Why the global chip shortage is a good sign for the world economy

- Demand for semiconductors is growing as world economic activity recovers. A combination of stronger recovery and inflation shows the global economy is returning to some semblance of normality

They may seem like small fry but they make our world go around. Whether in Tesla cars, toasters or tumble dryers, computer chips are so integral to our daily lives that, without them, our world would grind to a halt.

The OECD reports that inflation in the major economies rose to 2.4 per cent in March. Inflation is coming back, but it’s not the bogeyman that markets need to fear. Higher prices are a sign of economic vitality, of which the world has been in short supply since the Covid-19 crisis began.

The pandemic may be far from over, but the combination of stronger recovery and inflation shows the global economy is returning to some semblance of normality.

Now, chip producers are playing catch-up, trying to keep pace with the surge in global demand for semiconductors as world economic activity bounces back.

03:46

Taiwan’s worst drought in decades adds pressure to global chip shortage

Last week, German semiconductor manufacturer Infineon, a major supplier to carmakers, warned that up to 2.5 million cars might not be produced in the first half of 2021 due to ongoing supply chain shortages. With market conditions booming for autos and consumer electronics after such a long period of pent-up demand, chip producers are being forced to step up production, but it will take time to reach optimal capacity.

A year of poor planning led to carmakers’ massive chip shortage

In the meantime, fine-tuning the balance between recovery and rising inflation expectations could prove challenging. There may be some short-term price distortions but global policymakers still need to err on the side of caution and keep monetary policy as loose as possible until the world fully recovers from the pandemic and sustainable growth is secured.

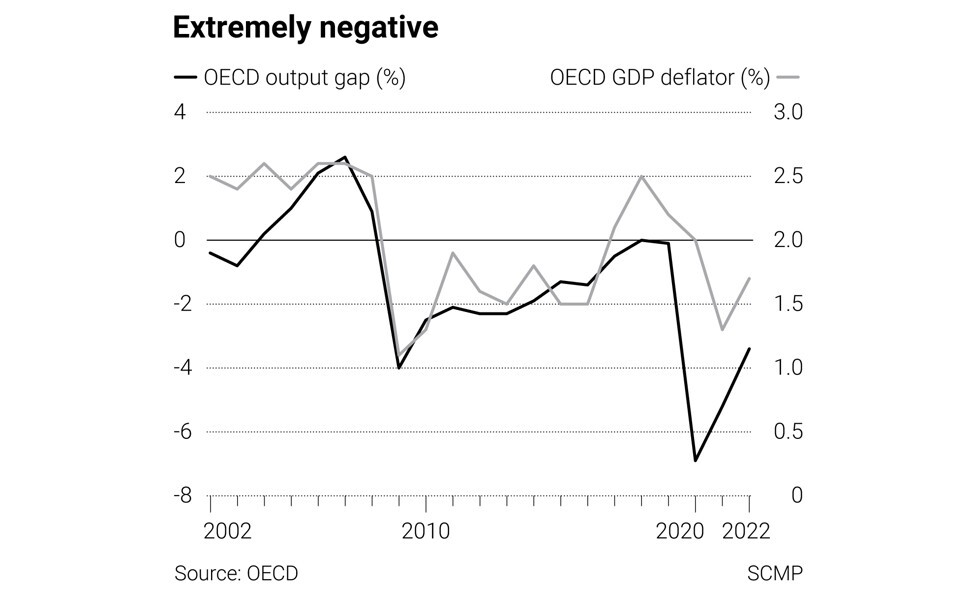

As yet, there are no signs of either demand-pull or cost-push inflation surfacing. Global growth is bouncing back, but it is happening from an extremely weak, non-inflationary base.

Right now, global recovery needs nurturing, not cutting off in its prime. US Federal Reserve chair Jerome Powell is quite correct to give stronger growth the benefit of the doubt until there is a much more convincing case for higher rates.

Global output gaps are still extremely negative, industrial capacity levels are slack and wage pressures remain low, given the fallout from the pandemic. The Organisation for Economic Cooperation and Development estimates the global economy might currently be operating as much as 5.2 per cent below potential output levels, suggesting little or no inflation danger this year.

Until the Fed signals that the time is ripe for tightening, the world can rest easy. No interest rate hikes in 2021 should be the equity market’s rallying cry.

David Brown is the chief executive of New View Economics