Beijing’s tilt towards state-owned enterprises raises doubts about future of private sector in Chinese economy

Rising difficulties for private firms, including a deleveraging campaign, have raised doubts about their future role

As China celebrates the 40th anniversary this year of reforms that opened up its economy, doubts have arisen about Beijing’s commitment to letting the private sector play a decisive role, a principle that has helped it emerge as the world’s second-largest economy.

While Beijing has talked up the need to support small and medium-sized private companies, which form the backbone of the economy, the government has allowed state-owned enterprises (SOEs) to accumulate more resources and clout. This has come at the expense of private companies, and has opened up a debate about Chinese economic policy – and its priorities.

China’s debt-cutting efforts are sinking private companies, while debt-ridden state firms float on

The debate came to a head last week, when Wu Xiaoping, a self-proclaimed financial expert, wrote in a post on a Chinese news portal that the private sector had “completed its historic mission” of helping SOEs achieve major leaps in development, and that now it should “fade away”. He said private enterprises did not show any discipline or planning for long-term considerations, and could not help China face increasingly strong international competition, a reference to the ongoing trade war with the United States.

Systematically marginalised?

What is clear is that private companies, which account for 60 per cent of China’s gross domestic product and 80 per cent of jobs in urban areas, are having an increasingly tough time, while SOEs are becoming larger and stronger.

During the first seven months of 2018, the accumulated profit at private industrial companies with annual revenues of more than 200 million yuan (US$29.2 million) was 1.02 trillion yuan, a decline of 27.9 per cent from a year earlier, with the decline accelerating from previous periods, according to the National Bureau of Statistics (NBS) in Beijing.

Profit at SOEs, on the other hand, increased by 28.5 per cent in the first seven months of this year, with the growth accelerating.

Additionally, Beijing’s nationwide deleveraging campaign – aimed at reducing debt levels in the economy – seems to be benefiting SOEs more than private companies. The debt-to-asset ratio at SOEs improved to 65 per cent at the end of June from 65.7 per cent at the end of 2017. In the same time frame, the debt ratio at private companies worsened to 55.8 per cent from 51.6 per cent, according to a report by the Center for National Balance Sheet at the National Institute for Finance and Development, a Beijing-based government think tank.

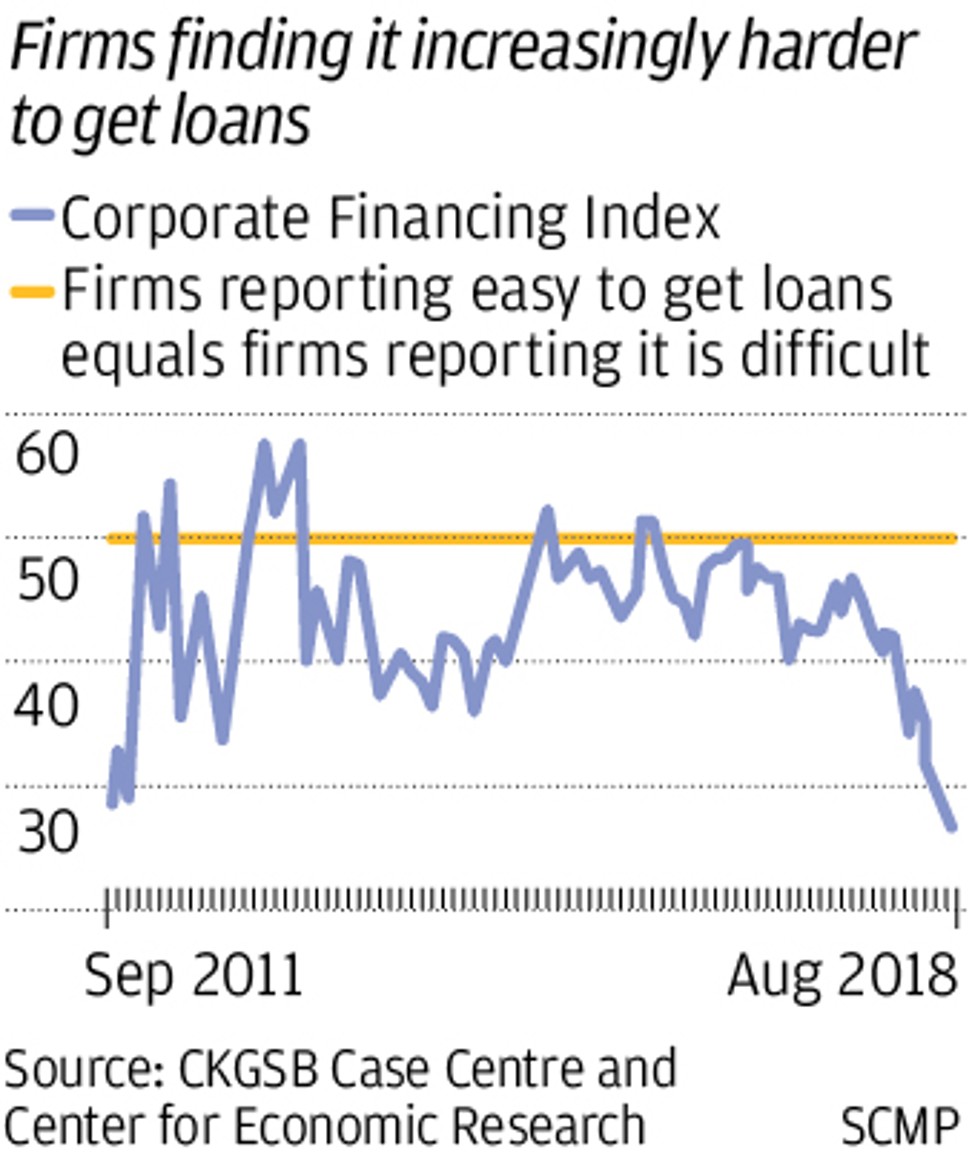

Deleveraging has also reduced the ability of private companies to get loans at an affordable price. Total credit to the average private company fell to 460 million yuan last year from 599 million yuan in 2015, while the average financing raised by SOEs more than tripled to 2.25 billion yuan from 715 million yuan, according to a study published in July by the Chinese Academy of Fiscal Sciences, a research institute under China’s Ministry of Finance.

China’s plan to cut debt, ensure efficient capital may be mission impossible in a slower economy

This has led a situation where a growing number of private companies are being taken over by SOEs, just as Wu’s article in Jinri Toutiao suggested.

This year, 23 listed mainland companies have handed over corporate control to a state-owned company. The last was Jiangsu Leike Defense Technology, whose largest shareholder sold their entire stake to a SOE, according to an announcement made on Monday, September 17.

Recent developments, such as the retirement of Jack Ma, the executive chairman of Alibaba Group Holding, which owns the South China Morning Post, as well as the arrest on sexual harassment charges of JD.com chief executive Richard Liu, have spurred speculation on Chinese social media that private entrepreneurs are being targeted by Beijing.

Some social media users speculated Wu was sounding out the public for Beijing. He confirmed to The Beijing News newspaper that he did write the article but refused to discuss its contents.

Although the Chinese leadership has made use of “authoritative” source commentaries in its flagship publications from time to time to foreshadow major policy shifts, it is not common for a relatively unknown commentator such as Wu – using his own name – to play the role of government mouthpiece.

Retreat of the private sector – and the economy

The government has attacked the private sector before.

“Communists can sum up their theory in one sentence – eliminate private ownership,” Zhou Xincheng, a professor of Marxism at the Renmin University of China, wrote in an article in Qizhi, a major theoretical journal of the Communist Party of China, published in January.

After the “transition to socialism” movement was completed in 1956, the private economy disappeared in China for more than two decades until the Third Plenum Session of the 11th Party Central Committee in 1978, which approved the restoration of a non-public economic sector. In 1992, supreme leader Deng Xiaoping embarked on his famous “southern tour”, during which he promoted the benefits of private enterprise and set the economy on a course that has allowed it to grow into the second-largest in the world.

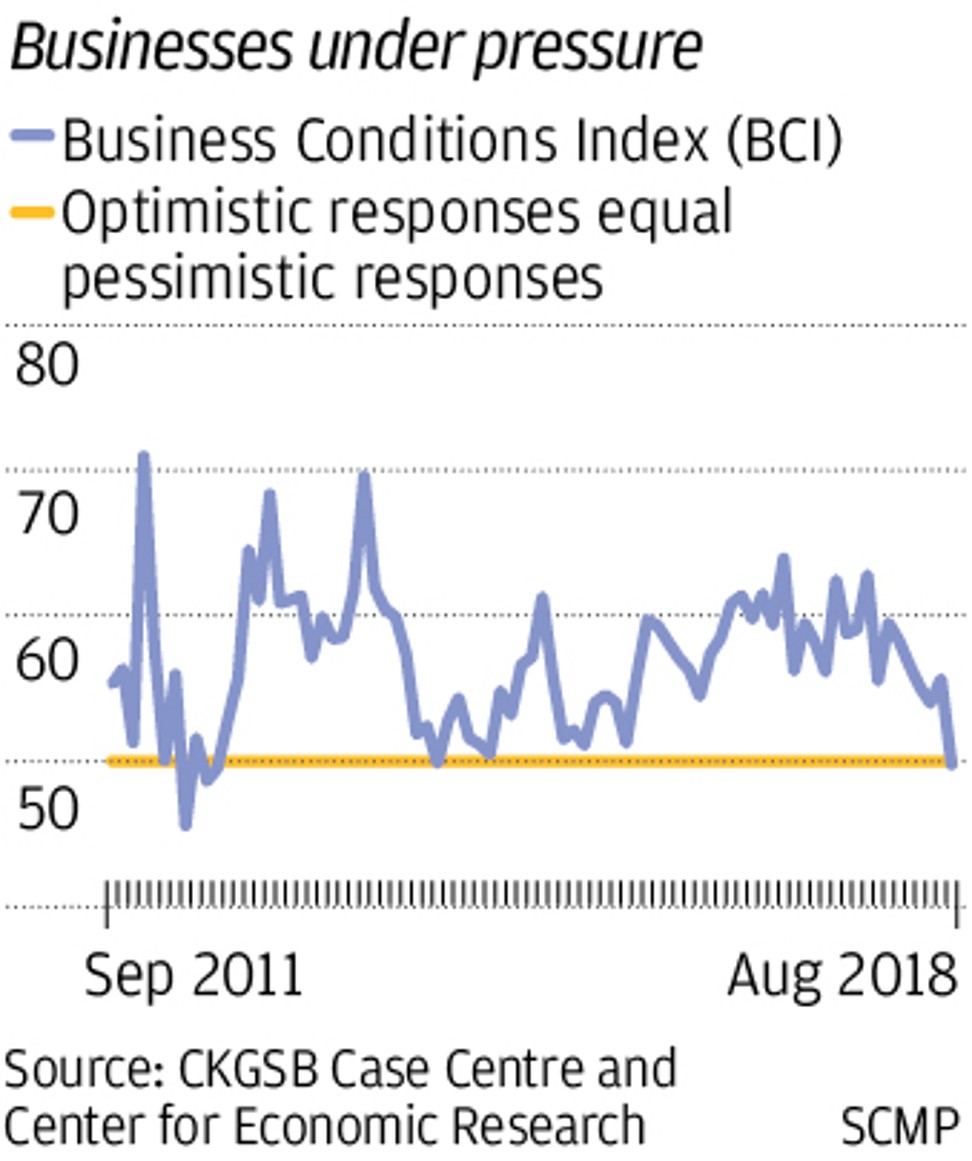

Some observers say the weakening of the private sector has played a part in the recent deceleration of Chinese economic growth.

“Market confidence is weak now, and not just because of the trade war,” Ding Shuang, chief China economist at Standard Chartered Bank, told the Post. “The [changing] relationship between the state-owned sector and the private sector is one fundamental reason.”

Is China targeting the right enemy in its war on debt?

Jiang Chao, chief economist at Haitong Securities in Shanghai, wrote in a research note last month: “The current problem facing the Chinese economy is not deleveraging, but rather more funds flowing into SOEs, leaving less money for private enterprises.

“This has resulted in ‘the state advances, the private sector retreats’,” he said.

“We cannot compete with SOEs now. More projects are being given to them,” said a former chairman of a now bankrupt new energy engineering and consulting company in Beijing, who only gave his surname as Teng.

He said many private companies were finding it tough to survive. “Many small and medium-sized private firms are still operating – but only because of their responsibility to employees,” said Teng, whose company went out of business last year.

The escalating trade war with the US will only add to the pain of Chinese private enterprises, since most export-related companies are privately owned and operated.

Support for private companies just lip service?

A day after Wu’s article was published, the Communist Party-controlled People’s Daily reposted a commentary piece from Economic Daily, another state-owned newspaper, which urges readers to be wary of “demagogic and exotic” arguments that say the “private sector should quit the economic arena”.

During a trip to Shanghai on Monday, Vice Premier Liu He, President Xi Jinping’s top economic adviser, said China will treat the state-owned and private economies as equals. On the same day, he emphasised in a speech to the World Artificial Intelligence Conference that the strength of private enterprises in the AI field could not be ignored.

And during a meeting with bankers on Tuesday, Yi Gang, governor of the People’s Bank of China, the country’s central bank, urged financial institutions to increase financial support for private sector enterprises, to underpin market confidence.

Chinese exporters hit by trade war to get help as Beijing orders banks to lend more

Some changes have occurred. Teng said a bank offered his company a line of credit worth 100,000 yuan without requiring collateral.

“The authorities should continue with market-oriented reforms, thus eliminating public concerns about the direction of Chinese reforms,” said Standard Chartered’s Ding.

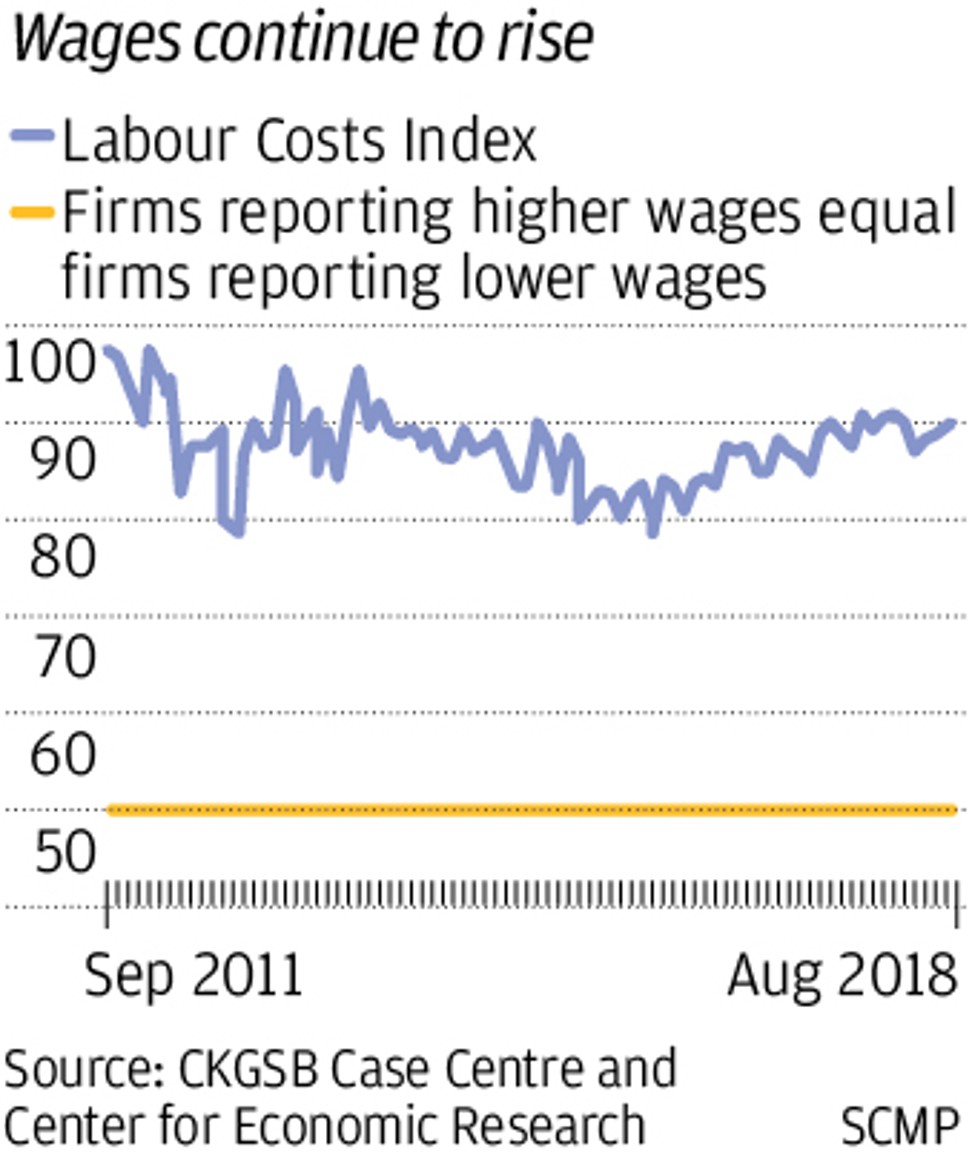

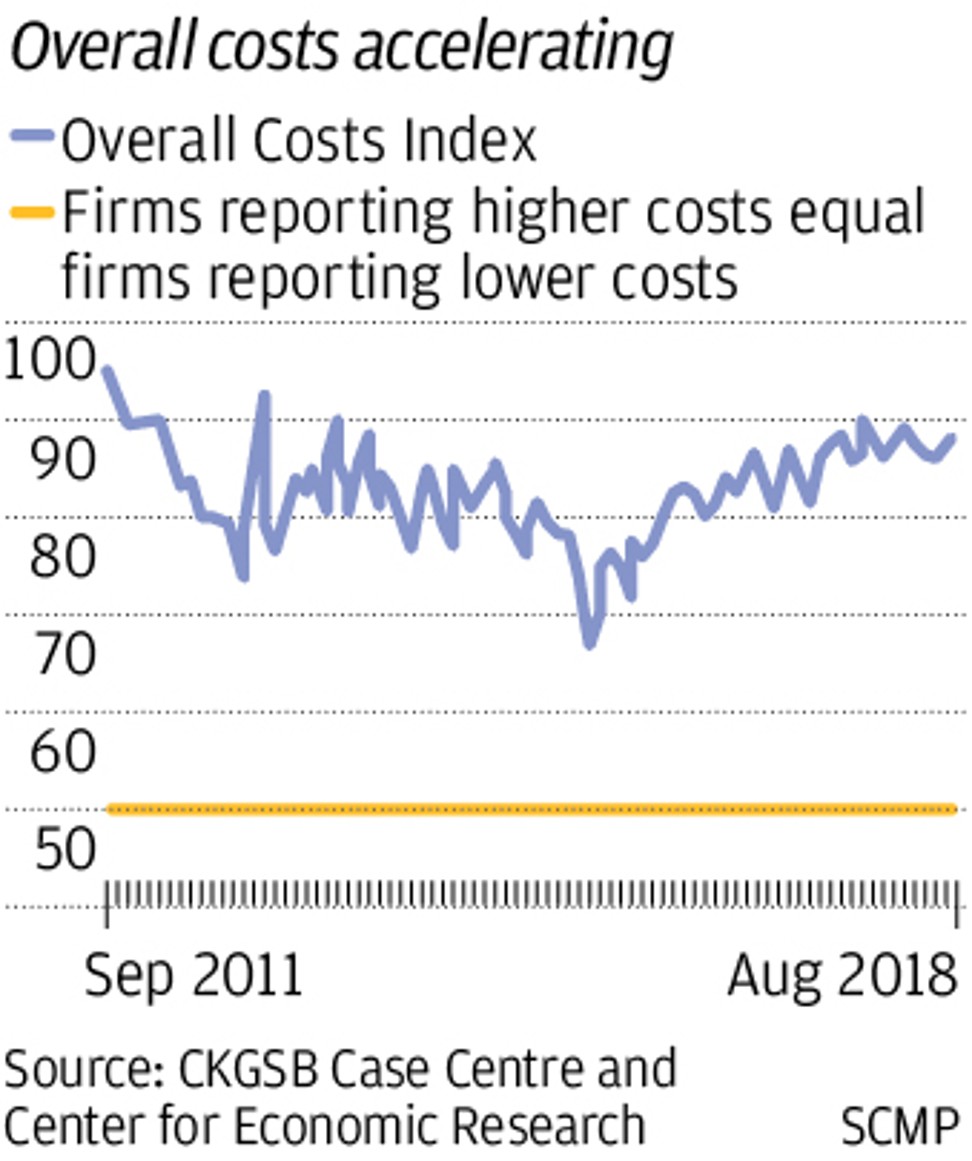

“It is necessary to offer private companies more market access, to protect their property rights and reduce their operating costs, which might be more important than trying to offset the effects of the trade dispute [with the US],” he said.

But Jiang Pengming, chairman of a technology entrepreneurs association in Beijing, said many underlying problems had not been addressed. “The system has labelled SOEs as princes and others as bastards … causing private firms, the good children in the economy, to always be wrong, and permitting SOEs to be badly behaved,” said Jiang.

Teng is very cautious about the government’s promises to support the private sector economy. “It was just diplomatic language, especially given that this year is the 40th anniversary of reform and opening up [of the Chinese economy],” he said.