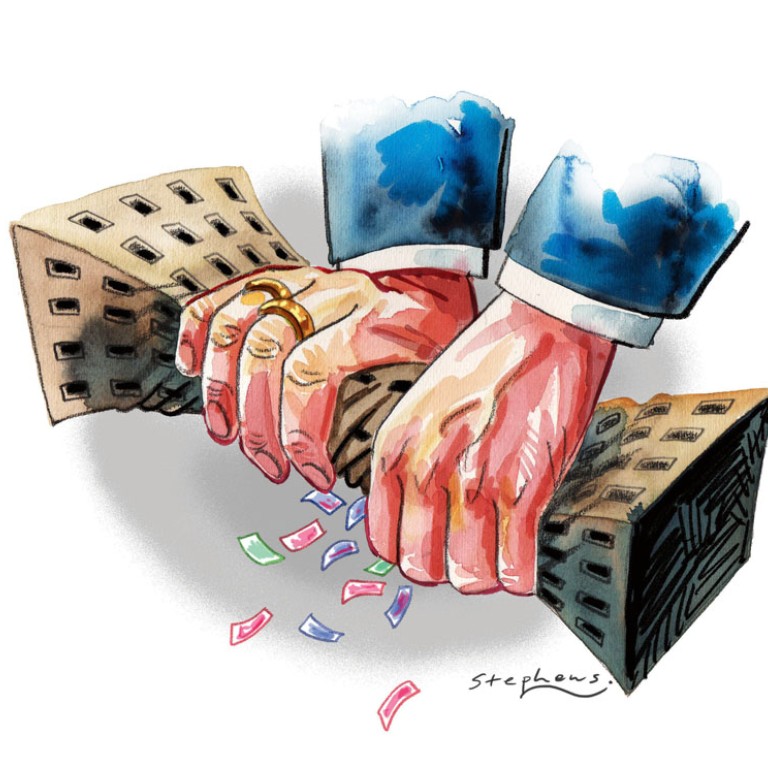

Stability will only return when Hong Kong ends its property tyranny

Andy Xie says Hong Kong must restructure its property market to help ordinary people - rather than milking them for the benefit of the business elite - if stability is to return

Sky-high property prices are the root cause of the ongoing social instability in Hong Kong. When the average household would have to put aside all their salary for 10 years to afford to buy the space for a bed - never mind eating and drinking, and other living expenses - or that incomes have grown by only 10 per cent in a decade, where is the hope for ordinary people, especially the young? Unless Hong Kong restructures its property market to serve the people, instead of milking them to the last drop, the city won't see stability again.

Hong Kong has been run like a medieval city state. A business elite at the top has the dominant voice on how wealth and income are created and distributed. Hong Kong's system encourages people to make money with maximum economic freedom and low taxes.

Tight land supply adds to the problem - often a result of hoarding by a few of the big boys. The banking system is structured to load people with a mountain of debt, which means people must work even harder to keep their tiny apartment.

The system worked when incomes were rising rapidly. When China was not fully open up to the world, Hong Kong had plenty of opportunities as a bridge between the two, and could charge a hefty premium for the service. After China joined the World Trade Organisation, those opportunities as a middleman vanished. Taxing people with ever higher property prices couldn't work anymore. But Hong Kong's system didn't adjust to the new reality. The ensuing instability is hurting everyone. The city's ruling elite, through uncontrollable greed, have done themselves in.

In contrast, Singapore has been run like a proper dictatorship. The system doesn't do stupid things to hurt its ruling class. It focuses its greed on foreigners and distributes the spoils among the people through good public housing, quality education and health care, and a nice pension. Most Hong Kong people seem to like Singapore.

When you think about it, medieval city states like Florence and Venice flourished using the same policies. They used strong militaries to protect their trade monopolies and, sometimes, just looted others when opportunities arose. Because their ruling elite had the wisdom to distribute the loot among all contributors, their enterprises or scams lasted for centuries. Their luck finally ran out when rising nation states built bigger militaries.

Both Hong Kong and Singapore are leftovers of the British colonial era. They have enjoyed much higher incomes than their giant neighbours by arbitraging their inefficiencies. The business model is not so different from Venice or Florence centuries ago. As their neighbours change, they must adapt to sustain their income premium. Instead of building ships or making semiconductors, Singapore has switched to casinos and private banking. Maybe these businesses don't smell so good, but they bring in the money to buy social peace.

Hong Kong hasn't adapted. When the old model doesn't work, the instinct here is to squeeze supply further. When the price is too high, let's carve a flat into several smaller ones. Wouldn't that make housing affordable? Hence, mini-flats have now become popular for speculators. But, even mini-flats are unaffordable. What's next? Should people learn to sleep standing up or hanging upside down?

The usual excuse against change is that Hong Kong doesn't have land. This is a big lie. Only 4 per cent of Hong Kong's land is given over to residential use. There is the same amount of reserved development land, and big developers hold a considerable chunk of it. Singapore has been developing mainly on reclaimed land. It has a real physical shortage, but has kept public housing cheap and spacious. Land isn't a constraint to Hong Kong's development.

What stands in the way is Hong Kong's ruling elite, a leftover from the colonial era, hanging onto the old model no matter what. Since they don't have other sources of competitiveness, changing would mean the end to their privileged status. This is why meaningful change won't happen through consultation among the elite. Some force has to impose the change. If Beijing wants stability in Hong Kong, it must focus on property, which means ditching its business friends.

In addition to artificially controlled land supply, interest rates play a role in the price cycle. But this confuses the debate. The interest rate cycle introduces volatility. So, if the US Federal Reserve raises rates to 3 per cent within three years, Hong Kong's property prices may fall by 50 per cent over that time.

Yet housing still wouldn't be affordable. When the price begins to fall suddenly, the debate will surely shift, and political support for limiting supply will return. Hong Kong could repeat the cycle.

Ruling Hong Kong requires a long-term vision, not the zig-zagging we've seen since the handover. During the Asian financial crisis, Hong Kong abandoned its expanded, but still modest, public housing programme, laying the seeds for today's instability. Policy responses now should focus not only on short-term issues.