Play on price gap of A and H shares no easy bet

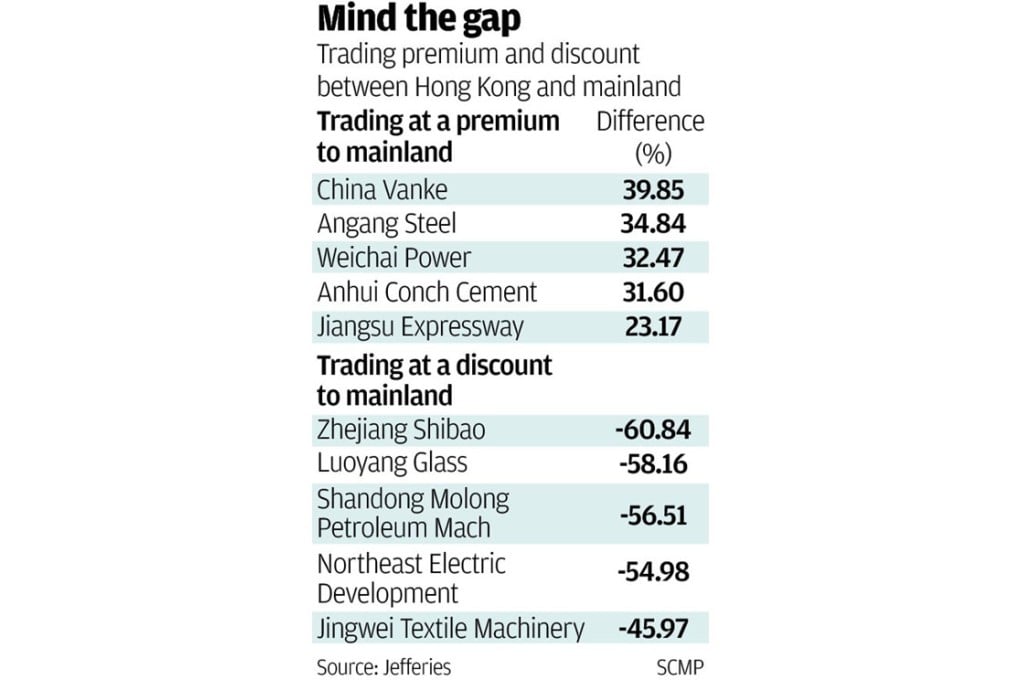

The valuation gap between dual-listed mainland companies is one powerful trading concept that for years has held the allure of a quick buck.

The valuation gap between dual-listed mainland companies is one powerful trading concept that for years has held the allure of a quick buck.

Contrary to expectations, it has been a frustrating trade.

All things being equal, share prices should move closer together. The company accounts are, after all, identical and every sign points to the mainland further liberalising its financial services sector, which would make it easier for foreign investors to trade mainland stocks.

Historical data shows a different picture. While the trading bands between dual-listed mainland equities, so-called A and H shares, have narrowed over the past six years, there is no sure guarantee that prices will move in a set direction.

A case in point - one might have expected the band to have narrowed after April's announcement that a planned cross-border trading system would allow investors in Hong Kong and the mainland to transact more freely.

The opposite took place. The Hang Seng China AH Premium Index, a gauge of the price difference between stocks traded in the two markets, generally drifted lower this year, meaning the premium paid for H shares over A shares got larger. The index closed at 92.76 on Friday. A score of 100 means stocks in the two markets are trading at par.

"It is not so easy to say the premium should narrow or expand. It is not straightforward. It is not intuitive," said Patrick Ho, an analyst at UBS Wealth Management.