As AI revolutionises the tech economy, countries focusing on semiconductor fabs may need to think again

- Tech consumers will increasingly be attracted to the latest AI capabilities, rather than hardware, and the biggest profits will be in AI software inventions and fee-based apps

- With tech manufacturing already facing cost pressures and competition, these transformations will challenge the outlook for many countries

Services are the critical pipeline through which Apple, the world’s largest company by market capitalisation, will deliver the AI tools it envisions running, for example, on its smartphones, without needing an internet connection or the cloud. Hardware improvements that distinguished new models from past iterations will be supplanted by advancements in AI capabilities.

The emerging rivalry for AI dominance between Apple and Microsoft is looking a lot like the contest between their operating systems. That experience taught them that the product that first captures the largest market share effectively becomes the standard.

Even at this very early stage, the stakes are enormous. Generative AI could add up to US$4.4 trillion annually to the global economy, according to a McKinsey report. In a Centre for Macroeconomics and Centre for Economic Policy Research survey of Europe-based economists, most of them said that AI could push economic growth worldwide to 4-6 per cent every year, compared to the 4 per cent average over previous decades.

Those projections, though, seem faint shadows of the potential suggested by the early uses of AI in everything from medical diagnosis to machine learning – even if the hype is heavily discounted.

Many of those features, though, were tweaks – not quantum breakthroughs on the scale of the smartphone’s invention. Software was important to make the gadgets work, but the focus was on manufacturing within tight timeframes the components that made possible each subsequent offering of new features.

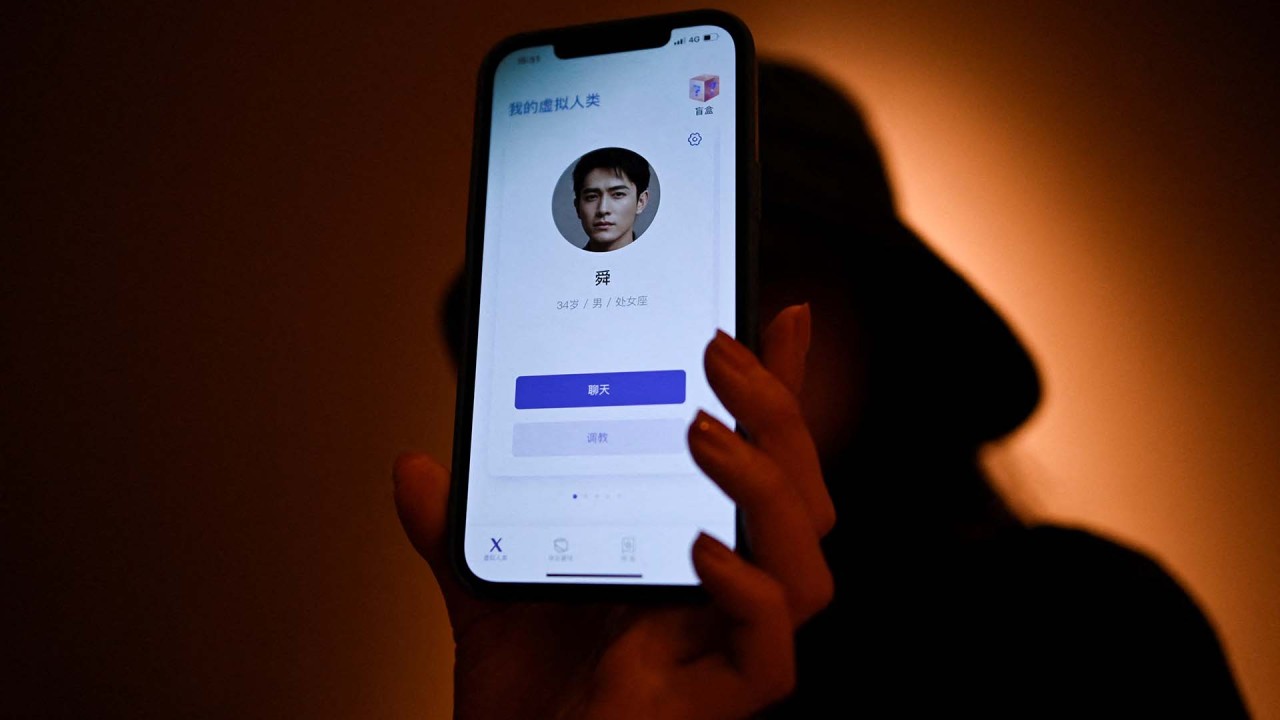

Today, however, sharper images, thinner bezels and curved contours will no longer generate the excitement that similar enhancements did. Increasingly, AI features are the ones luring consumers in. And the need for AI software and applications is so great and specialised that premiums can now be charged.

But while the development of AI still requires considerable supercomputing capacity to both process power-hungry algorithms and design a new generation of hardware, the manufacturing of consumer tech has increasingly been forced to the sidelines by shrinking margins and a growing field of competition.

For economies looking to grow through tech manufacturing, the outlook is no longer clear – the proliferation of chip fabrication plants, or fabs, provides a vivid example, with fierce competition keeping fab worker wages low.

More components are being commoditised, meaning that product differentiation is narrowing between manufacturers, driving a pricing race to the bottom. The difficulties are compounded by the speed at which components will become obsolete as AI creates the need for new ones. Only in highly specialised areas, such as graphics processing units, will manufacturers maintain high profits. Even then, it’s hard to say for how long.

But there are other issues too, starting with data collection and analysis. AI will consume unfathomable amounts of information to produce results. Success, including the accuracy of predictions, will depend on the quality and size of data amassed. An AI system must know as much about the world as possible to best perform its tasks. Prioritising this will slow the rush for hardware advancements.

Manufacturers will become subservient to solutions that AI proposes to improve efficiency, achieve zero waste and minimise downtime. AI could make many hardware components redundant as it discovers new ways to accomplish tasks with fewer components.

The capital expenditures on AI will be massive in scale and duration, as recent announcements by Apple, Microsoft and Alphabet attest. The competition for capital will place manufacturing below AI software development as a priority, especially since AI is expected to generate far more revenue than hardware.

These points hint at the vast change ahead in the age of AI. Manufacturing’s role will be relegated to the shadows. Countries that view fabs as a way to accelerate growth and prosperity may soon see the same problems that beleaguered their “rust belts” undermine their “factories of the future”.

James David Spellman, a graduate of Oxford University, is principal of Strategic Communications LLC, a consulting firm based in Washington, DC