It’s time for China to be honest about the poor shape of its economy

- The comforting numbers, rose-tinted projections and all-round positive spin that Beijing has been feeding the public have to stop. The Chinese economy is in trouble and policymakers must take radical action to stop the rot

China’s economy is crying out for brave management and a bold action plan. It’s no use Beijing beating around the bush with policy half-measures. Beijing needs barnstorming economic stimulus with more tax cuts, deficit spending and monetary easing than has been the case so far. But it needs better understanding about past, present and future trends on which to base its decisions.

Government forecasters should be brutally honest about the economy’s loss of momentum. It is pointless putting on a positive spin, leaving policymakers struggling to make do with ill-defined, rose-tinted projections. Beijing needs to understand all the contingent risks. If future gross domestic product simulations are centred on a 4-to-5 per cent range this year, it is cause for alarm. If 2-to-3 per cent GDP growth is on the cards this year, the government should hit the panic button.

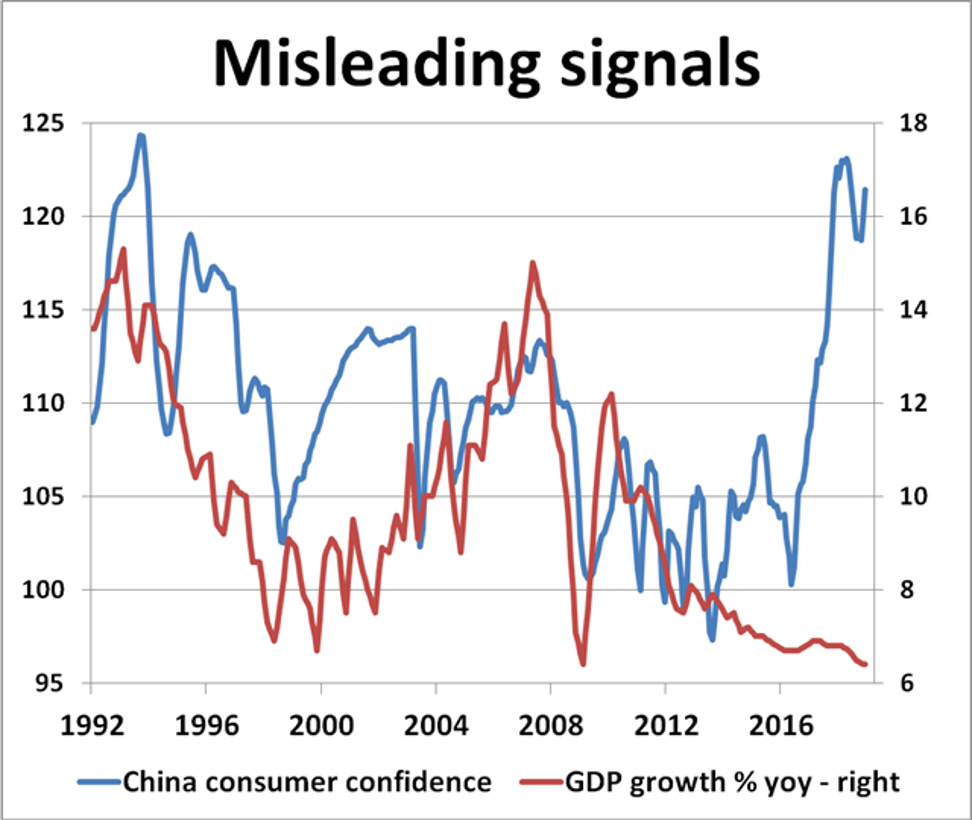

Some official data can even be downright misleading. Take, for instance, the National Bureau of Statistics’ consumer confidence index showing optimism running close to a 25-year high. It is well out of line with independent market reports showing deeper concerns about the trade war, job insecurity and weaker purchasing power, causing consumers to budget much more carefully. As a major GDP driver, with consumer spending accounting for up to two-thirds of China’s growth, this is critical.

The slower pace of retail sales, falling auto purchases and muted housing market conditions are all adding to a potential shortfall in consumer demand. The government should be worried enough to step up provisions to cut taxes further, boost job-creation and cut the cost of borrowing. Beijing needs to get its skates on to stop the rot.

Economic confidence is vital for growth but it is slipping. And it is not just consumer optimism in doubt. A raft of business confidence surveys shows factory output, new recruitment and investment intentions increasingly at risk. The building blocks for faster sustainable recovery are just not there.

Beijing may be hoping for an early breakthrough on a trade settlement with Washington, but this misses the point. It is the domestic economy that is most at risk and where Beijing needs to focus much more effort. Opening up the monetary and fiscal floodgates is a pressing priority now.

The government must wake up to the risks before it is too late. Beijing cannot afford to bury its head in the sand any longer.

David Brown is chief executive of New View Economics