Will the NFT art market ever recover? Bored Apes and CryptoPunks cashed in and crashed out when the crypto bubble burst – but there’s still a future for digital art tokens built on the blockchain

How Hermès got Mason Rothschild ‘MetaBirkin’ NFTs permanently banned

Buying, selling and investing in art was suddenly easier and more accessible than it had ever been.

This phenomenon was supposed to thrive regardless of how well the cryptocurrency market was doing. After all, theoretically, if the price of the cryptocurrency used to buy an NFT dropped, it would mean you’d be buying the art at a discount.

The problem is that these technologies have been reappropriated by businessmen to, instead of helping the artist, squeeze them out of the game

“Arthur Hayes [co-founder and former CEO of cryptocurrency exchange BitMex] wrote an article stating that during the crypto bubble, people didn’t make money on the implementation of projects: they made their big 100-times returns based on speculation,” said Dr Patrice Poujol, who launched a Web3 film company, the Lumiere Project, in 2019. “NFTs didn’t quite work because investors didn’t perceive the value that producers thought was there, and prices came crashing back down to Earth.”

Is AI the future of art – and will it put artists out of work?

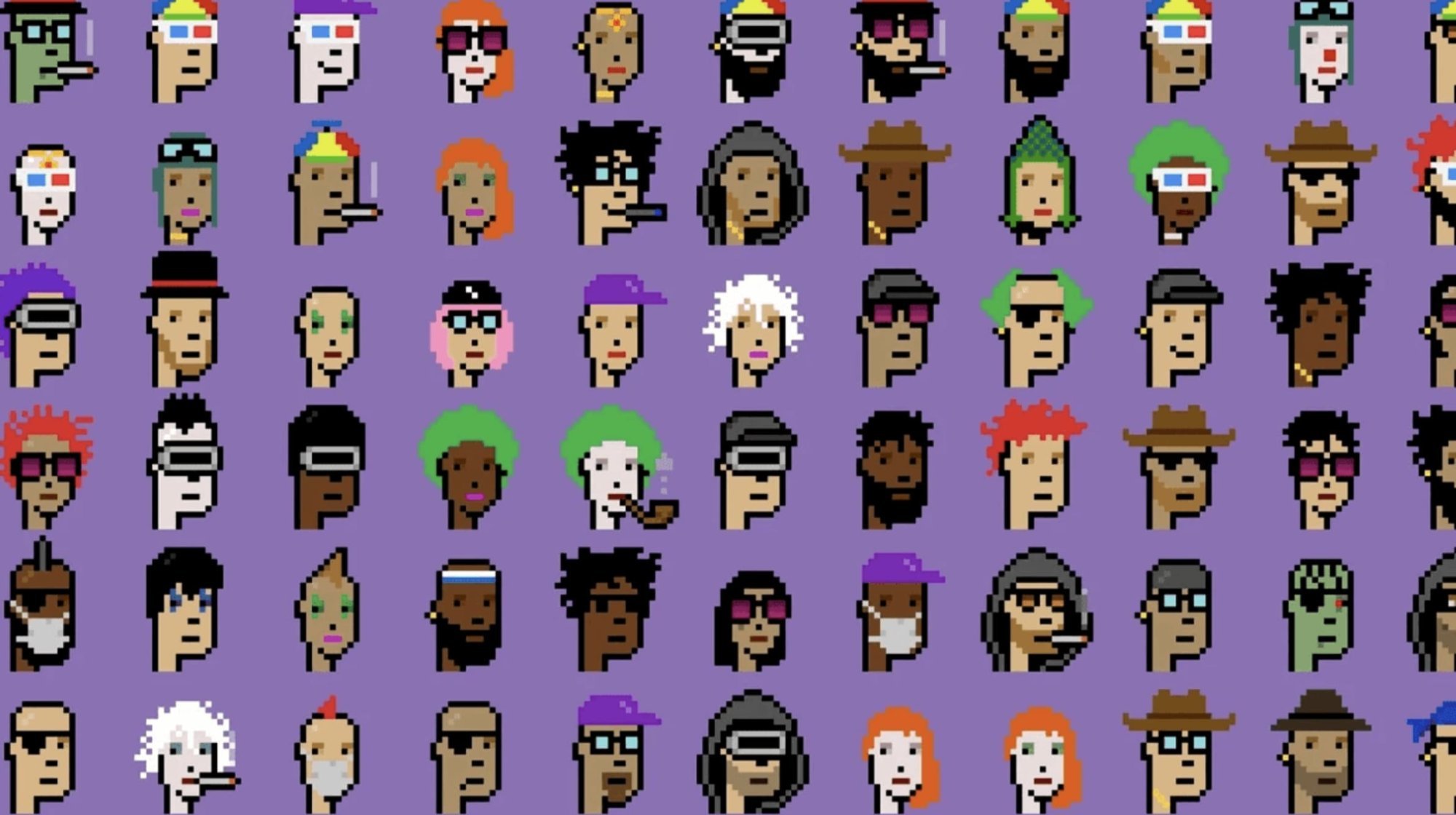

The rise of NFTs coincided with the first editions of AI art, which allowed artists to create pieces within a matter of minutes. This led to the oversaturation of NFT marketplaces. Additionally, with the exception of a few creative artists like Beeple, the most successful NFT projects were those with appealing branding and prestige.

How Instagram became the modern artist’s most important canvas

An obvious example of this is the aforementioned “Bored Ape Yacht Club”. It mass-produced JPEGs of the exact same ape in different outfits and colour schemes. It’s hard to argue that these easily reproducible two-dimensional sprites became worth up to US$3.4 million by being at the absolute cutting edge of creative digital artistry.

“Grand promises that NFTs would put artists at the centre of the structured gain all disappeared,” he continued. “Apart from established artists, it was really difficult for emerging ones with no followers. It’s now a long shot, and what we saw with NFTs was actually a reappropriation of art for monetary purposes.”

Block by block: 4 ways the art world needs blockchain

Poujol thinks that the increased sophistication of AI art has led to a digital-art NFT marketplace akin to a “Netflix on steroids”. With this level of oversaturation, it’s hard for an artist to stand out and find their own voice.

But with art becoming increasingly generic and uniform, Poujol thinks there is an opportunity for artists who make an effort to show the human element in their art.

He is still optimistic about NFTs and Web3 technology. In fact, they form a major part of Lumiere. For example, someone can purchase an NFT and use it to influence a decision in film production – say, over what type of shirt the lead actor wears in a certain scene.

“This is what you can sell as an NFT, and this is the potential it has as a technology for the art world – not just a picture of a random celebrity, or a JPEG of apes, but real access and real experiences,” said Poujol.

Who are the Winklevoss twins, Tyler and Cameron, and where are they now?

In addition, the crypto crash got rid of a lot of the scammers and hype trains. What remains are real projects and real artists in it for the long-run. What’s more, as the market matures, there will hopefully be more deserving, hard-working artists who get the recognition and money they deserve.

The cryptocurrency market has seen an incredible rally over the past few months, with bitcoin hitting an all-time high of US$73,800 in mid-March. If another major crypto bull run begins, could we see a resurgence of NFTs? If so, what will the new marketplace look like? Will prices be less volatile? Will valuations be based more on artistic merit than hype and status?

The answers to these questions remain to be seen, and it will be interesting to find out over the coming months.

- After Beeple’s overnight success, Bored Ape, CryptoPunk and other once-hot art NFTs have tanked since the market’s boom in mid-2021 to mid-2022 – and while bitcoin has coming surging back this year, digital art tokens have not

- ‘Art became an auto-generated aesthetic that pushed the artist out of the project,’ notes the Lumiere Project’s Patrice Poujol, whose film company’s NFTs emphasise ‘real access and real experiences’