EU has reason to keep things sweet with China despite protectionist rules

- Although new EU measures covering environmental, human rights and anti-subsidy concerns threaten Chinese business interests, EU and Chinese leaders, braced for Trump 2.0, have reason to keep tensions from boiling over

The measure prospectively targets all developing countries that have different regulatory standards in these areas, and many Chinese businesses are expected to fall under its focus.

According to a survey by the Chinese Chamber of Commerce to the EU, China’s enterprises are especially concerned over the law’s due diligence requirements, with compliance expected to impose high costs.

The EU’s new laws against forced labour would be interconnected with its supply chain legislation given that Xinjiang is a major producer of garments that are exported globally. The region is also China’s main producer of solar panels.

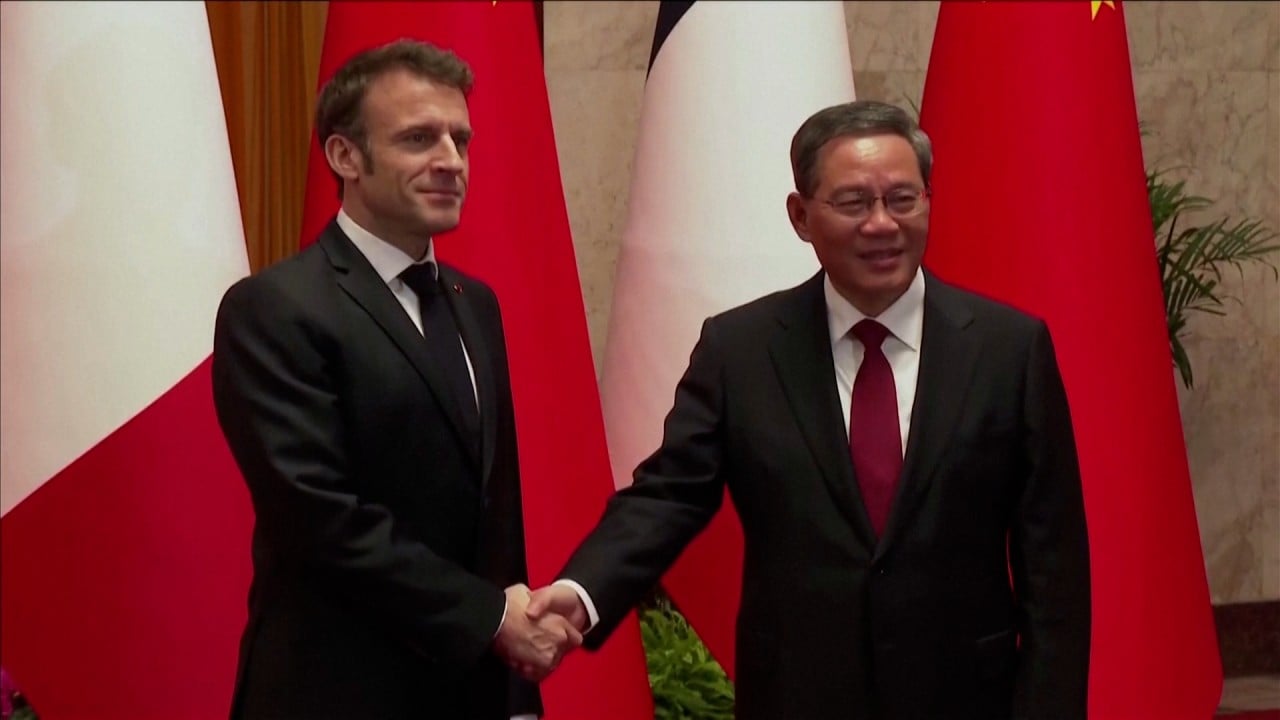

Yet, as the temperature on both sides appears to be on the verge of boiling over into a potential trade war, Chinese and EU leaders seem to be making efforts to bring back both parties from the brink of a protectionist spiral.

Such an outcome threatens to unleash an unprecedented wave of protectionism from Washington which would have destructive effects on trade for both China and the EU.

In a sign of what may come, Trump threatened earlier this month to impose a 100 per cent tariff on imported cars, including EVs, vowing that “you’re not going to be able to sell those guys if I get elected”.

In light of a potentially more complex trade environment, China and the EU may seek to cooperate more on direct investment policies.

Why China can rest easy if Trump is re-electedUS president

As an alternative, the vast German carmaking and chemical sectors have been investing heavily in the Chinese market. French companies have embraced a similar approach, albeit more focused on luxury consumer goods.

According to China’s Commerce Ministry, European direct investment rose by 92 per cent in 2022, albeit after declining flows during the pandemic years. Moreover, direct investment by Germany reached a record US$13 billion last year.

From this perspective, many goods currently produced in the EU may not appear on the EU’s trade data in the future, as they will increasingly be both produced and consumed in China.

In this context, the coming leaders’ meetings in Beijing and Paris should serve as affirmation of their intentions to support direct investment in China, thereby enhancing European corporate access to the growing Chinese market, while hedging against increased risks of trade protectionism.

Bob Savic is a senior research fellow at the Global Policy Institute in London, UK, and a visiting professor with the University of Nottingham’s Faculty of International Relations