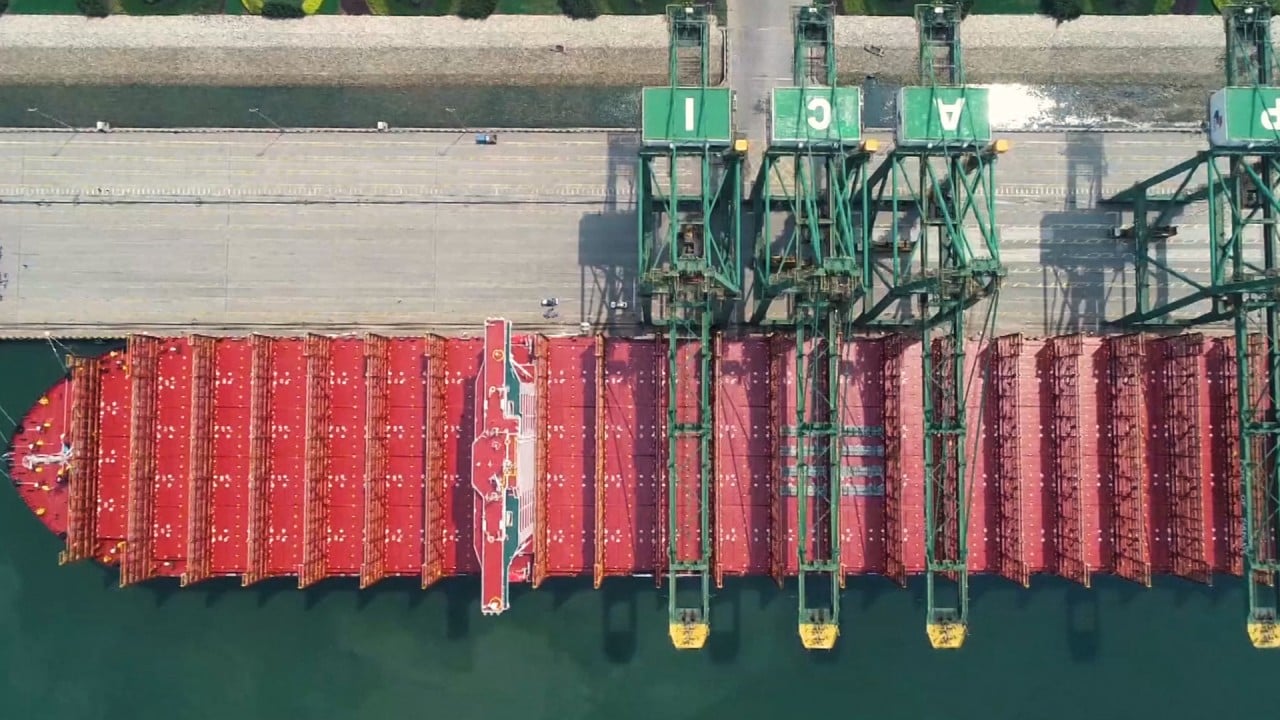

China’s new Yantai deep water port receives first iron ore mega ship from Brazil’s Vale

- Brazilian miner Vale docked a massive Valemax ship at the Port of Yantai on Wednesday, as China seeks to diversify sources of iron ore

- Shipments from Brazil will not challenge Australian miners in the short-run, but show China is looking to secure a reliable long-term supply

Brazilian miner Vale this week docked its first skyscraper-sized ore ship at one of China’s newest deep water ports, putting into motion Beijing’s strategy to diversify its sources of iron ore.

The fully-laden Valemax iron ore carrier, named Sea Maranhao, arrived at the Port of Yantai in Shandong province about mid-day local time on Wednesday after departing Brazil’s Ponta Da Madeira Maritime Terminal on June 20, according to S&P Global Platts and maritime intelligence website MarineTraffic.

Vale currently operates 67 Valemax ships around the world, making its iron ore shipments to China price competitive with those from Australian miners, who mostly use smaller Capesize ships for the shorter journey.

05:02

Coronavirus backlash further fraying China’s ties to global economy

Valemax vessels can carry much bigger loads than normal ships, up to 400,000 deadweight tonnes (dwt), half again larger than the 250,000dwt to 300,000dwt capacity of Capesize vessels.

The new shipment would increase Vale’s ability to blend different grades of iron ore to accommodate the varying needs of Chinese mills on a “just in time” basis, S&P Global Platts said.

“This is the same measure as Vale took at the port of Teluk Rubiah in Malaysia years ago. Vale’s port-side blending business has been expanding quickly in the past few years in China and it makes sense to use larger ships to achieve lower average freight cost,” S&P Global Platts analysts said.

Brazil, which has been hard-hit by the coronavirus, has struggled to ramp up iron ore production and exports to pre-Covid-19 volumes, let alone anywhere near close to levels seen before the Vale tailings dam disaster in January 2019

Port-side trading allows buyers to acquire iron ore in smaller volumes with shorter lead times and smaller credit queues than seaborne trading, which is based on longer-term contracts. This allows steel mills to keep their inventories to a minimum, but still restock on a just-in-time basis if demand rises.

An increase in Brazilian ore shipments will help China secure supply from reliable trading partners, given ongoing political tensions between Beijing and Canberra, analysts said.

01:14

World’s largest container vessel, MSC Gülsün, begins maiden voyage in northern China

Hongmei Li, a senior analyst at Mysteel Global, said China had long planned to diversify its steel supply, which fit nicely with Vale’s intention to blend more iron ore at the Chinese ports to serve its Asian customers.

“It makes sense for China to approve more [deep berths to host Valemax ships],” she said.

Vale is still trying to resume normal shipment levels to China, which were dented after the Brumadinho dam disaster last January last year shut down much of its mining operations in southern Brazil.

Annual shipments of about 400 million tonnes a year would be required before it could start to compete against its Australian counterparts, analysts said.

Brazil miner Vale looks to meet China’s appetite for iron ore with new port

“We would avoid reading too much into just one vessel or consignment with respect to the structural repositioning of global iron ore trading partnerships, despite the current contentious Australian-Chinese political relationship,” said Atilla Widnell, managing director at commodities analysis firm Navigate Commodities.

“Brazil, which has been hard-hit by the coronavirus, has struggled to ramp up iron ore production and exports to pre-Covid-19 volumes, let alone anywhere near close to levels seen before the Vale tailings dam disaster in January 2019.”

06:40

The Yangtze River: Why China’s ‘beating heart’ is too big to fail

The South American nation was still struggling to recover market share it lost to Australian miners whose shipments in the first six months of the year set records, Widnell added.

Still, Vale has started the process of increasing its shipments, including looking at new ports in its northern mining system, such as the Alcantara Port Terminal in Sao Luis, to increase shipment capacity to Chinese deepwater ports that can host the Valemax ships.

Rio Tinto, Fortescue say China recovery driving record iron ore shipments

Widnell anticipates China’s steel-intensive construction and infrastructure projects to keep demand high for the next two to three years.

S&P Global Platts analysts expect another seasonal uptick in Chinese steel demand in September and October, with total steel production in China set to reach 1.026 billion tonnes by the end of 2020, despite the disruptions from Covid-19 and flooding. In comparison, China’s steel production in 2019 was just shy of 1 billion tonnes.

Widnell anticipates China’s steel-intensive construction and infrastructure projects to keep demand high for the next two to three years.

Despite rising steel prices, margins have more or less flatlined for the past one month due to the strength of iron ore prices, S&P Global Platts said.

“Some Chinese mills think the supply side reform and stimulus packages have benefited the iron ore miners, mostly overseas, more than themselves,” analysts for the firm said.

Prices for fine grade iron ore rose to US$116.35 per tonne on Wednesday, the highest level since July 2019, according to S&P Platts Iron Ore Index (IODEX). The recent strength in IODEX is being driven by persistently tight inventories of fine grade iron ore.

The four new deepwater ports that can host Valemax ships “could de-bottleneck the supply chain to some extent”, S&P Global Platts.

But it added strong demand from Chinese mills was underpinning the price, though rising Brazilian supply should provide some relief.