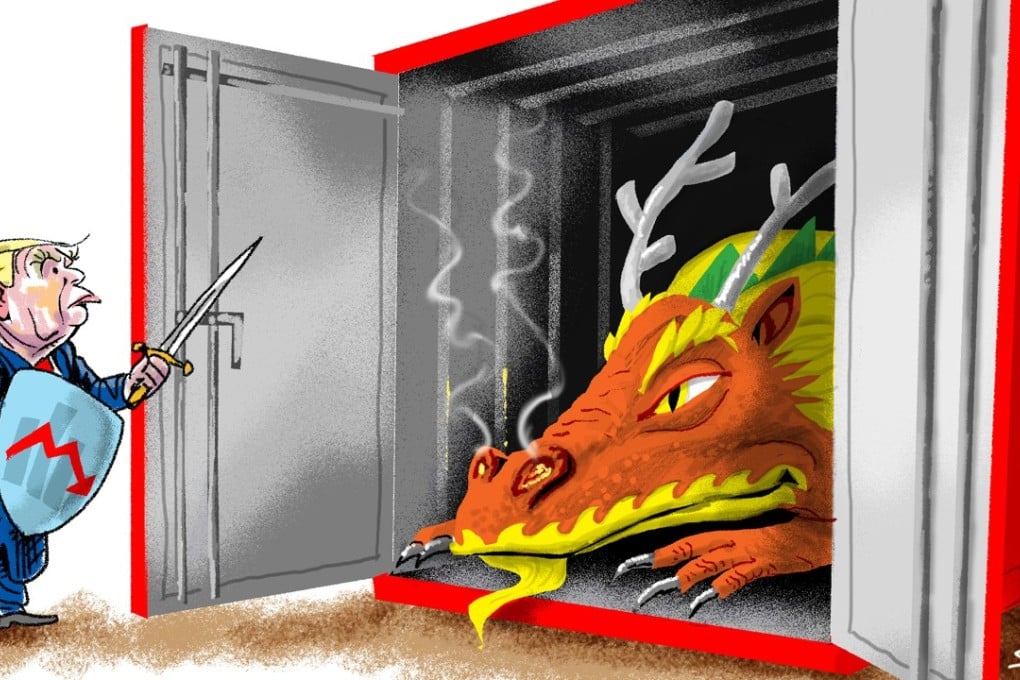

A Sino-US trade war may be upon us – and China may have the upper hand

William Marshall says while the Trump administration’s aggressive moves against China are making the headlines, it may be the longer-term Chinese plan to build up its intellectual property heft that will have a greater impact

As rhetoric gives way to aggressive US action, a long-feared trade war may indeed be upon us.

While the aggression and bombast of the early rounds certainly go to the Trump administration, a coherent long-term strategy seems to be lacking. With the suspension of the Comprehensive Economic Dialogue, the Trump administration has abandoned what has been arguably the most effective trade negotiation tool employed by previous US administrations with China.

The deficit in US goods trade with China has long been a pressure point with succeeding US administrations. In recent years, that deficit has grown to unprecedented levels. In the most recent statistics from the US Census Bureau, the trade imbalance in goods imported from China versus goods exported to China has grown by more than 33 per cent in the year to date through October this year, compared with the same period last year. For a president who was elected in part on his tough talk surrounding US trade relations with China, this is not a headline number Trump will be re-tweeting.

The US is preparing for a trade war with China – don’t be fooled by the noise

For its part, China is concerned about America’s willingness to recognise China as a market economy, the restrictive application of US export control laws against China and the protection of Chinese enterprises investing in the US.