Why China is right to try to end its bubble addiction

Andy Xie says China has recognised that tightening the money supply is the way to rein in the excesses of the past, and, along with curbing corruption, is good for long-term economic health

China's economy is slowing. It is good news. It reflects that China's economy is finally ending its bubble addiction. Even better, the central government remains calm over the slowing news. All signs point to China's new leadership taking the plunge to digest the excesses from sometimes crazy stimulus policy under the previous government.

From 2004, China pursued a bubbly path by refusing to rein in monetary growth despite inflationary pressure and an emerging labour shortage. The bubbly path was amplified by a slow but steady appreciation of the renminbi against the dollar.

The perception of a sure winner enticed a huge amount of hot money to flood into China. The resulting liquidity orgy caused one asset bubble after another.

After China joined the World Trade Organisation, it became the factory for the world. The success is due to the competitiveness of Chinese workers. China's wealth is created at factories and construction sites by workers who are as productive as their counterparts in the West but paid one-eighth to one-tenth as much.

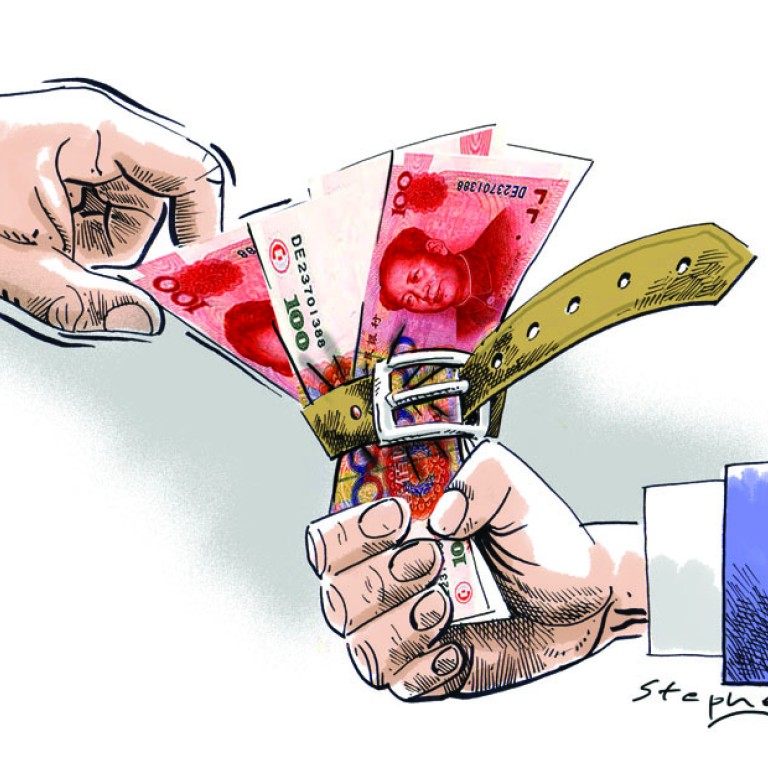

A consequence of China's bubbly path is wealth redistribution to the vested interests, who can line their pockets from negative real interest rates. As the credit bubble lasts, the credit-to-GDP ratio has surged. China's credit is twice its gross domestic product.

The real interest rate should be equal to total factor productivity. In China's case, it should be 4-5 per cent. Instead, if one uses a GDP deflator as the real gauge for inflation, China's real interest rate is about minus 5 per cent. The macro policy redistributes a percentage of GDP from the people to vested interests. This is the biggest reason that China's household consumption is one-third of GDP instead of a normal 50 per cent for such an emerging economy.

The state-owned enterprises are the biggest beneficiaries. They have grown their assets massively in the past decade. But their returns on assets have deteriorated. Fast growth of an inefficient sector could only be made possible by massive subsidies. In China's case, it is done through monetary policy.

Financial transactions have become a major money spinner for those who can control them. When the subsidy is so big, the demand of course exceeds supply. Hence, who gets credit becomes a privilege. Those who can arrange access can take a cut.

Redistribution through manipulating finance seems like a victimless crime. Few people are willing to fight a battle against a predatory monetary policy. There are no names for people to focus their fury on. Hijacking monetary policy to enrich vested interests appears to be the favoured form of corruption in the 21st century. Sicilian-style mobs are definitely passé.

China's property bubble is really a tool for the monetary bubble. It is where the printed money is warehoused. Local government debt is another sinkhole.

Real rich people are cash rich. For some to be cash rich, there must be an equal amount of debt for others. Hence the unique discussions in China on where to sink the printed money to contain inflation. Wouldn't it be nice to print less to contain inflation in the first place?

Deflating the monetary bubble and implementing an anti-corruption campaign are the only effective means to restore China's vitality and resume its course to becoming a developed economy. China has been talking about rebalancing the economy for a decade. But the economy has become more unbalanced. The reason is the policy that puts short-term growth above all other objectives.

The excuse is the necessity to create 10 million jobs a year. Otherwise, unemployment will trigger social instability. This mantra is being repeated in all quarters despite a widespread labour shortage for all factories and construction sites. There is little doubt that the propaganda is to prolong a macro policy that favours a few at the expense of all others.

China is well positioned to absorb the fallout of a deflating credit bubble. A cooling economy removes some pressure in the labour market. It gives exporters more breathing room. An unemployment crisis is highly unlikely, removing the most important concern over a slowing economy.

A deflating bubble makes things cheaper. It increases household purchasing power and, hence, consumption. Wages are rising, probably faster than labour productivity. As long as the consumer price index doesn't rise even faster, the share of household consumption in the economy will rise. Stimulus prevents market forces from rebalancing the economy. Letting the market go is indeed the right recipe.

Corruption imposes a significant cost on the Chinese economy, and the burden is spread among people through an inflation tax. An anti-corruption campaign can remove most of the cost. In the short term, some rue the negative effect of deserted luxury entertainment venues on the economy. The business consumption, about one-tenth of GDP, is declining. But, as the money is not there, it goes to the people at large. A falling mao-tai price, for example, restores the demand from the middle class. In the end, mao-tai is consumed. When it is consumed by ordinary people, it goes into household consumption. The economy becomes more balanced.

China is at the crossroads. It must not allow speculation and corruption to continue. Using monetary policy to rob people eventually triggers mass unrest. The new leadership has shown determination to revive the country. And tightening money supply is the only way to restore China to its only path to prosperity: rewarding hard work.