Chinese aluminium tycoon Liu Zhongtian indicted in US over tariff evasion of US$1.8 billion

- China Zhongwang Holdings founder accused of engaging in a scheme that smuggled vast quantities of the metal into the US using firms he secretly controlled

- Fraud allegedly used fake US sales to boost the company ahead of its 2009 Hong Kong IPO

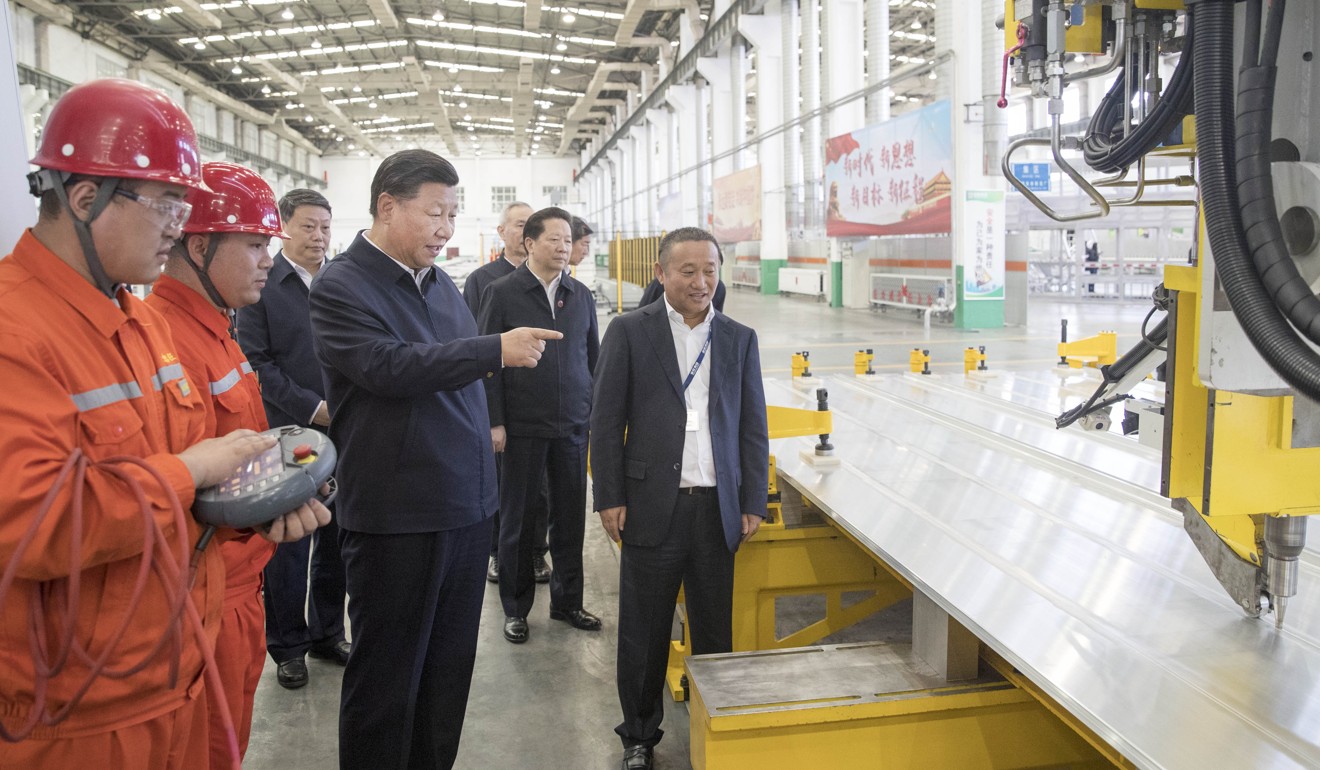

Chinese aluminium billionaire Liu Zhongtian has been indicted in the US on allegations that he evaded US$1.8 billion in American tariffs, using a complex scheme that supposedly smuggled vast quantities of the metal into the US using a series of firms that he secretly controlled.

Liu, China Zhongwang Holdings and others were indicted on dozens of charges of conspiracy, wire fraud and international money laundering.

They are also accused of defrauding investors in the 2009 Hong Kong listing of China Zhongwang, Liu’s flagship firm. The prospectus for the US$1.26 billion IPO – one the biggest in the world that year – deceptively boosted the company’s revenue by faking information about its US market via the smuggling scheme, the indictment claims.

“This indictment outlines the unscrupulous and anti-competitive practices of a corrupt businessman who defrauded the United States out of US$1.8 billion in tariffs due on Chinese imports,” said United States Attorney Nick Hanna for the Central District of California in a press release.

“Moreover, the bogus sales of hundreds of millions of dollars of aluminum artificially inflated the value of a publicly traded company, putting at risk investors around the world. The rampant criminality described in this case also posed a threat to American industry, livelihoods and investments.”

China makes concession on US farm goods in ‘frank’ and ‘constructive’ talks

The indictment was filed by a California grand jury this May 7, but was only unsealed this week. It comes amid high-stakes trade negotiations between Washington and Beijing, which have been embroiled in a trade war for more than a year as US President Donald Trump seeks to draw down China’s trade surplus with the US.

In addition to evading tariffs, Liu and his co-accused are said to have used the smuggling scheme to “maintain the false pretence that defendant China Zhongwang was obtaining significant revenue from the sales of aluminium to United States-based customers even though there were few, if any, such sales”, according to the indictment.

The aluminium was actually being stockpiled at US and Mexican facilities ultimately controlled by Liu, it said, in what amounted to fraud against investors in China Zhongwang.

The Wall Street Journal, citing a US official with knowledge of the investigation, said an arrest warrant was being drawn up for Liu, 55.

He faces 24 charges with a combined maximum prison sentence of 465 years, according to the US Department of Justice.

A California lawyer who has previously represented Liu did not immediately respond to a voicemail and email from the South China Morning Post seeking comment on the indictment, which describes Liu as a permanent resident of the US with Chinese citizenship.

According to the accusations, the smuggled aluminium could have faced duties of up to 374 per cent.

Aluminium alloy products maker China Zhongwang eyes home comforts

The indictment claims a co-accused California resident, Xiang Chun Shao, managed a series of US firms related to a company called Perfectus on behalf of Liu

China Zhongwang defrauded its investors by falsely depicting sales to firms, including Perfectus, as “arms-length” transactions. In fact, the sales were ultimately funded by Liu and China Zhongwang itself, the indictment says.

US demand for China Zhongwang’s products was also falsely inflated by Perfectus’ simply stockpiling its aluminium purchases, the indictment adds.

It said the purchases were in the form of 2.2 million fake aluminium pallets.

Zhongwang buys Germany’s Alunna as springboard into Europe

As supposedly finished products, these were subject to much lower duties than the 374 per cent tariff they allegedly should have attracted as aluminium extrusion raw materials.

“By falsely identifying the pallets as finished merchandise, the Perfectus predecessor entities were able to evade paying approximately US$1.8 billion [in duties],” the indictment says, and the supposed pallets were “nothing more than extrusions that had been tack welded together”.

“At the direction of Liu, none of these pallets was ever sold,” the indictment says of the imports that allegedly took place between 2011 and 2014.

But the scheme is said to extend back to July 2008, when Liu transferred US$300 million to a US account that would end up being used to buy US warehouses for the aluminium. The massive facilities measured more than 2 million square feet (186,000 square metres) in total.

This was less than a year before China Zhongwang was listed on the Hong Kong stock exchange, in an IPO that raised US$1.26 billion.

Trade war or not, China is still a manufacturing superpower

A third individual, Zhaohua Chen, is accused of taking part in the scheme with Liu by ordering that facilities be bought to melt down the pallets into a usable form.

Liu and others also allegedly transferred US$1.2 billion to bank accounts linked to the Perfectus companies, to allow them to purchase the pallets.

The indictment says the funds were channelled through 19 Chinese and Hong Kong shell companies secretly controlled by Liu and China Zhongwang and falsely described as loans, although the Perfectus companies never intended repayment.

China Zhongwang’s Hong Kong headquarters has yet to respond to an email, sent outside office hours, seeking comment on the indictments.

Neither Liu, Chen, nor Shao are believed to be in the United States, the US Department of Justice said.