De-risking from China: companies and countries have different goals

- Businesses might use similar ‘de-risking’ rhetoric to some governments, but their priorities are different as they try to stay connected to a critical market

- Many foreign firms already derive a large part of their revenue from China, and the country’s infrastructure lets them produce at scale and deliver on time

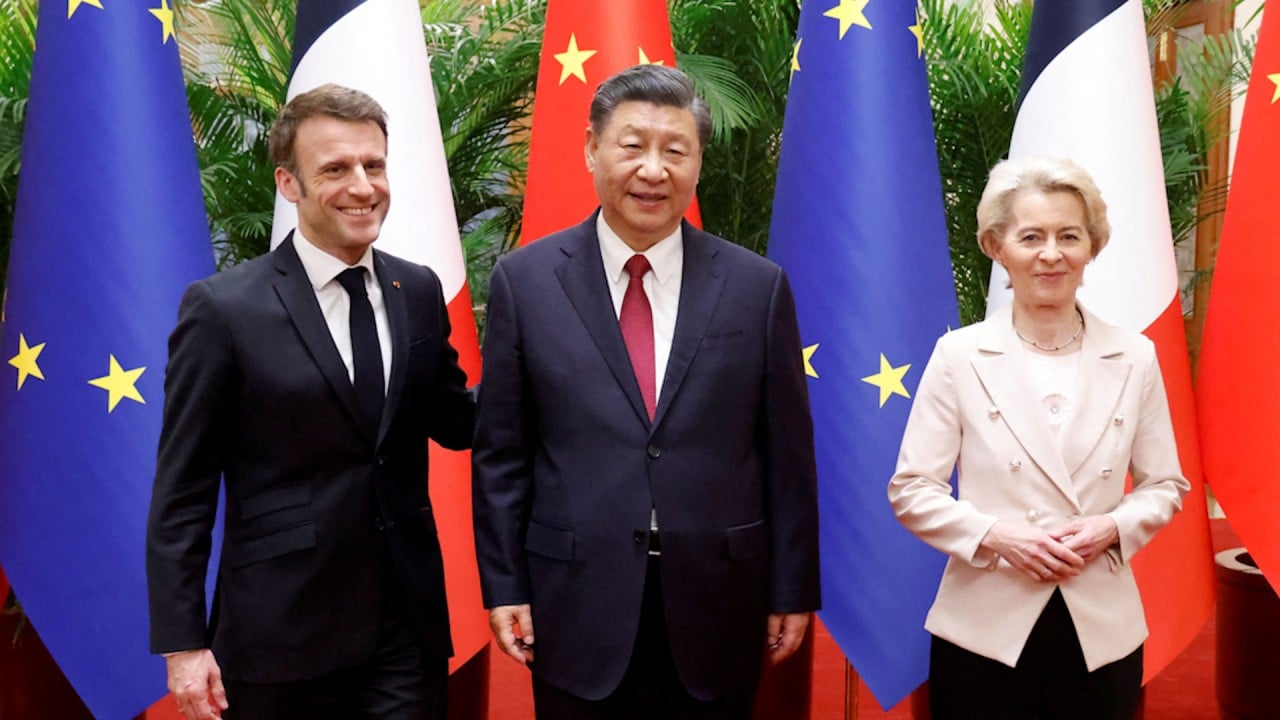

There is no hiding that China’s relationship with the West, especially the United States, has become more complicated in the past decade. At the state level, there is strategic competition in the technology and finance sectors, as well as China’s expanding influence in geopolitics.

The growing tensions between the world’s two superpowers are raising alarm bells with companies that have business interests across the world.

These shifts in relationships require both governments and businesses to adjust their strategies. This is where a flurry of D-words comes into play, including deglobalisation, decoupling and de-risking.

With pandemic-related travel restrictions being lifted across Asia, multinational companies can accelerate their assessment of possible new production locations.

Dell’s plan to phase out China-made chips to accelerate global tech decoupling

This reflects the current scale of the Chinese car market as well as the rising competition from domestic carmakers, especially in electric vehicles.

Second, while it is understandable that companies want to diversify their supply chains to reduce potential disruptions, China’s logistics infrastructure remains competitive and allows these businesses to produce at a large scale and deliver on time.

China, including Hong Kong, has seven out of the top 10 biggest container ports in the world in 2021, according to the World Shipping Council. For other emerging economies to pick up some market share from China, investment in infrastructure will need to accelerate to provide the appropriate logistics.

A good leader plans for tough times and contingencies while conducting business as usual. Operations in China are already an important component of many international companies.

This means that company leaders are more likely to manage the risks to their businesses of operating in China instead of disengaging from the Chinese economy and market altogether.

Tai Hui is chief market strategist for the Asia-Pacific at JP Morgan Asset Management