China flexes its economic muscles to push green finance on the New Silk Road

Deborah Lehr says Beijing’s leadership on the ‘Belt and Road Initiative’ means it can encourage partners to emulate its plans for sustainable development

China has launched the world’s largest green bond market, officials’ promotions are linked to meeting environmental targets and banks grant preferential interest rates to sustainable projects. China will soon create the world’s largest experiment in pricing carbon with its national exchange.

China will meet 2020 carbon reduction target, Xie Zhenhua says

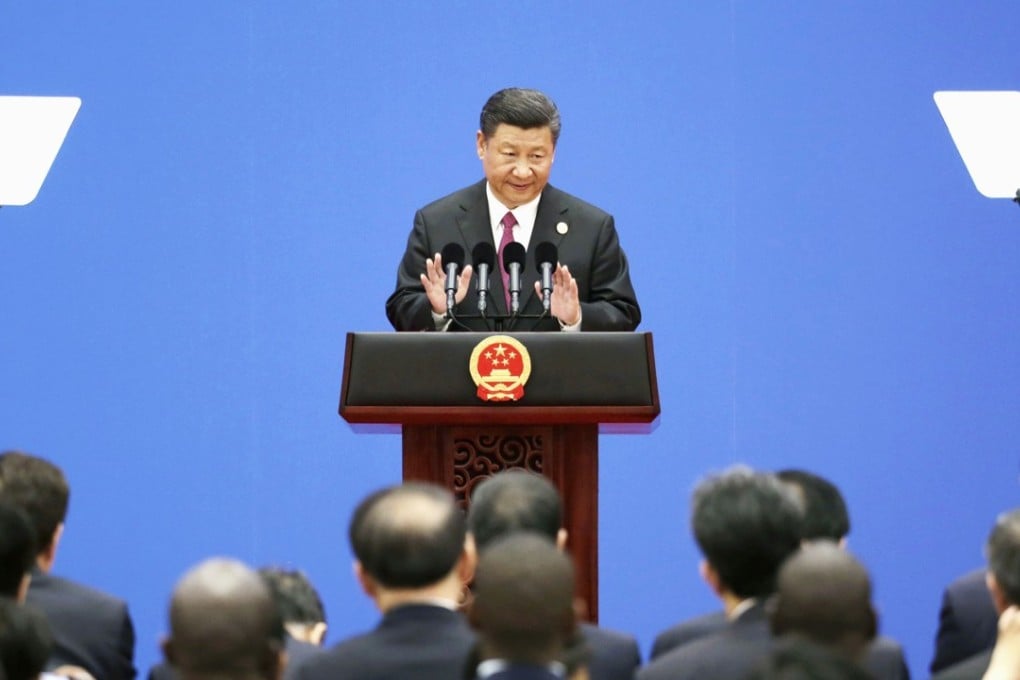

At the forum, China’s Ministry of Environmental Protection and the United Nations Environment Programme announced an international coalition for green development on the belt and road. UNEP sees tremendous opportunity in the initiative to promote massive sustainable development and be part of the reconstruction of war-torn countries like Afghanistan and Iraq. They also see it as an opportunity to require green standards both in financing and construction.

Kazakhstan eager for business with China’s ‘Belt and Road Initiative’

UNEP is offering its full range of resources. Erik Solheim, executive director of UNEP, wrote in an op-ed that, “Our environmental expertise runs from sustainable finance and clean technologies to ecosystems and sustainable consumption and production. ... Through our Finance Initiative, we can work with private investors to promote sustainable investment practises along the Belt and Road.”