How temporary is the new mainland mercantilism?

A probe on misdeeds at state enterprises obliges restraints on overseas companies which might otherwise flourish under a domestic crackdown

Accusations come almost daily. China is waging a mercantilist campaign against multinationals, from German car titans to American technology firms to Japanese ball-bearing makers, for supposed monopoly abuses and other legal infractions.

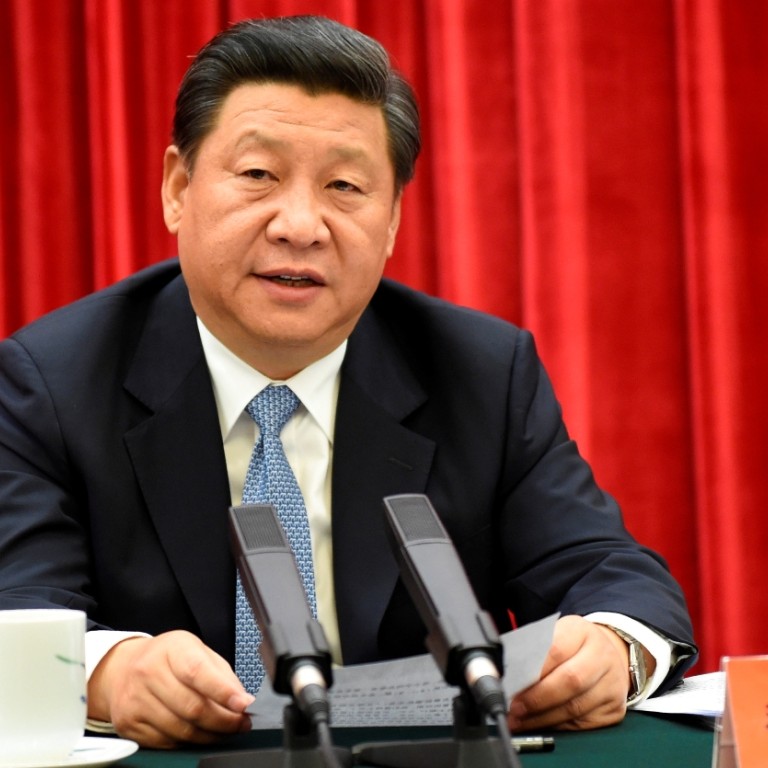

There is more going on, however. As General Secretary of the Communist Party, Xi Jinping has launched a far bigger campaign within the party itself.

His "anti-corruption" effort may explain the recent protectionist outbreak. If so, the conclusion of Xi's internal programme will lead to a great improvement in the environment for multinationals. Viewed in isolation, the government's commercial policies are not indefensible.

The targeting of foreigners was initiated by Xi's administration, which purports to be giving the market a "decisive role". Right now, the Ministry of Commerce, State Administration for Industry and Commerce, and National Development and Reform Commission play the decisive role for foreign business.

The government denies bias, claiming domestic firms are also scrutinised. While true, laws are still being applied unfairly. This is happening through extreme differences across sectors.

Attacks on multinationals are a political shield for the anti-corruption campaign

Industries where foreign entities lead are examined from all angles for inadequate competition. These include cars and technology but also pharmaceuticals, eyeglasses and milk powder.

In sectors with little foreign presence, the government wants to dramatically reduce competition. A few examples are agriculture, electronics, and rare earths. The attack on foreign carmakers comes after failed domestic consolidation.

Part of long-standing attempts to build national champions to compete globally, consolidation involves orchestrated mergers with no money paid - a reduction of competition through non-market means.

Anti-trust laws are intended to prevent market power from being used to reduce competition. Beijing is wielding its anti-trust law against multinationals while exercising state power with the opposite intention. There's no reasonable way to defend this.

It is not unusual for Beijing to adopt unwise policies - Hu Jintao's government did so repeatedly. But it seems strange for the Xi administration to tout intense reform while treating private ownership and market competition as negotiable.

There is an explanation. The major change from Hu to Xi is not rougher treatment of foreigners but rougher treatment of some party members. The debate over whether Xi's ultimate goal is genuine reform or to concentrate power in his hands will not be settled for years.

Regardless of the motive, though, his actions essentially require a simultaneous crackdown on multinationals.

In the era of the mixed economy, party corruption has become fully intertwined with state-owned enterprises (SOEs). Handouts under the table pale against the huge sums extracted through control over and relationships with state giants.

To pursue corruption among a large number of party officials, thus, inevitably disrupts SOE's.

China National Petroleum Corp is the biggest example of an SOE affected by the crackdown but it is not alone. China Resources and less famous enterprises such as China Grain Reserves and China Publishing Group have been targeted.

There have been multiple investigations into shipping SOEs. Banking is seen as a natural place for graft to flourish, given the large sums moving in and out of the country.

Xi's rectification campaign within the party has enormous economic scope, spanning energy, retail trade, agriculture, media, shipping and banking. Interfering with SOEs in these sectors will inevitably bring charges that the crackdown indirectly benefits competing foreign interests.

Put another way: it is politically risky to take a hammer to the state sector while foreign firms can easily pursue expanded market share and profits. In this light, the attacks on multinationals are a political shield for the anti-corruption campaign.

The protectionist surge of the past year is not a mystery. And the outcome is foreseeable: it will likely end shortly after the party shake-up ends.