China has been opening up its financial markets to international investors over the past two decades. The removal of quotas for the Qualified Foreign Institutional Investor (QFII) and Renminbi Qualified Foreign Institutional Investor (RQFII) schemes,

announced on September 10, is the latest milestone of this

liberalisation.

As foreign investors gain greater access to China’s equity and bond markets, it makes sense to allow Chinese investors overseas to also access a broader range of financial assets to diversify their portfolios. Facilitating this two-way capital flow will help speed up development of Chinese financial markets.

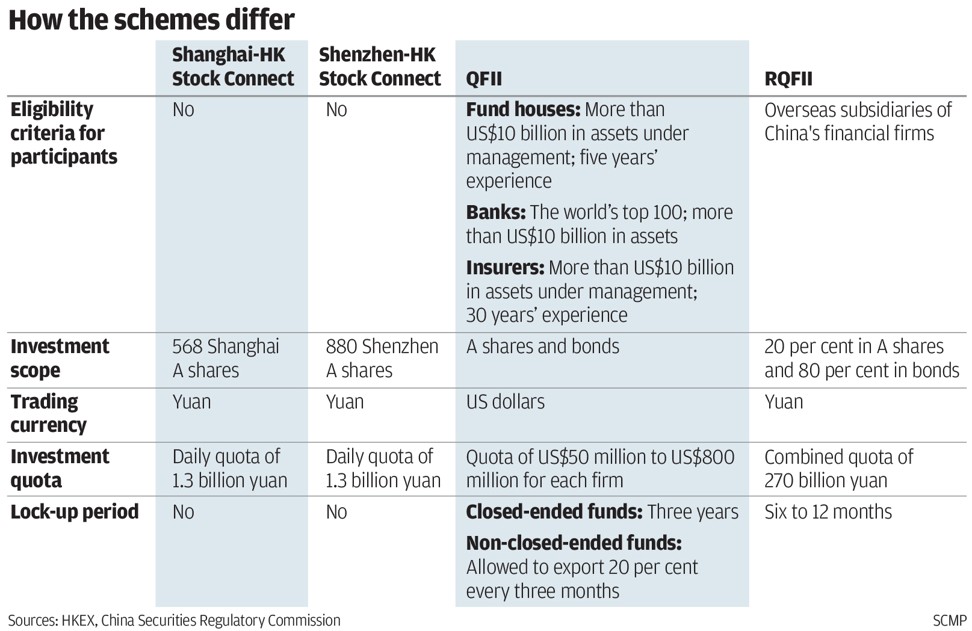

The latest announcement is not an attempt to give onshore stock and bond markets a quick boost. Before they were removed, only about one-third of the QFII and RQFII quotas had been utilised. Foreign investors can also access Chinese markets via

stock connect schemes (Hong Kong-Shanghai, Hong Kong-Shenzhen and

London-Shanghai) and the

bond connect scheme.

However, abolishing the quotas means investors can buy as many Chinese onshore equities or fixed-income products as they wish, subject to foreign-exchange requirements. This is crucial for both asset classes to see greater representation in global equity and bond indices, such as the

MSCI Emerging Markets Index for equities, and the JPMorgan Government Bond Index-Emerging Markets Global Diversified Index for fixed income.

International investors’ presence in China’s onshore market is small. They represent around 3 per cent of capitalisation for the

equities market and 2 per cent for the bond market. Boosting their presence would diversify China’s investor base, which is dominated by local retail investors, and dilute the tendency for a herd instinct, and so better manage market volatility.

For example, a bear market in the US is defined as a 20 per cent correction in the stock market, and this happens every 10 years on average. In China, a market drop of this magnitude happens every 18-24 months.

Moreover, many international investors focus on corporate fundamentals, such as profitability, dividend payouts and corporate governance, which can help improve how companies are run. Greater scrutiny would also benefit the fixed-income market, especially in corporate credit, where credit research allows investors to assess the default risks of corporate issuers. A greater variety of investors would look at the same issuers from different angles and allow markets to better price credit risk.

So far

so good for foreign investors in China. What about Chinese investors overseas?

Chinese investing abroad can do so under the Qualified Domestic Institutional Investor (QDII) scheme, which is the QFII equivalent for Chinese investors, and through the stock connect and the

mutual fund recognition schemes. The overall direction is liberalisation, and the pace is influenced by the renminbi exchange rate.

Many think Chinese want to invest overseas to hedge against the renminbi’s long-term

downward trend. This may be one, but not the only, consideration. Chinese investors appreciate the importance of asset allocation and a well-diversified portfolio. Overseas investment is important because domestic markets have a low correlation with international markets, and this makes diversification more effective.

Relaxing QDII quotas and mutual fund recognition regulations would allow Chinese investors to build stronger portfolios. They could also apply the lessons learned overseas in the domestic market, in the form of demanding better company management or a greater focus on

environmental, social and corporate governance practices.

The authorities are keen to attract more foreign investors into Chinese markets and there are plenty of benefits. An orderly opening up of international markets to Chinese investors can also help to strengthen the domestic financial system.

Think of a financial system as a series of pipes, pumps and tanks: it works best when there is a two-way flow allowing the system to run smoothly and effectively.

Tai Hui is chief market strategist for the Asia-Pacific at J.P. Morgan Asset Management

This article appeared in the South China Morning Post print edition as: China’s capital liberalisation needs to be a two-way street