Global Impact: China’s ‘two sessions’ rolls around at decisive moment for the world’s second-largest economy

- Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world

- In this week’s issue, we look ahead to the ‘two sessions’, with China’s key annual meetings set to get under way in Beijing at a crucial time for the world’s second-largest economy

With the world clouded with uncertainty as conflicts rage in the Middle East and Ukraine, nearly 3,000 Chinese lawmakers and other members of the political elite are set to converge on Beijing. There, they will deliberate on plans to maintain stability in the world’s second-largest economy.

Observers are keen to see how Beijing will use the meetings to promote its plans and project confidence.

Most are now playing a waiting game, content to spectate until Beijing spells out its next moves to rein in policy unpredictability and regain its appeal for investors while creating more jobs and spearheading tech innovation.

All those dismissals share one thing in common – no explanation from Beijing.

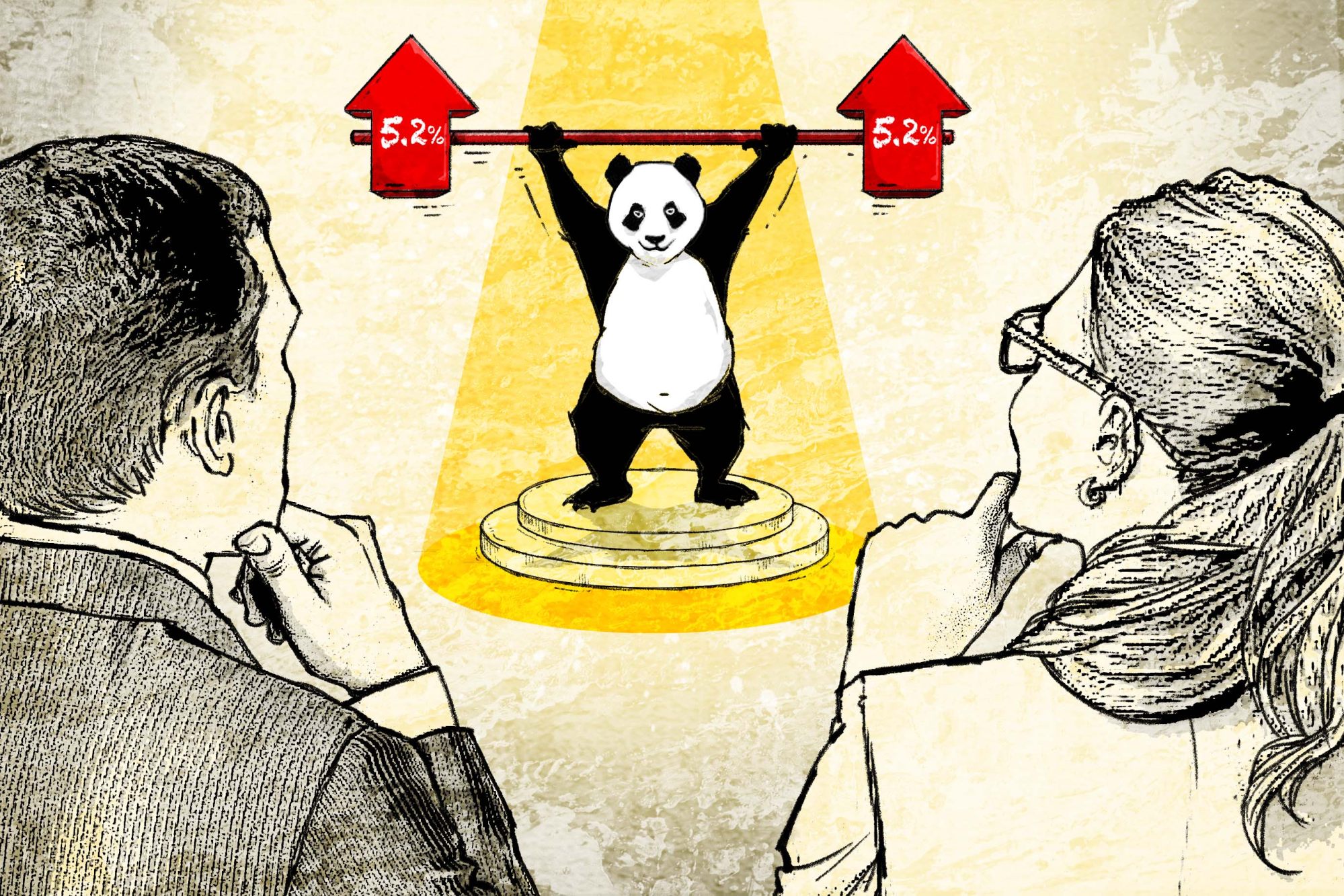

Why China may have to ‘push harder’ to maintain its economic growth in 2024

A dozen high-level members were also ousted from their positions on corruption charges, as Xi’s signature campaign against government misconduct entered its 11th year.

High-level state bankers and financiers have also been hit, despite the potential downstream effects on business.

Beijing’s handling of personnel issues in the military may offer clues to understanding the notoriously secretive People’s Liberation Army.

What does Li Qiang’s schedule reveal about the changing role of China’s premier?

China’s ‘Two Sessions’ 2024: what to expect

Science and technology have also become severe sticking points in the US-China rivalry, and Beijing has not been shy in asserting its ambition, pushing sweeping self-reliance drives even as the US sanctions imports of key technologies.

The two sessions may be the country’s chosen platform to lay out its technological road map, especially as China has fallen behind in areas like semiconductor manufacturing – essential for cutting-edge applications such as artificial intelligence.

Its scientific aspirations may be further tested with a possible return of Donald Trump to the White House, as November’s US presidential election is fast approaching and the ex-president has made no secret of his desire to curb China’s advancement up the value chain.

And with that volatility added to the mix, making plans that project confidence at a time of perpetual changes will be weighing on China’s politicians at the upcoming gatherings.

60-Second Catch-up

Deep dives

Why China may have to ‘push harder’ to maintain its economic growth in 2024

-

China saw better-than-expected growth in 2023 thanks to emerging industries, but oversupply and likely trade restrictions may foreclose those options

-

Analysts recommend new approach in run-up to top legislative sessions, suggest clear road map for private sector, overseas investors

China’s political elite will gather next week for the country’s annual legislative sessions, where plans will be set for the country’s economy, diplomacy, trade and military. In the second part of the series, Frank Chen and He Huifeng examine how Beijing will guide its economy through uncharted waters.

Though it is typically a time for warmer weather, this spring could bring a chill to China’s previously sizzling industries – particularly new energy – as hopes for a banner year of economic growth may not come to fruition if overcapacity concerns and strained trade relations prove enough of a hindrance.

What does Li Qiang’s schedule reveal about the changing role of China’s premier?

-

Side-by-side comparison finds Li Qiang and predecessor Li Keqiang had different priorities early in their terms, determined by economy and geopolitics

-

Li Qiang appears to have less authority on some matters, including those related to foreign affairs, says analyst

China’s political elite and lawmakers will gather next week for the country’s annual legislative sessions which will set budgets and lay down Beijing’s plans for the country’s economy, diplomacy, trade and military. In the first part of the series, Vanessa Cai looks at the role of premier and how it has changed under Li Qiang.

‘New productive forces’: empty rhetoric, or engine for China’s future growth?

-

The term ‘new productive forces’ has been employed more frequently in reference to methods to boost China’s growth and recovery

-

Technology and services, particularly home-grown innovations, could both enhance existing industries and generate new, reliable sources of activity

In recent communications, China’s leaders and media have frequently used the phrase “new productive forces” when discussing how to revitalise and transform the economy – itself a hot topic in a period where growth has slowed and officials have been struggling to find momentum.

The expression took on greater prominence after President Xi Jinping referred to the concept as a “leading factor” for “promoting high-quality development” of the Chinese economy.

Radio silence on China’s economic plenum suggests reform still in the back seat

-

Without a date for a third plenum, typically a major agenda-setting moment for the economy, observers are concerned China’s recovery will remain weak

-

Mixed signals are weighing down on investor confidence, they say, as many wait for concrete policy support indicating renewed emphasis on growth

Beijing’s reluctance to go full throttle in boosting economic growth – combined with an absence of clear directives for reform – could further dampen an already dreary climate, experts and foreign business groups have warned.

China’s subdued economic recovery, its restraint in employing strong stimulus measures and mixed policy signals continue to weigh on both domestic and foreign investment as well as consumer confidence, they said.

Why is China mixing its economic messages when business confidence is so low?

-

Regulator reversals and empty government rhetoric will make it even harder to restore near-term business confidence, analysts say

-

Beijing’s ‘twists and turns’ raise questions about government alignment as pressure mounts to shore up economy

The new year traditionally offers a window for an upbeat economic mood in China, falling between the Communist Party’s annual economic work conference in December – the usual arena to inject support for growth and the private sector – and the celebratory Spring Festival, typically in late January or early February.

But this new year feels a bit different.

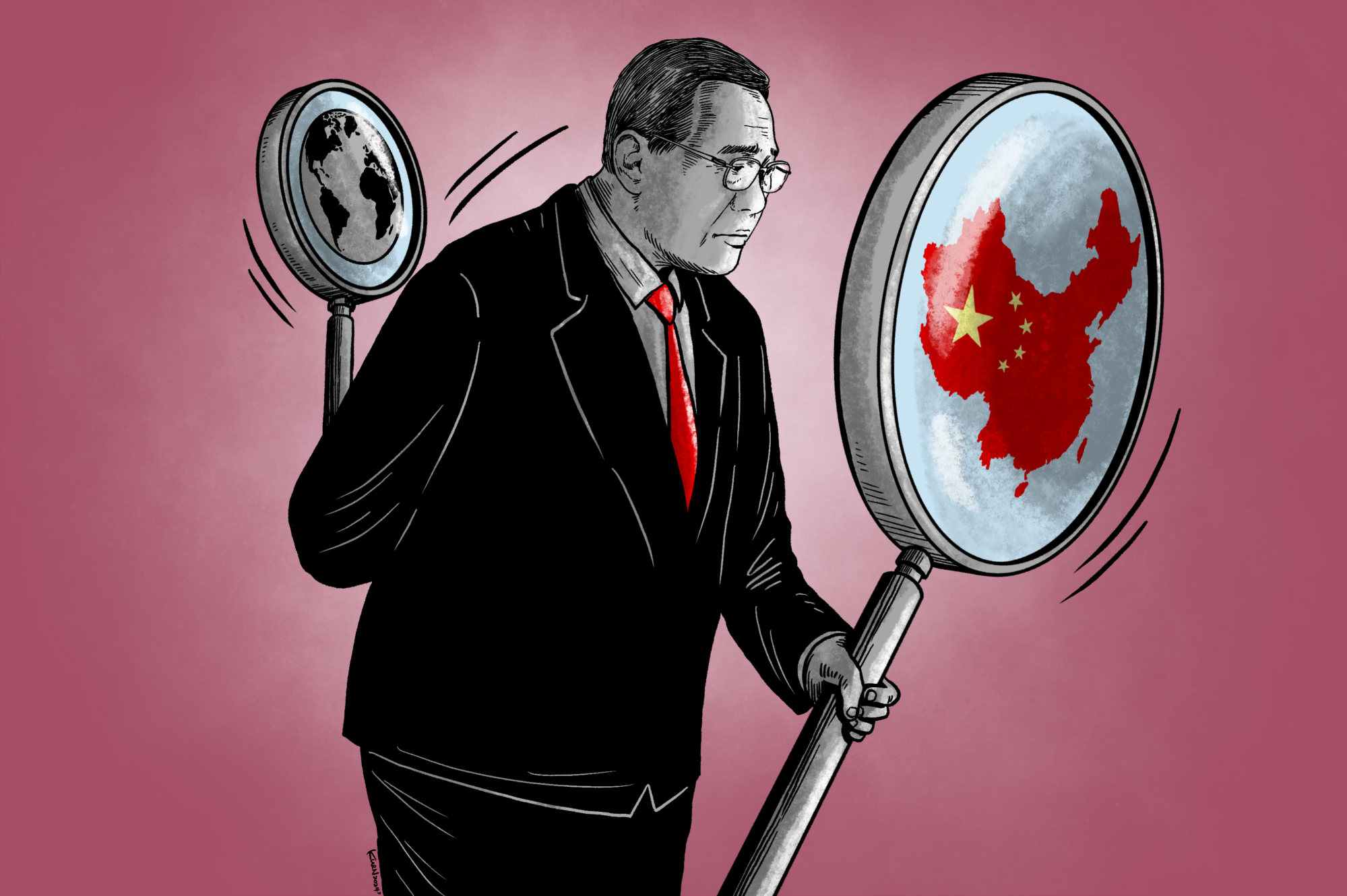

China’s rose-tinted growth scrutinised through jaundiced eyes of wary foreigners

-

Much-ballyhooed GDP growth and other testaments to China’s strength may not be having the reassuring effect that Beijing is hoping for, highlighting urgent need for uplifting policies

-

Foreign chambers and economic analysts say challenges related to national security, data flows and market barriers still dominate hearts and minds in decision-making

The early and unexpected disclosure by China’s No 2 political figure was intended to send a clear message that the world’s second-largest economy had shrugged off the crippling effects of its zero-Covid policies during the pandemic, and that it would remain attractive to foreign investors.

Global Impact is a weekly curated newsletter featuring a news topic originating in China with a significant macro impact for our newsreaders around the world.