China, EU financial regulators embark on voyage through choppy waters in search of common ground

- In first meeting of China-EU Working Group on Financial Cooperation, regulators find their footing while laying out areas of concerns

- Analysts say these types of financial dialogues with both the US and EU promote stability and are in the world’s best interests, but progress could be slow to come

With an eye toward a horizon in which the world’s financial systems can be safeguarded and improved, Chinese and European regulators set off this week on what analysts deemed a maiden voyage – one that looks to be a long and arduous journey.

In its first set of meetings, the China-EU Working Group on Financial Cooperation laid the foundation for a new communication channel in which grievances can be hammered out. And it comes at a time when bilateral financial concerns appear to be rising among industry players and regulators.

“Financial authorities from both sides exchanged views about the respective macroeconomic and financial stability situations, as well as on the regulatory and supervisory architecture in place in China and the EU, respectively,” the European Commission said in a statement on Wednesday, following the meetings on Monday and Tuesday.

And the People’s Bank of China (PBOC) added in a separate statement that discussions covered cross-border data transfers, a financial monitoring framework, capital market improvements and sustainable financial operations.

China’s EVs find greener pastures with free-trade partners amid US, EU barriers

China’s side involved authorities with departments concerning securities and foreign exchange, and the EU delegation was led by John Berrigan, a European Commission official in charge of financial stability, financial services and capital markets union.

But compared with those dialogues, which are more “clouded by the nature of their strategic rivalry”, the Chinese and European representatives seemed “pretty satisfied with their discussions”, according to Ding Chun, a professor specialising in European studies at Fudan University.

“[It] is a maiden voyage on which both sides have laid out issues they are concerned about,” Ding said. “It is not just an ordinary communication mechanism.”

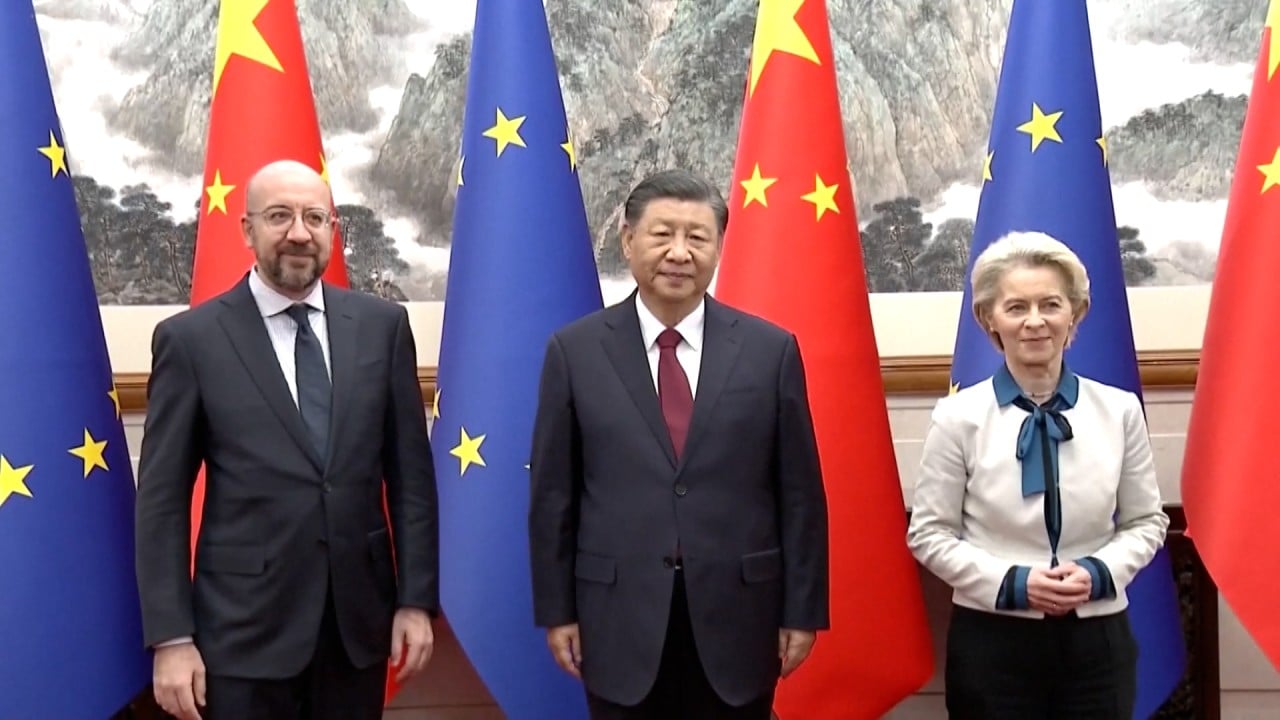

The working group was set up following the outcome of the 10th China-EU high-level dialogue on trade and investment in September, which aimed to deepen financial cooperation between the two sides.

Zhou Yu, head of the PBOC’s international department, said the face-to-face talks with European and American counterparts will help address on-the-ground problems in the future.

With Beijing expressing a desire to further open up China’s financial sector, Zhou said that leadership is working to curtail hindrances to cross-border financial data flows.

“In our communication with major economies, we often exchange views on international financial trends, global economic and financial stability, and other issues,” she said at a press conference on Wednesday. “This kind of communication and exchange is also a global public good, and it helps promote global financial stability.”

EU slows China de-risking plans in face of member state resistance

The EU, with a de-risking strategy high on its agenda, launched countervailing investigations into Chinese electric-vehicle producers in October and an anti-subsidy probe into China’s state-owned train maker in February.

Rolf Langhammer, a professor with the Germany-based Kiel Institute for the World Economy, said that China’s rising debts, yuan depreciation and property crisis have raised worries over investors’ onshore interests.

“EU actors in the financial sector may feel discriminated against by local financial actors with respect to market entry and ‘behind border measures’,” he said, clarifying these as “national treatment”.

“On the other hand,” he said, “China fears repressive actions in the EU against Chinese portfolios and direct investment in the EU.”

The working group [with the EU] is a platform for both sides to discuss and hedge risks together

As for their new working-group chat, Langhammer said there was “not much more to expect than just a ‘housewarming’ and an exchange of papers”. And he expected that there is still “a long way” to go in their efforts to agree on “common actions to make the financial system more resilient against crises”.

Wang Yiwei, director of Renmin University’s Centre for European Studies, said that the working group laid a solid foundation for both parties to resolve problems in the future.

“The United States has hiked their [interest] rates more than 10 times,” he added, referring to a flurry of such moves over the past couple of years. “The working group [with the EU] is a platform for both sides to discuss and hedge risks together.”