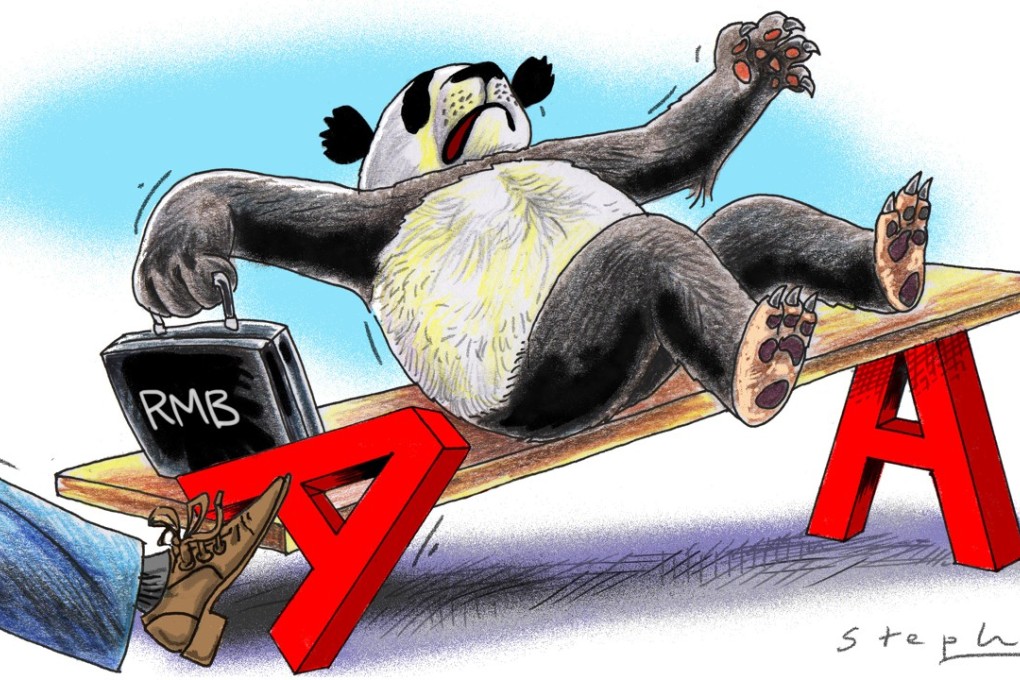

Why is China being penalised for its debt problem, but advanced economies aren’t?

Dan Steinbock says China’s debt-to-GDP ratio is in fact no higher than those of major countries that enjoy a higher credit rating. And unlike these other, more mature economies, China can look forward to years of solid growth

Interestingly, S&P also revised China’s outlook to stable from negative, although ratings cuts usually go hand in hand with a more negative outlook.

Like major advanced economies, China has now a debt challenge. Yet, the context is different, and so are the implications.

Here’s why S&P may be on to something with its cut of China’s sovereign credit rating

In 2008, on the eve of the global financial crisis, China’s leverage – as measured by a ratio of credit to gross domestic product – was 132 per cent of the economy. Even in 2012, it was still barely 160 per cent. Yet, today, it amounts to 258 per cent of the economy and continues to soar. Why has Chinese debt risen so rapidly?

The increase can be attributed to two surges. The first was the result of the 4 trillion yuan (about HK$4.5 trillion then) stimulus package of 2009, which supported new infrastructure but also unleashed a huge amount of liquidity for speculation. Today, the latter is reflected by China’s excessive local government debt (whereas central government debt remains moderate).

China’s mortgage debt bubble raises spectre of 2007 US crisis