China ETF back in favour amid hopes for stimulus

Investors are returning to the largest Chinese exchange-traded fund in the United States at the fastest pace in almost two years on signs that a government stimulus programme will support growth in the economy.

Investors are returning to the largest Chinese exchange-traded fund in the United States at the fastest pace in almost two years on signs that a government stimulus programme will support growth in the economy.

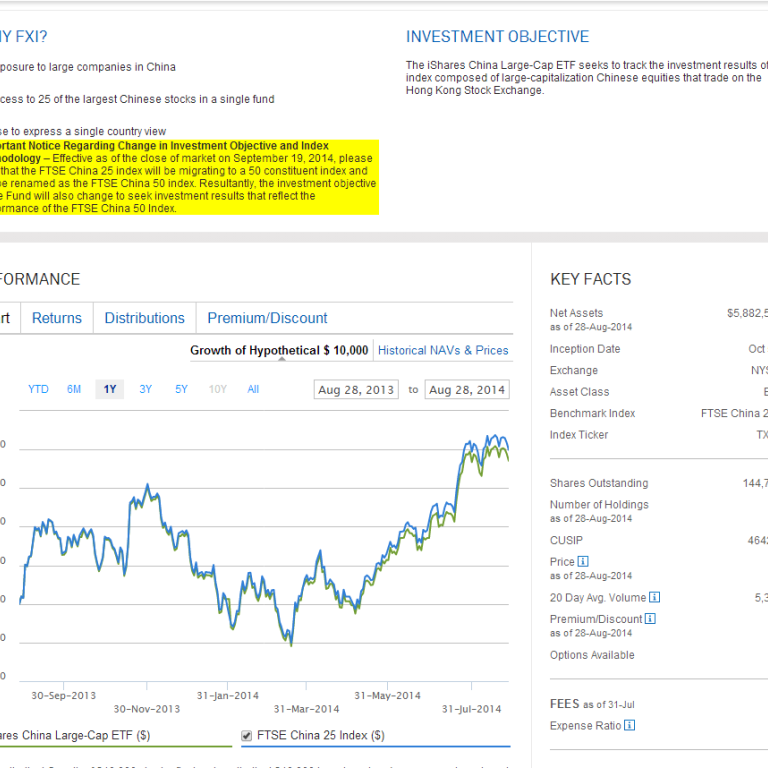

The iShares China Large-Cap ETF has attracted a net US$518 million this month, putting it on track for the biggest monthly inflow since US$1.34 billion was added in December 2012. The fund, which has Tencent Holdings and China Mobile among its 25 stocks, reached an 18-month high on August 13 after rallying 26 per cent from a March low.

People are getting more constructive on the government’s recovery plan

Investors are speculating that Chinese equities will extend gains as Premier Li Keqiang's government has promoted railway spending, cut some banks' reserve requirements and reduced taxes to protect an annual growth goal of about 7.5 per cent that has been under threat from a weakening real estate market.

"People are getting more constructive on China, on the Chinese government's smooth recovery plan," said Walter Price, a senior portfolio manager at Allianz Global Investors. "The US and European markets are making their new highs, and the China market is very far from its high, so the feeling is that these stocks are going to catch up."

The H-share index trades 46 per cent below an October 2007 high, while the Shanghai Composite Index is still 64 per cent down from its highest level after gaining 3.8 per cent this year. The S&P 500 Index rose to surpass 2,000 points for the first time this week and reached a record on Wednesday.

Two months of net inflows have helped drive assets of the iShares China ETF up 24 per cent to US$5.9 billion.

While China's economic growth accelerated to 7.5 per cent in the three months to June following a two-quarter slowdown, government data showed new credit growth for July hit the lowest since October 2008 as industrial output expansion slowed.

Prices of new homes fell last month in almost all cities that the government tracks amid a market slump, prompting the municipalities to start easing local curbs from June.

Bank of America Corp's David Cui said last month the stimulus that was sparking the rally was actually making equities less appealing as leverage rose and free cash flow dwindled.

Fluctuations in economic growth added to investor concerns about a hard landing earlier this year and fuelled a sell-off in Chinese stocks, according to Michelle Gibley, director of international research at Charles Schwab Corp.