Top China adviser tries to boost battered confidence in economy after weak stocks, financial data

- Liu He, Chinese President Xi Jinping’s top economic adviser, brings words of comfort to fragile business community

- Psychological effect of trade war bigger than actual impact, he says

China’s vice-premier Liu He on Friday sought to shore up confidence in the country’s slowing economy and faltering stock markets amid escalating trade tensions with the US, after shares fell to a four-year low on Thursday.

In an interview with state media, Liu, the top economic aide to President Xi Jinping, commented on the recent sharp decline of China’s stock market, tried to dispel worries on the economy shrouded in major uncertainties stemming from the trade war with the US, and reaffirmed the government’s commitment to treat private companies equally when confidence is running low.

The remarks, in a Q&A format released by Xinhua and People’s Daily in the early afternoon, followed a rare joint pep talk by the country’s three top financial officials earlier in the day – the central bank governor, the bank and insurance regulator boss and the securities commission chairman.

Watch: US-China trade war – day 105 and counting

Liu’s comments also came as Xi is set to visit Guangdong, the southern province where China’s economic liberalisation started 40 years ago, as early as this weekend.

Chinese President Xi Jinping set to visit Guangdong to boost confidence in economic model

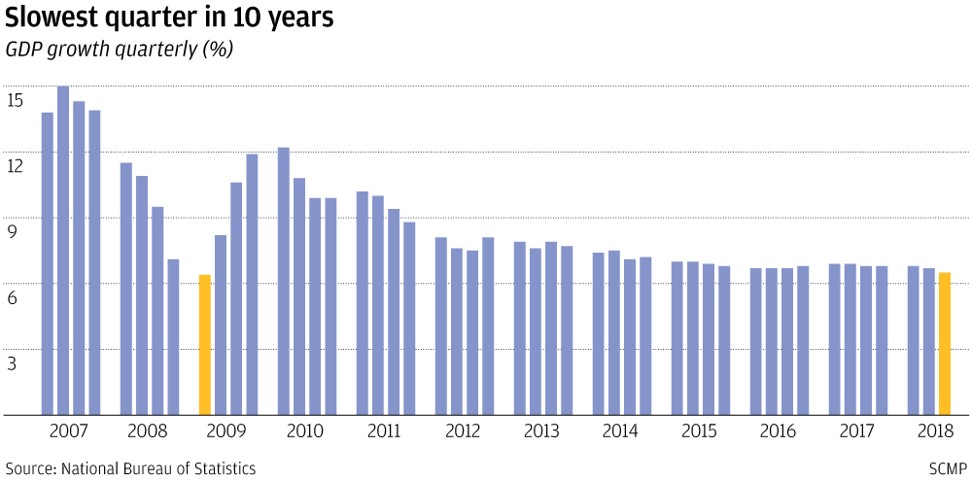

On Friday morning China released disappointing third-quarter GDP data which showed the economy had recorded its lowest growth rate in nearly 10 years as the trade war exacted a toll on exporters and manufacturers.

China has introduced measures to steady its domestic investment and demand, but it will take three to six months to show up in the numbers

China’s economy expanded by 6.5 per cent in the three months to September, down from 6.7 per cent in the second quarter.

“The Sino-US trade friction has affected the market,” said Liu, who is also Beijing’s chief negotiator with Washington over trade issues. “But frankly speaking, the psychological effect is bigger than the actual impact.”

“China and the US are now in contact with each other,” he added.

President Xi and US President Donald Trump have tentatively agreed to meet in late November at the G20 leaders’ summit in Buenos Aires, Argentina, the South China Morning Post has confirmed.

Xi Jinping, Donald Trump agree to talks at G20 summit next month, source says

The benchmark Shanghai Composite Index has lost nearly 20 per cent since April, when the US slapped punitive tariffs on Chinese exports of aluminium and steel.

According to Liu, the reasons behind the stock market sell-off include major countries’ interest rate hikes, China’s ongoing economic restructuring, changed market expectations in the face of major uncertainties and “technical corrections” in the market.

However, he stressed the value of Chinese listed companies, saying the current low stock prices of Chinese companies offer a good opportunity for global long-term investors to buy.

Banny Lam, head of research at CEB International Investment, said the pep talks came at a crucial time when confidence in China’s economy and financial market was fragile.

“China has introduced measures to steady its domestic investment and demand, but it will take three to six months to show up in the numbers,” Lam said.

[Liu He] did not offer any concrete measures to change the incentive structure of banks or local governments

Before that, people are waiting for the expected meeting between Xi and Trump at the end of next month. “If they get to sit down and talk I think it will give global markets a real confidence boost.”

In the interview, Liu said China was channelling more funds to the stock market. He also tried to ease concerns about the status of China’s private sector amid criticism that Xi’s focus on fostering bigger and stronger state-owned enterprises (SOEs) would crowd out private firms and lead to discrimination.

Those who favour SOEs and turn down private companies in extending loans and other issues are “politically problematic,” Liu warned. “They do not support the development of private companies. Their behaviour should be corrected,” he said.

China’s economy to brace for slower growth pace as trade war with United States takes its toll

Chen Daoyin, a Shanghai-based political commentator, said Liu’s remarks may backfire.

“It’s a reality that loans granted [by banks] to SOEs are safer than those to private companies because the former have the government as their backer. If China forces banks to change under political pressure, it will distort this market logic,” he said.

Alfred Muluan Wu, associate professor in Lee Kuan Yew School of Public Policy at National University of Singapore, said Liu was aiming to soothe private investors after the latest wave of bankruptcies had forced a rising number of private companies to be sold to or merged with SOEs.

“However, Liu did not offer any concrete measures to change the incentive structure of banks or local governments. Without details about implementation, we don’t see any chance of change,” Wu said.

Liu told investors China would continue with SOE reform and improve financial services to the real economy, noting the nation’s economic prospects were “very bright” from a long-term view.

Betting on China’s large and growing middle class, demand from its ageing population and a new round of technological evolution, Liu called on investors to “calm down” and believe in a better tomorrow.

Liu also reiterated China’s commitments to further open up the banking, securities and insurance sectors.

“The principles of opening up and reform have been set, the key is the implementation … We will press ahead with implementation,” he said.

Le Xia, chief economist for Asia at BBVA Research said: “The authorities should take prompt and effective action to boost market confidence and the real economy rather than just paying lip service. If there are no follow-up measures, even statements from Chinese leadership [officials] can at most have a transitory impact on the market.”

Liu led a coordinated effort with the country’s central bank and financial regulators on Friday to extend a lifeline to businesses battered by a liquidity squeeze resulting from the stock market rout.

Earlier on Friday, the People’s Bank of China, the China Banking and Insurance Regulatory Commission, and the China Securities Regulatory Commission all said they would ramp up support for private companies exposed to the liquidity squeeze – caused by forced sales of their shares which had been used as collateral for loans.

The coordinated effort had an immediate effect on the stock market – the Shanghai Composite Index ended 2.58 per cent higher on Friday.

Additional reporting by Nectar Gan and Amanda Lee