How luxury brands use four social media apps in China to reach consumers who shop mostly online

WeChat. Weibo. Little Red Book. Douyin. With more smartphone users than any other country, mastering social media in China is a must for brands to connect with consumers and make sales

WeChat and Weibo dominate China’s social media scene. But just as there’s more to e-commerce than Taobao and JD.com, China’s leading social media platforms are only part of the story.

The digital environment in a market with more smartphone users than any other is constantly changing – one social media app eclipsed its competitors within little more than a year of its launch, for example.

China’s live-streaming fashion boom changing the way Gen Z shops

For luxury brands, mastering social media in China is a must for connecting to consumers and making sales.

Facebook is just a channel for traffic, while WeChat is a complete ecosystem

More than 80 per cent of Chinese luxury shoppers are on social media, according to a recent report by ParkLu, a marketplace for key opinion leaders. They are also using networks on their favourite platforms to research products and brands before they buy.

Online censorship prevents Chinese consumers easily accessing popular overseas social media platforms including Facebook, Instagram, and Twitter, so brands and marketers seeking to master China’s social networks have to adopt different strategies and often play by different rules.

Take WeChat, for example. It sets itself apart from social networks like Facebook because “Facebook is just a channel for traffic, while WeChat is a complete ecosystem”, says Thomas Graziani, co-founder of WeChat marketing agency Walk the Chat.

“Within WeChat, brands can provide anything from content, payment methods, and social interactions to live streaming, customer service, a customised e-commerce experience, and more,” he explains.

Graziani says platforms like WeChat offer luxury brands the opportunity to “claim back the ownership of customers and their data” in a digital space that was once dominated by e-commerce platforms like Tmall and JD.com.

“By setting up websites within the WeChat ecosystem, they can provide a much more customised and personal experience to their followers and customers,” he says.

This year, “social commerce” is the new buzzword as social media marketers realise the power that online social sharing has on Chinese consumers’ purchasing decisions. Combining shopping and commerce in one app is also convenient – around 443 million Chinese consumers will shop on their smartphones this year, and their purchases will account for more than 75 per cent of total online retail sales, according to eMarketer.

These are the four major social media platforms every luxury brand should know in China.

WeChat has been a magnet for retailers, with nearly every major luxury label having an official account on the app.

WeChat could once have been described as a cross between Facebook and WhatsApp, but it’s moved a long way from there, and now reaches one billion monthly active users.

These users message their friends, pay their bills, shop online, and share content. Mini programs, sub-apps that exist within WeChat, allow brands to offer a service without the customer needing to exit the app and access a separate one.

China’s independent, edgy fashion magazines are on the rise

Mini programs have been developed by hundreds of different companies, including a growing number of luxury brands, but it is China’s key opinion leaders (KOLs) that have been attracting buzz for their high conversion rates and sales through mini program e-commerce.

Linking to external sites from regular blog posts on WeChat has its limitations, but they can be linked directly to mini programs, which makes it easier for KOLs and bloggers to direct their followers to purchase recommended products.

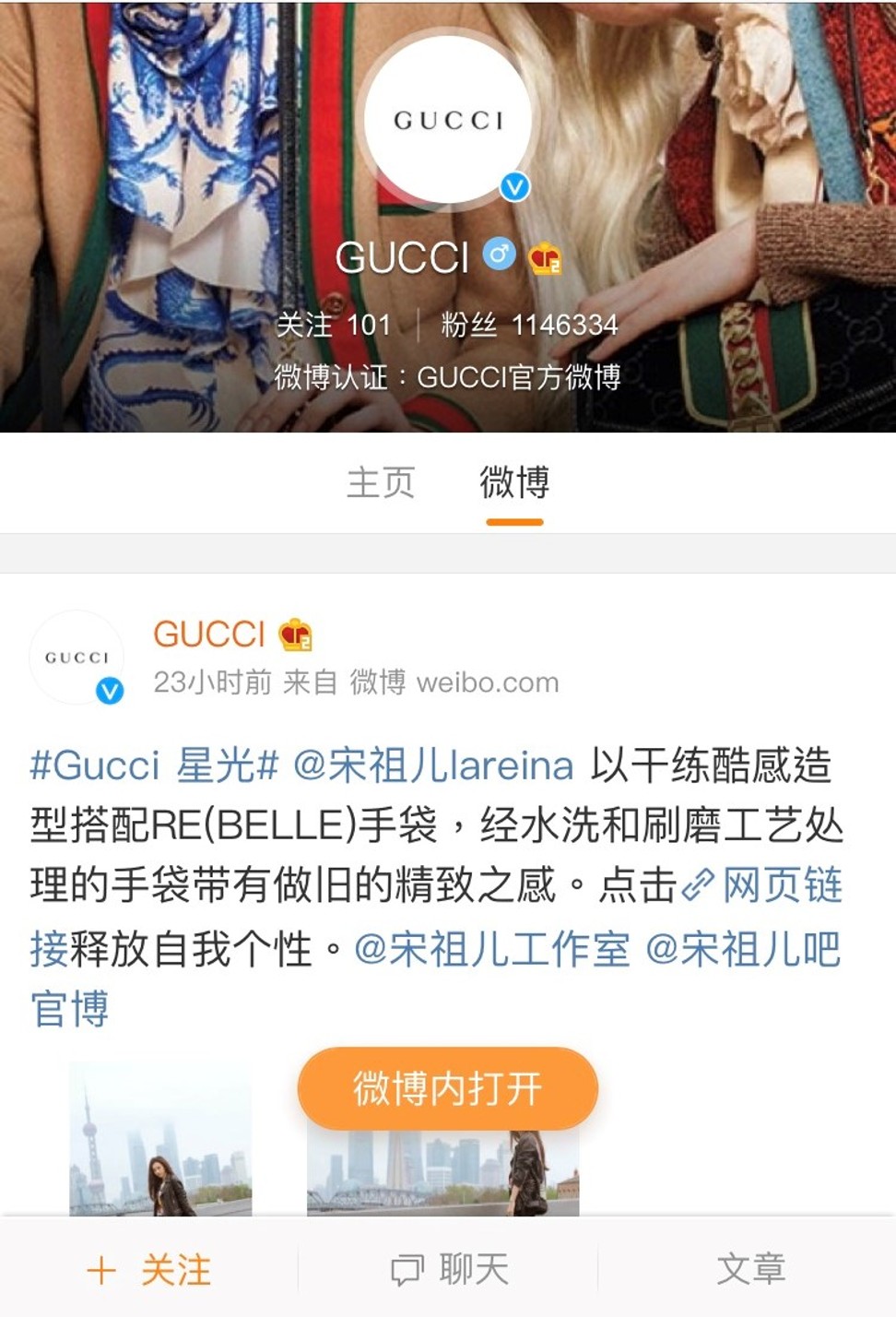

Though WeChat tends to get all the attention, Weibo, essentially China’s Twitter, has been a boon for luxury brands over the years, especially those that have learned to balance a social media portfolio between accounts.

WeChat isn’t designed to support viral content, but the more public Weibo, which thrives on hashtags, is. Brands target the platform’s 411 million monthly active users often by working with celebrities, whose large followings tend to drive conversation.

China’s Weibo second-quarter earnings beat estimates

They can also can benefit from Weibo’s live-streaming platform and “Weibo Stories”, which is similar to Instagram Stories – a feature that lets users post photos and videos that vanish after 24 hours on Instagram.

Content creators on Weibo can also post links to e-commerce sites, although because Tmall’s parent company Alibaba has a stake in Weibo, users are not allowed to link to e-tailers that compete with Alibaba, such as JD.com.

Douyin

Instagram Stories has dominated the short video scene in the West, but in China, this category has until recently been notoriously saturated. In late 2017, one platform rose above the rest, and became the sixth most downloaded app in the world in the first quarter of this year.

China’s internet watchdog clamps down on ‘disrespectful’ advertising

Douyin, better known as Tik Tok overseas, is a lot like Musical.ly (which Douyin’s parent company, Bytedance, bought in November 2017), as it lets users upload 15-second clips of themselves lip-syncing to music, creating video that they can edit with Snapchat-like filters and share with their followers. Content creators with a certain number of followers can also live-stream on Douyin.

Media and marketing agencies are touting Douyin as a key platform for reaching China’s Generation Z, or consumers under 24 years old, who are among the site’s 154 million monthly active users. More than 60 per cent of them are affluent women living in China’s first- and second-tier cities.

These numbers and Douyin’s intuitive interface, with content powered by AI, are already attracting a wide range of companies aiming to reach China’s urban youth, such as Airbnb, Adidas, and Audi, to run campaigns on the app.

Michael Kors became the first luxury brand to work with Douyin last November, and since then, brands such as Dior and Tommy Hilfiger have followed suit. Its huge user base has also attracted numerous A-list celebrities and KOLs, including actress Angelababy and singer Kris Wu. Even e-commerce companies, including the luxury e-tailer Secoo, have a presence on the platform.

Red

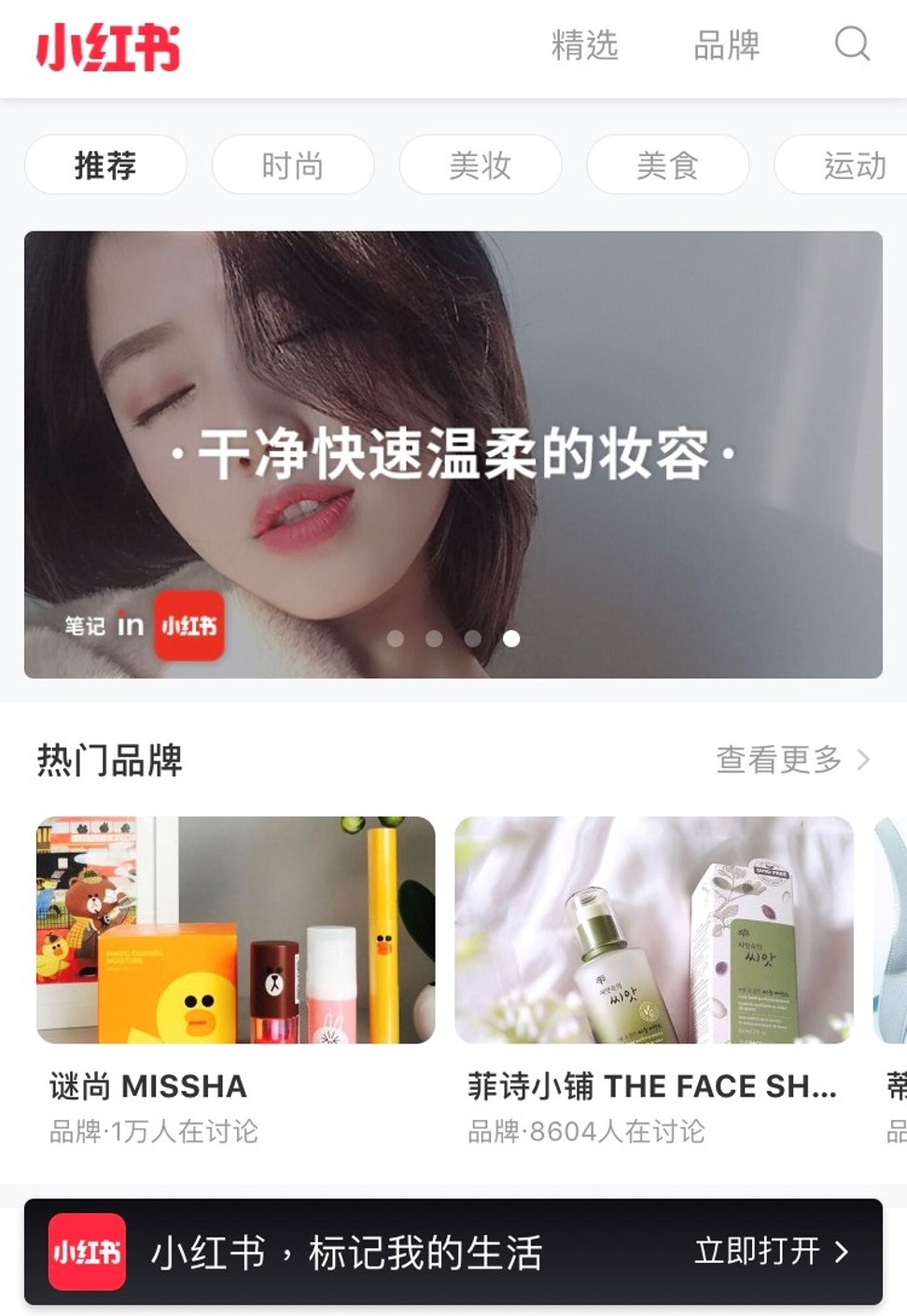

While big-name luxury brands can benefit from WeChat, Weibo, and Douyin, beauty brands are the major winners on Little Red Book, known as Xiaohongshu in Chinese or, simply, Red. The app got its start helping millennial Chinese shoppers, mostly women, educate their friends and followers about products sold overseas.

It now boasts nearly 100 million users and has its own cross-border e-commerce platform. Red, which is backed by Tencent, is also planning to complement its online reach with a bricks-and-mortar store in Shanghai this summer, according to Bloomberg.

Cosmetics and skincare brands are benefiting greatly from the app, which hosts user reviews from both the average shopper and beauty influencers. This gives consumers the opportunity to read up on a lipstick or concealer before either buying it within the app or at their favourite retailer.

Bella Hadid and the Chrome Hearts family hit Hangzhou in China

It’s a critical process for more than half of the consumers in China, compared to just 47 per cent globally, according to research by PwC HK.

Luxury brands are also widely mentioned on Red, with Gucci and Hermès among the top labels referenced, according to ParkLu’s recent Influencer Marketing Analysis.