China’s financial crisis team goes into overdrive with 10th meeting in two months

- Financial Stability and Development Committee pledges fresh support for stock market, economy, official statement says

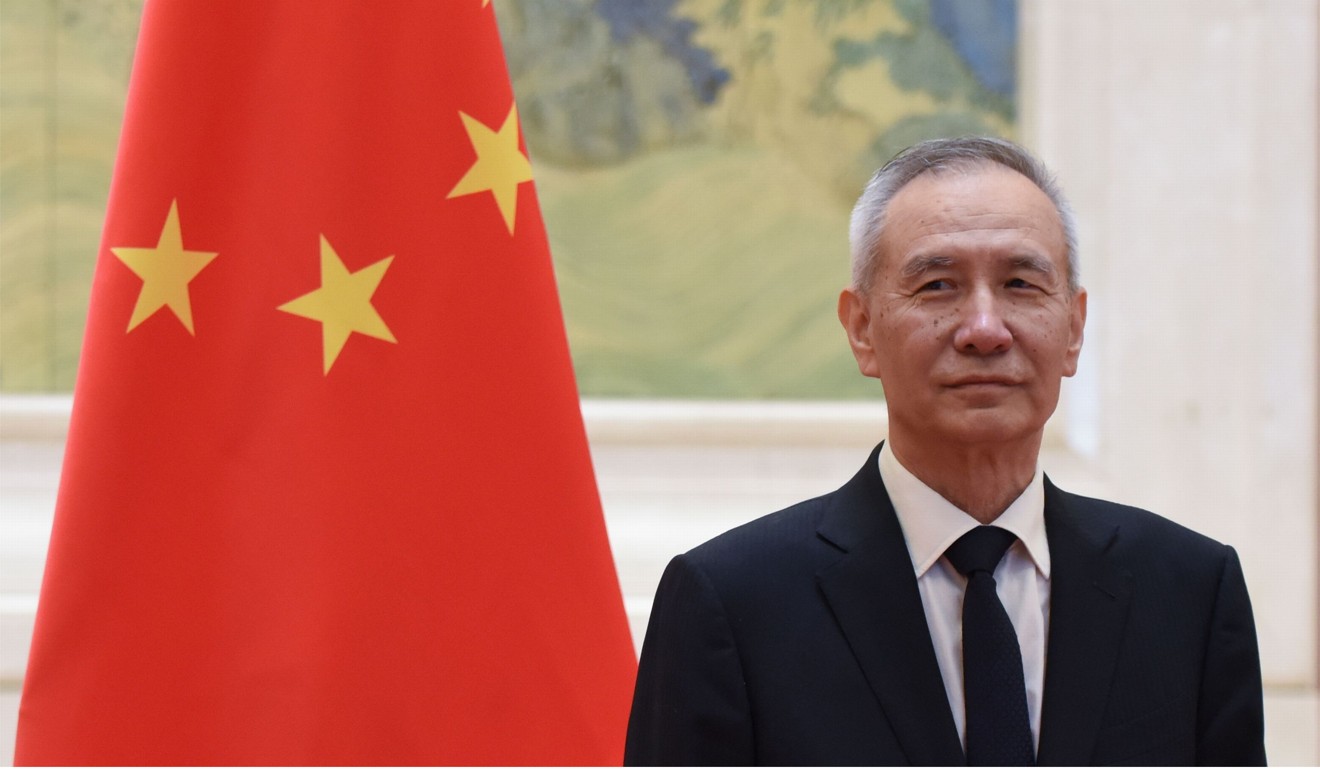

- Vice-Premier Liu He’s team under pressure to resolve problems caused by trade war, slowing growth

A team led by Chinese President Xi Jinping’s top economic aide and tasked with maintaining financial stability amid an escalating trade war with the United States and a weakening economy met for the 10th time in two months on Saturday.

Vice-Premier Liu He assembled his Financial Stability and Development Committee for a “10th thematic meeting on preventing and resolving financial risks”, according to a statement published on the government’s website on Sunday.

Liu took charge of the group of senior financial decision makers in July and held its first “thematic meeting” on August 24, according to a report by China Securities Journal. Details of the eight gatherings held between then and Saturday went unreported, though state media said on Sunday that Liu had also chaired three plenary sessions of the committee since taking charge.

“The anxiety among the top leadership is 100 per cent,” Xu Jianwei, senior China economist at French bank Natixis, said.

“One of Beijing’s top priorities for this year was deleveraging, but that policy has shifted gradually because there are more serious problems,” he said.

“If deleveraging continues, many Chinese companies may die in the process. But if deleveraging slows down, the financial risks will continue to pile up. So regulators are for sure very worried, and I don’t think they have found a particularly good way out of it.”

Trade war escalation may trigger financial crisis in China, researchers warn

The website statement said the meeting agreed that China’s economic policy should seek to create a “triangular support framework”, comprising a neutral monetary policy stance, a vibrant corporate sector and a well-functioning stock market.

In particular, banks should not “stop, cut, withdraw or suspend” loans to small businesses and private firms, it said.

The meeting took place just a day after Liu and three other top financial officials – People’s Bank of China governor Yi Gang, China Banking and Insurance Regulatory Commission chief Guo Shuqing and China Securities Regulatory Commission chairman Liu Shiyu – made public statements intended to help bolster confidence in the economy and stock market.

China’s economy grew 6.5 per cent year on year in the third quarter – its slowest rate since the global financial crisis – on the back of lacklustre growth in investment and consumption, according to official figures from the National Bureau of Statistics.

China’s economy to brace for slower growth pace as trade war with United States takes its toll

The financial stability committee was set up last year to coordinate policies emanating from different ministries. Its day-to-day operations are managed from an office at the People’s Bank of China in Beijing.

While officially positioned as a coordinating rather than decision-making agency, the apparent intensity of its activity suggests it has become the de facto financial super regulator.

Top China adviser tries to boost battered confidence in economy after weak stocks, financial data

At its first “thematic” meeting in August, the committee discussed how to tackle the financial risks related to peer-to-peer lending and the use of shares as collateral for loans.

The former has been a long-standing problem in China and hundreds of fraudulent lending platforms have collapsed leaving the public millions of yuan out of pocket and sparking widespread street protests. The latter exacerbated the impact of the recent stock market rout.

Chinese President Xi Jinping set to visit Guangdong to boost confidence in economic model

China’s stock market has slumped this year, with the benchmark Shanghai Composite Index hitting a four-year low earlier in the month.

The committee said Beijing would continue to support the market as “a capital market plays critical role in stabilising economy, stabilising the financial system, and stabilising expectations”.

All relevant ministries, including the central bank, stock market and foreign exchange watchdogs, and banking regulator, have been told to implement the committee’s decisions to bolster confidence in the stock market and economy, the statement said.