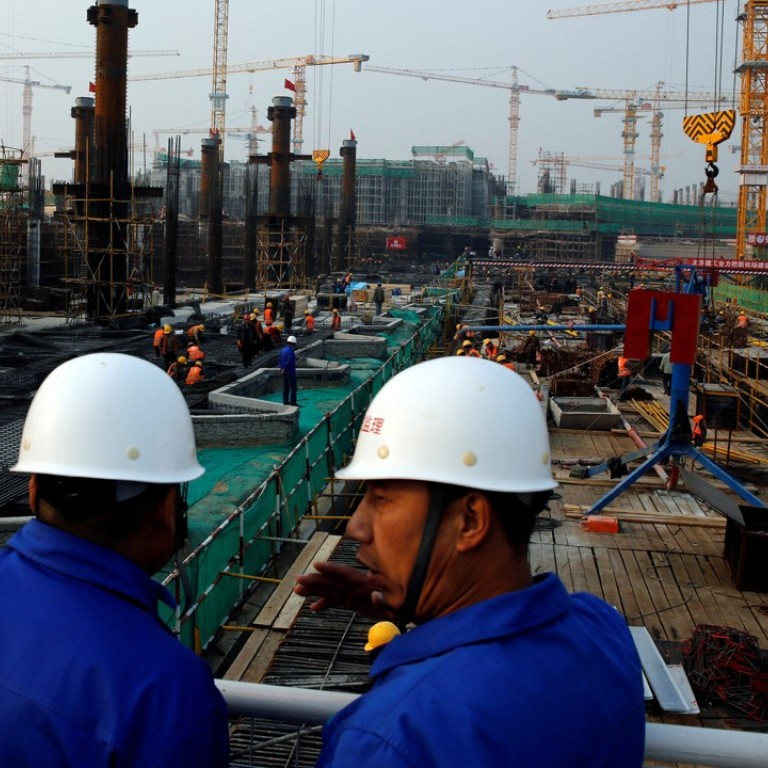

China is expected to see a bond-selling spree after the finance ministry asked local governments to issue bonds as soon as possible as it tries to boost growth, a move that will push lenders to bankroll the authorities.

The move also indicates a return to Beijing’s old playbook of relying on debt-fuelled state investment to keep economic growth on track at a time when the leadership is worried about dangers beyond its control, though it has refrained from an all-out stimulus strategy, analysts said.

The Ministry of Finance issued the order on Tuesday, after Beijing decided to prioritise maintaining growth over cutting debt due to headwinds from a trade war with Washington and decelerating investment at home.

Low-hanging fruit and a mountain of debt – how China’s credit binge is playing out

The cabinet had already said it would allow local governments to issue 1.35 trillion yuan (US$195.12 billion) of “special purpose” bonds for infrastructure investments. But the finance ministry took it a step further, telling local governments to sell at least 80 per cent of those newly approved special purpose bonds before the end of September. Most local government bonds are sold to the country’s financial institutions and a surge in their supply will in turn put pressure on the People’s Bank of China to loosen its monetary policy.

Zhou Hao, a senior economist at Commerzbank in Singapore, said Beijing seemed to be “scrambling to solve immediate problems and putting long-term reforms on the back-burner”.

The latest order also puts an end to an unusually public disagreement between the finance ministry, in charge of fiscal policy, and the central bank, in charge of monetary policy.

China’s central bank, which is part of the cabinet, has for years tried to avoid becoming a cashier to the government, especially under former reformist governor Zhou Xiaochuan. However, it has often had no choice but to allow the state banks to facilitate government spending plans, as it did a decade ago when it backed Beijing’s massive stimulus package that has left the country saddled with debt.

Xu Zhong, head of the central bank’s research bureau, publicly criticised the finance ministry last month in an article for Caixin, saying the stalled reform of the fiscal system was to blame for China’s debt woes and suggesting a “bankruptcy mechanism” for debt-ridden local governments.

He argued that the high leverage ratio in the form of local government liabilities, and even household debt, had been caused by a defective fiscal and tax system.

Xu said the fiscal authority had failed to do its job of putting in place a proactive policy and had instead put excessive pressure on the financial system.

“They’re behaving like hooligans, claiming this is a proactive fiscal policy yet not increasing the fiscal deficit,” he wrote in the July 13 article.

China ramps up spending as the trade war bites, adding to the burden of its long-term debt

The finance ministry did not directly respond to Xu’s criticism. But three days later, Caixin ran another article written by “a person within the fiscal system” who argued it was wrong to put all the blame on local governments for the debt problem and that the banks, which had profited from the financing, were also responsible.

It also said the People’s Bank of China had too narrow a mindset for the central bank of a “great country”, and that its attack on the finance ministry made it seem more like the central bank of a “small country”.

Xu said in a speech over the weekend that his criticism of the finance ministry was just “academic discussion” and did not represent the official stance of the People’s Bank of China.

For now, the central bank and the ministry are on the same page after the Politburo at the end of July put priority on stabilising the economy, employment and financial situation to counter external uncertainties.

Local governments have been quick to take advantage of the new opportunity to raise funds.

In Guangdong, the provincial authorities released three bond sale prospectuses on Tuesday, aiming to raise a total of 44 billion yuan for urban development, affordable housing and water treatment projects in the Pearl River Delta region. The bond issues were described as “extremely urgent” by the Guangdong government in the official documents.

Local government bond sales could raise more than 1 trillion yuan this month, official newspaper the China Securities Journal reported.

Caught in China’s cash crunch: why private companies are collapsing into a black hole of shadowy debt

It comes after infrastructure investment growth, backed by government spending, slowed to 5.7 per cent in the first seven months – the lowest growth in nearly 20 years. Overall fixed-asset investment growth slipped to a new low of 5.5 per cent in the same period.

Iris Pang, chief Greater China economist for ING Bank, said the disagreement between the ministry and the central bank stemmed from last year’s deleveraging campaign, but now, “nobody is actually talking about deleveraging any more”.

“[China] has now really entered the emergency room as it seems US President Donald Trump is not backing down … so the top priority has changed to stabilising the economy,” she said.