What the West gets wrong about China’s big economic ideas

- Business leaders assess the US-China trade war and the prospects for resolution

- Fung Group chairman says trade has changed and China must change with it

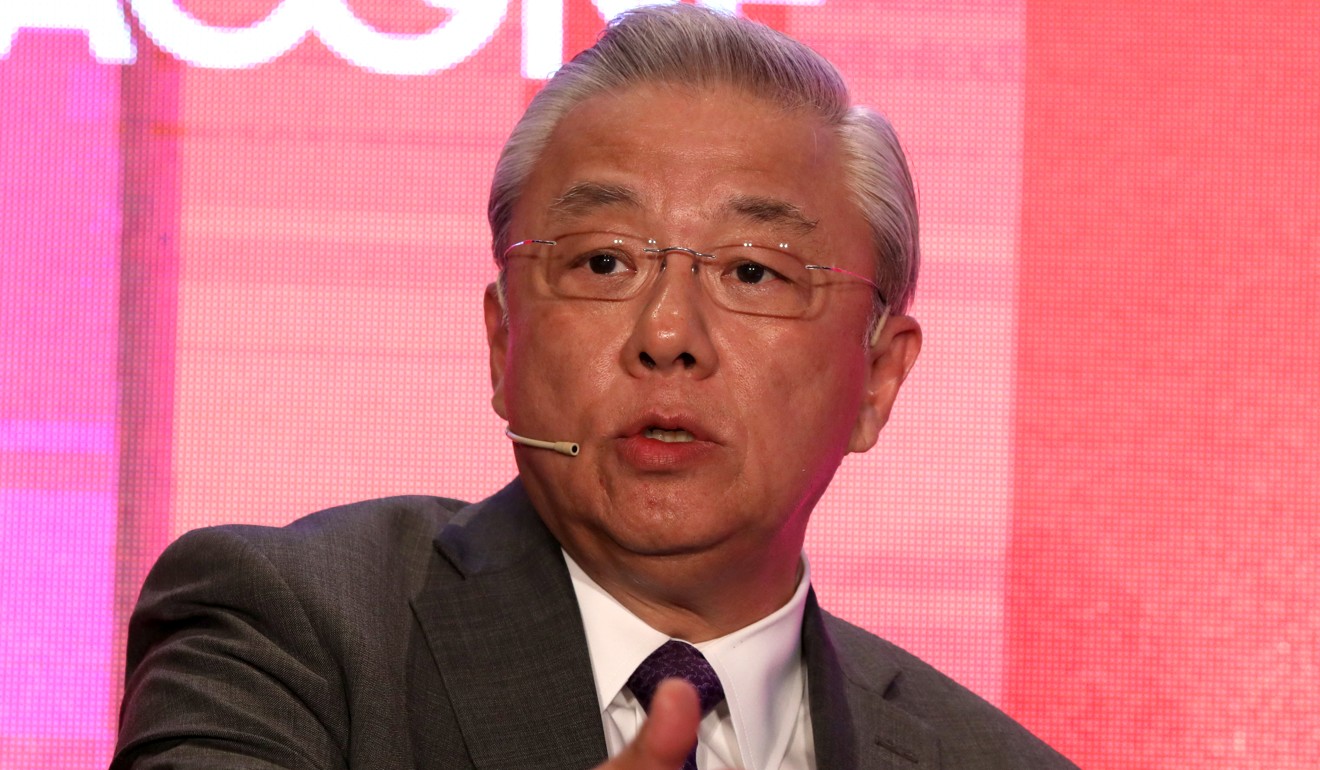

China is a long way from its economic goals, and the fear of a Chinese threat among Western nations is caused by a misunderstanding of Beijing’s propaganda, Chen Shuang, chief executive officer of China Everbright, said.

Speaking at the South China Morning Post’s annual China Conference, Chen – who heads the listed Hong Kong branch of the state-owned financial conglomerate, said Chinese businesses such as Everbright had become casualties of fear caused by the misreading of China’s sloganeering.

Other business leaders who spoke said Chinese companies were finding ways to mitigate the effects of a US trade war with China which was doing neither side any good.

Chen said there was a huge gap in understanding between the West and China over “Made in China 2025”, the “Belt and Road Initiative” and the Greater Bay Area plan.

He said Western countries might not understand that it was common practice for the Chinese government to rally domestic support with propaganda.

City’s ties with the West must not be lost, bosses tell China Conference

“When China wants to do something, it will first come up with a strategy and turn it into a slogan,” Chen said.

“Whether it is the Belt and Road Initiative, Greater Bay Area, or Made in China 2025, [the goals] are still far off, even as we work hard to achieve them. But in the West, they believe it is already a reality.”

Chen said China was a far cry from being a threat to the US. He said China lagged behind the US in most areas and it had only recently matched it in others.

“China’s development is in its early stages and it is a new player. After the second world war, most [global] rules were decided by the US, and China followed those rules,” he told the more than 350 political, business leaders and academics at the conference.

“How many [global] rules were set by China? What are the so-called Chinese threats? China is [only] competitive in some areas.”

Chen said it was important to bridge the gap in understanding [in the West] when China rolled out ambitious economic initiatives. “It shows how important effective communication is,” he said.

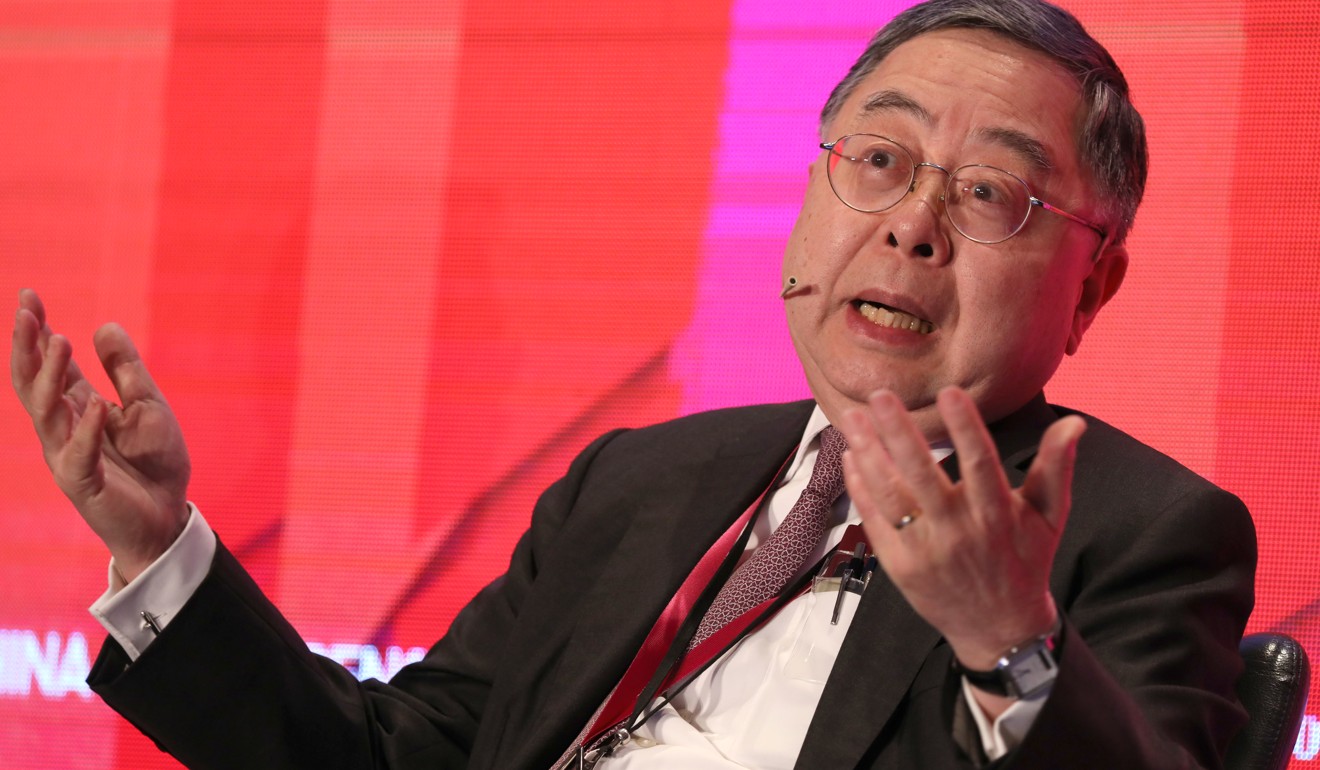

Victor Fung, chairman of the Fung Group, a Hong Kong-based conglomerate, said: “One of the biggest effects the trade war will have on the whole world is that the pattern of trade will be changed.

“The biggest [trade flow] corridor is between China and the US. If you interrupt that, will trade stop? No, it will find new way.”

He said many Chinese manufacturers were moving the final stages of their production to other countries, so China would not be the country of origin on the labels on their products.

“We are very busy at the moment. We are besieged by customers wanting to move finishing [while] the upper stream could still very much stay in China.”

Fung suggested that Chinese business should move finishing to belt and road countries, where China had helped to build infrastructure and improve logistics.

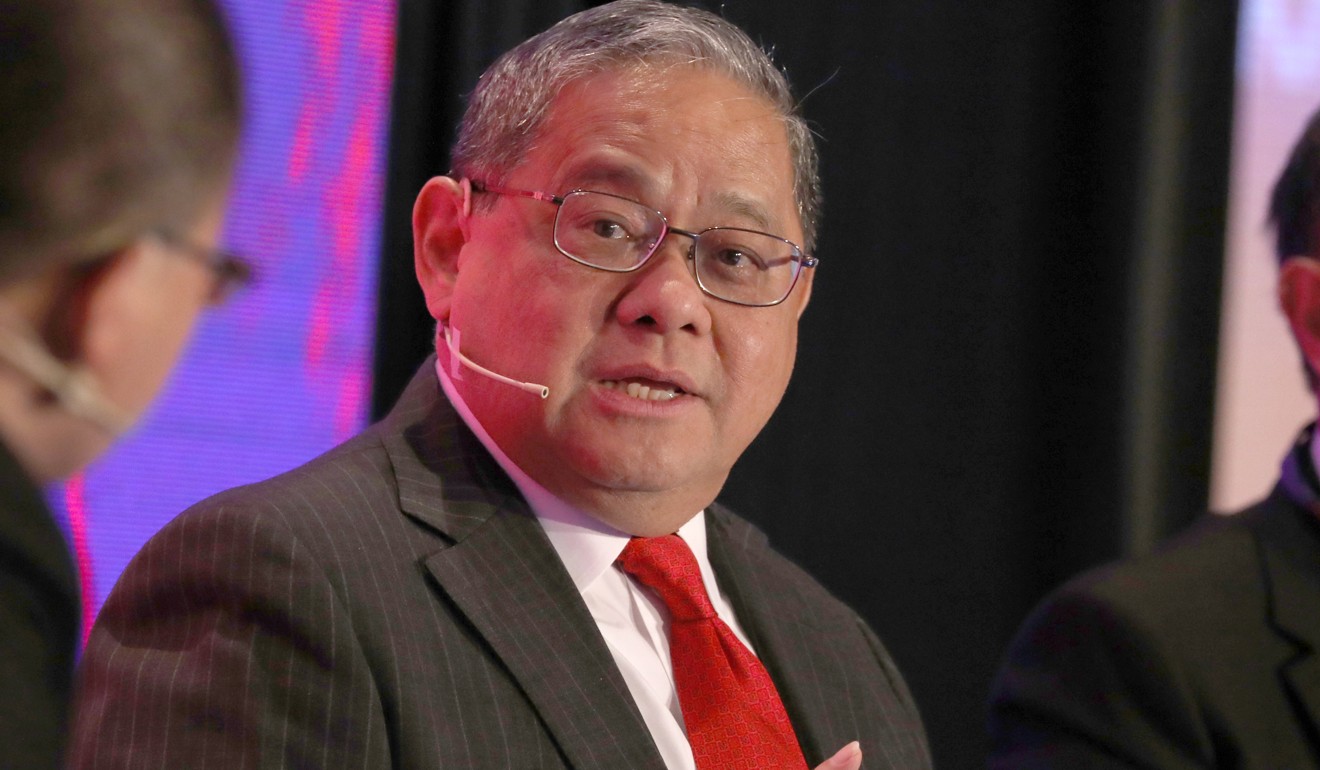

Ronnie Chan, chairman of Hang Lung Properties, one of the largest property developers in Hong Kong, said trade was a “tertiary issue”, a sideshow compared to the competition between China and the US in areas such as technology and currency.

Rising protectionism, concerns about tech politicising merger reviews

In the short term, he said, China would appear to make many concessions in tariffs and related issues to satisfy US trade negotiators, but it would try to maximise its advantage in other areas.

Chan, who is the chairman of the Asia Society, is known for his close ties to US politicians and think tanks.

“I don’t think in the end it’s a one-sided deal. [US President] Donald Trump will no doubt claim victory; China will just quietly laugh all the way to the bank with what it wants,” he said.

Fred Teng, president of the America China Public Affairs Institute, said the US had much to lose in the long term because China would have to use a lot of its foreign reserves to buy goods to balance trade, and that may affect China’s purchase of US Treasury bonds.

“Right now, Donald Trump wants the trade balance between the United States and China to be evened out, zero. So, China’s concession might be to buy US$1 trillion worth of goods from the United States over the next six years, so that China is buying more,” Teng said.

“If the US and China’s trade balance is zero, with imports and exports exactly the same, China will not have the US$1 trillion of Treasury bills. The reason China buys Treasury bills is because it has a surplus. When China has extra money it goes into Treasury bills.

“But how many buyers can you find to take US$1 trillion worth of Treasuries?”

Why China’s Belt and Road Initiative is here to stay

Geng Xiao, professor of practice at Peking University HSBC Business School, said the China-US trade war risked entrenching positions.

“This is dangerous in the sense that this will reinforce the Chinese hardliners. Basically, why should they privatise state-owned enterprises if the US is preparing for a war with China? In that sense, I think the future will be very challenging for everybody.”

Jing Ulrich, managing director and vice-chairwoman of Asia-Pacific, JP Morgan Chase, said the Made in China 2025 rhetoric had been diplomatically toned down, “but China is definitely not giving up on its efforts to develop home-grown technology”.

“China has been seeking to be more self reliant, especially in areas such as AI, 5G technology, auto-vehicles and biotechnology. It is doubling down efforts to achieve these goals continuing to developing a sound industrial policy,” she said.

“The US and China are competitive. I just hope this doesn’t become an adversarial relationship, because the two are the most powerful in the world, so interlocked and intertwined ... it [conflict] will not benefit anyone.”

Additional reporting by Zhenhua Lu, Su Xinqi, and Kinling Lo