Chinese firms targeted as EU launches probes into solar subsidies

- Two companies are being investigated by the European Commission in relation to Romanian project

- EU industry chief says the probes ‘aim to preserve Europe’s economic security and competitiveness’

The European Commission is investigating whether two Chinese-linked companies used state subsidies to undercut rival bids in a Romanian solar project.

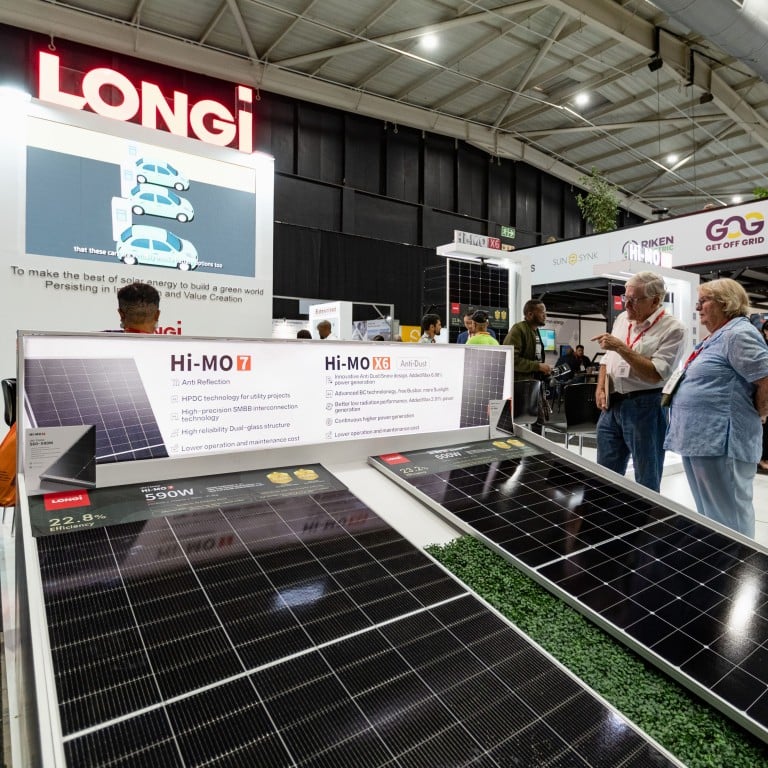

The first investigation concerns a consortium involving a German subsidiary of Longi Green Energy Technology Co. Hong Kong-listed Longi is the world’s largest manufacturer of solar panels and is headquartered in the Chinese city of Xian. The second investigation concerns two subsidiaries of Shanghai Electric Group Co, a Chinese state-owned company.

“Solar panels have become strategically important for Europe: for our clean energy production, jobs in Europe, and security of supply,” said EU industry boss Thierry Breton.

“The two new in-depth investigations on foreign subsidies in the solar panel sector aim to preserve Europe’s economic security and competitiveness by ensuring that companies in our single market are truly competitive and play fair,” he added.

It marks the second use of the EU’s foreign subsidies regulation to probe Chinese firms since February, and demonstrates Brussels’ willingness to use the commercial weaponry at its disposal to counter what it sees as unfair competition from Beijing.

The inquiry, announced in February, was the first of its kind and marked the maiden use of the foreign subsidies regulation designed to stop state handouts from distorting the EU’s single market.

EU ‘absolutely willing’ to use trade tools against China: top official

CRRC Qingdao Sifang Locomotive Co, a division of state-owned rolling stock manufacturer CRRC Corporation, had hoped to provide 20 electric push-pull trains and their maintenance.

After CRRC withdrew from proceedings, Breton said that “in just a few weeks, our first investigation under the foreign subsidies regulation has already yielded results”.

The foreign subsidies regulation, which took effect last July, obliges firms bidding for EU public procurement contracts worth over €250 million (US$268.7 million) to be open about the level of state subsidies they received in the preceding three years, provided that was higher than €4 million (US$4.3 million).

While the EU avoids saying its trade weapons are aimed at China to avoid breaching global trading rules, it was long expected that this regulation would hit Chinese firms, given the widespread suspicions about the levels of government subsidies there.

The China Chamber of Commerce to the EU accused the bloc of using the new regulation as a “tool of economic coercion”.

“We express our serious dissatisfaction with the abuse of the new tool by the relevant EU authorities and the use of the regulation as a new tool of economic coercion to interfere with the reasonable and lawful economic operations of Chinese enterprises in the EU’s green and low-carbon transition market,” read a statement.

Europe and China have tangled on solar before: a trade war flared in the sector 10 years ago, and has threatened to rear its head in recent months after manufacturers complained they were being pummelled by cheap imports from the world’s second largest economy.

Chinese solar power industry urged to stay united in face of US pressure

So far, Brussels has declined to slap new import tariffs or market entry restrictions on Chinese supplies, despite the demands of some manufacturers.

In a letter sent to the European Commission, a group representing “nearly the entire European PV manufacturing industry” called for “emergency measures” to safeguard the EU supply chain amid “significant oversupply” from China.

It claimed that oversupply of PV modules from China late in 2022 and through 2023 had “triggered a drastic reduction in prices”, forcing European manufacturers to reduce production and leaving stocks “languishing” in warehouses.

The EU’s powerful department of trade decided against trade measures, however, after noting the industry’s divisions on whether they would be beneficial.