US-China trade war: Europe’s ‘de-risking’ approach is sensible amid American insanity

- The trade war against China that Donald Trump initiated in 2018 is self-defeating, and it defies reason that US President Joe Biden has continued it

- Given the realities of global trade, it is understandable that Europe’s leaders focus on ‘de-risking’ rather than decoupling

Adam Posen, president of the Peterson Institute for International Economics, identifies “four profound analytic fallacies” underpinning US trade policies in his recent Foreign Policy article “America’s Zero-Sum Economics Doesn’t Add Up”.

He notes the false idea that “self-dealing” is smart; the belief that self-sufficiency is attainable or even desirable; the idea that subsidies are helpful; and that “on-shoring” is good. Posen says these fallacies are “contradicted by more than two centuries of well-researched histories of foreign economic policies and their effects”.

Trading partners worldwide are praying they will not be forced to take sides and assessing how to cope if they end up with no choice.

At a global level, trade has flatlined since 2019, with no clear recovery in the year ahead. The World Trade Organization’s latest Global Trade Outlook noted a sharp trade downturn in the final quarter of last year, and is forecasting a fragile 1.7 per cent growth in trade this year. Ralph Ossa, the WTO’s chief economist, pointed to many ongoing uncertainties surrounding monetary policy, financial market volatility and geopolitical tensions.

At the same time, UNCTAD forecasts “continuing trade stagnation”.

In a dissection of US-China trade, economist Chad Bown of the Peterson Institute asks whether there has been a decoupling after four years of trade war. “Yes and no,” he hedges. “On the one hand, US imports of certain products from China – including semiconductors, some IT hardware and consumer electronics – have fallen dramatically. Even clothing, footwear and furniture imports are down.

“But on the other, imports from China of laptops and computer monitors, phones, video game consoles and toys are higher than ever.”

Don’t believe the data. US-China trade ‘becoming less directly interdependent’

Even though there is evidence of some decoupling, trade between the US and China remains high. China’s dependence on US farm products has fallen, with imports down to 18 per cent last year from 26 per cent in 2012. Its import of soybeans has fallen to 31 per cent last year from more than 40 per cent before the trade war.

Some remain sceptical about the scope for decoupling, given China’s size, infrastructure and workforce. A recent Drewry study showed that China has a lead in port capacity, especially for the latest generation of container ships. It has 76 terminals able to berth ships carrying 14,000 20-foot containers, compared with 31 across the rest of Asia. This logistics lead is a product of more than US$40 billion investment and would take years to erode.

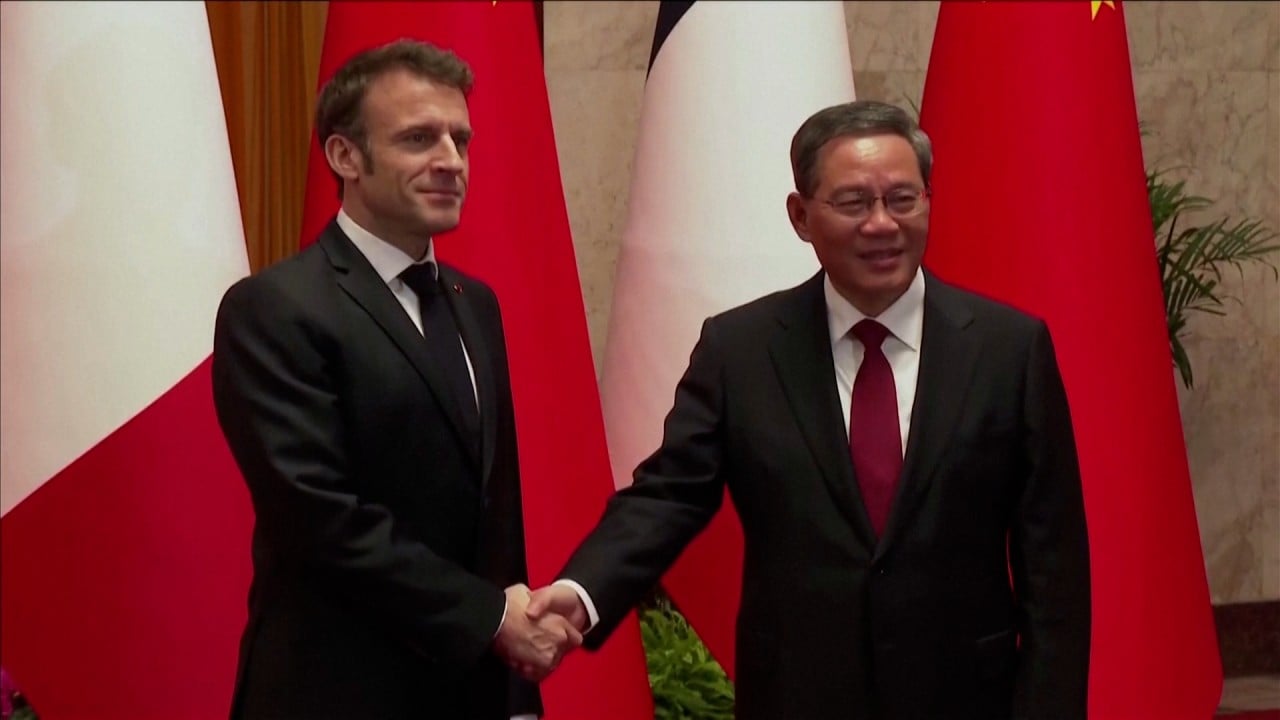

With these realities clearly in mind, it is perhaps not surprising that Europe’s leaders – whatever their anxieties be about the future direction of China as a global economic power – prefer to focus on de-risking rather than decoupling.

In the meanwhile, the US might need to prepare to pay a high price for its trade war. Posen might be right about “profound analytic fallacies”, but it seems no one in the US is listening.

David Dodwell is CEO of the trade policy and international relations consultancy Strategic Access, focused on developments and challenges facing the Asia-Pacific over the past four decades